The University of Cape Town’s Energy Research Centre (ERC) has welcomed the decision of the South African government to end “years of deferral” by setting a clear date, January 1, 2019, for the implementation of a carbon tax.

The ERC believes a carbon tax is in South Africa’s national interest and that, by joining those countries moving to price carbon, South Africa is showing leadership.

However, in a presentation to Parliament’s Standing Committee on Finance, which is considering the Carbon Tax Bill, ERC’s Professor Harald Winkler said a simpler tax design would be better, as well as more effective.

“This means, among other things, an effective tax rate, which is adjusted in relation to our national mitigation goal,” Winkler explained.

The ERC believes the proposed tax rate of R120/t of carbon dioxide-equivalent (CO2-eq) is too low and is also an illusion, given that all taxpayers receive a 60% basic free allowance. Therefore, the effective tax rate starts at R48/t CO2-eq.

A simpler and more effective design would be to tax the full amount of R120/t and provide for a “jobs and competitiveness programme”, which would allow energy-intensive and trade-exposed taxpayers, to claw back up to 50% of carbon-tax paid, provided they can demonstrate a contribution to increasing employment.

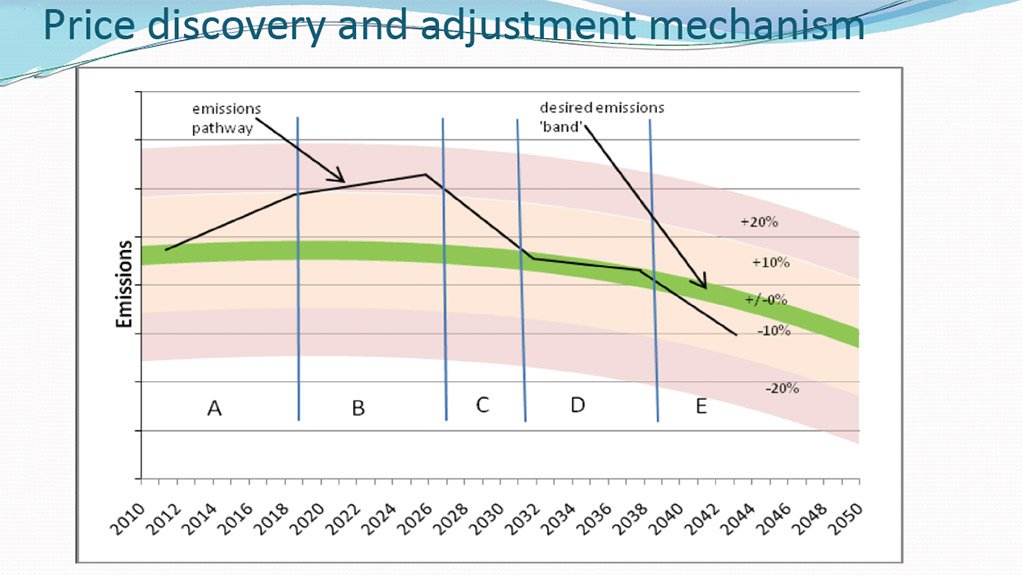

There was also no operational link, Winkler highlighted, between mitigation goals and the carbon tax. To create a link, the ERC recommends that the rate of tax be adjusted on an annual basis, following review of emissions in South Africa’s latest greenhouse gas inventory.

The tax rate should then be increased if emissions are, or are projected, to rise above the country’ peak-plateau-decline (PPD) trajectory. It could also be lowered if emissions are below the PPD range.

“This tax must achieve its purpose of emission reductions. Hence, an adjustment mechanism is essential,” Winkler concluded.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here