- Who Finances Rural Local Municipalities? - Policy Brief 73.14 MB

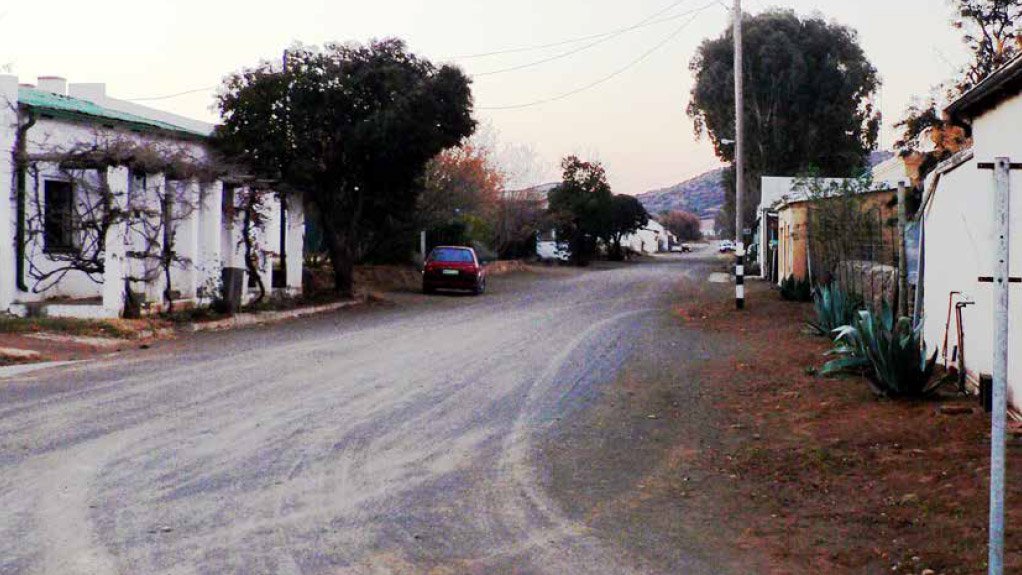

The majority of financially unviable municipalities are in rural areas and depend significantly on grants to fulfil their mandate.

The government’s aim is to minimise this grant dependency by amalgamating municipalities. The Financial and Fiscal Commission (the Commission) investigated whether amalgamations result in viable municipalities, as well as the adequacy of intergovernmental transfers and possible alternative own-revenue sources that would lessen the dependency of rural municipalities on transfers.

The study found that amalgamations do not necessarily result in financially viable municipalities, and (if all grants are included) the current system of transfers is adequate for some (but not all) services rendered by rural local municipalities. Potential own-revenue sources that municipalities could explore include entry charges to social amenities and hotel/restaurant fees.

There is no direct or indirect link between functionality and municipal boundaries, and many factors (e.g. service delivery and financial management) contribute to a dysfunctional municipality. The Commission recommends that the transfer system be sensitive to financially unviable municipalities and that cost implications be assessed before proceeding with demarcations. Grants with similar mandates should be consolidated, and transfers should be informed by objective cost estimates. Rural municipalities should be capacitated to prepare property registers and valuation rolls, and to seek alternative own-revenue sources.

Report by the Financial & Fiscal Commission

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here