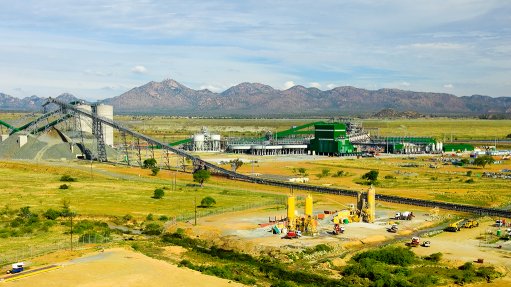

Anglo Platinum's Mogalakwena mine in Limpopo where hydrogen truck is being trialed.

JOHANNESBURG (miningweekly.com) – Platinum group metals (PGM) mining and marketing company, the Johannesburg Stock Exchange primary-listed Anglo American Platinum, highlighted on Monday that it is working to deliver a responsible and orderly separation from the secondarily-listed Anglo American by the end of next year.

“Our management team and independent board is already working alongside a dedicated team with Anglo American to achieve this,” Anglo Platinum CEO Craig Miller outlined.

“We're looking forward to being the PGM leader, as a standalone entity. We have the mines, as well as the world class processing facilities together with that of our marketing,” Miller added during a media briefing covered by Mining Weekly.

Expressing optimism about the demand outlook for PGMs, he enthused about the key role that PGMs play in creating a greener world – “whether in internal combustion, hybrid or hydrogen electric vehicle drivetrains”.

He described the automotive demand outlook for PGM-containing catalytic converters as being firmer as production plans and sales of pure battery electric vehicle vehicles stall, with PGM-containing hyrids gaining market share.

He noted that the largest automakers had extended their timeframes for internal combustion engine production and included various forms of hybrid vehicles in their product offering.

Additionally, there are a growing number of uses for PGMs – from new battery technologies to emerging medical technologies. Even alkaline electrolysers were now being boosted by PGM inputs, he confirmed in response to Mining Weekly.

Miller predicted that the planned demerger from Anglo American would create a more focused PGM independence that would optimise the company’s business, assets and people.

“We will build upon our strong foundations across the PGM value chain, which includes industry-leading mineral endowments, world class mines, well established and fully invested processing infrastructure, and globally recognised marketing capabilities.

“We are in parallel focusing on enhancing our leadership in sustainability, innovation and market development. All of this will still be from an organisation proudly based in South Africa. We are confident in the future and look forward to working alongside our stakeholders to continue building a highly successful PGM business that creates superior and sustainable value for the long term.

NET CASH

Anglo Platinum ended the first half of 2024 on June 30 in a R14.5-billion net cash position and with restructuring and cost savings measures being advanced.

Half-year refined PGM production was up 5% to 1.78-million ounces compared with the prior period, while metal-in-concentrate was a 5%-lower 1.76-million ounces.

Sales volumes increased 9% on inventory drawdown while earnings of R12.3-billion were realised on a PGM dollar basket price of $1 442.

The all-in sustaining cost (AISC) of $957 per three-element (3E) ounce, was well ahead of the below-$1 050 target and on track to sustain cash generation through a low PGM price cycle.

Statutory employee restructuring consultation is complete and Mortimer Smelter is on care and maintenance.

ACTION PLAN

The Action Plan includes R10-billion annual cost savings from operating costs and stay-in-business capital from a 2023 baseline and R4.7-billion has been achieved in the first half of the year.

The measures are expected to result in a cash operating unit cost of R16 500 to R17 500 per PGM ounce, as well as an AISC of below $1 050 per 3E ounce in 2024.