JOHANNESBURG (miningweekly.com) – What Harmony Gold has achieved in the 12 months to June 30 is incredible with the true driver of value being quality gold ounces and a display of capability in regions beyond South Africa, upbeat CEO Peter Steenkamp said on Thursday.

The Johannesburg Stock Exchange-listed Harmony has delivered an exceptional combined performance across its operations at a time of record gold prices, which have come together to deliver record cash and dividends for shareholders.

Free cash flow soared 111% to R12 743-million, headline earnings per share soared 132% and earnings per share were 78% up.

“This achievement was a result of clear strategic content and successful execution, enabling us to deliver above plan and capitalise on higher gold prices, which resulted in a record year for Harmony,” the long-serving Steenkamp, who retires at year-end, highlighted during a media briefing covered by Mining Weekly.

While the gold price received continues to improve on a sustainable tailwind, the true driver of value has been Harmony’s investment in quality ounces.

Underground recovered grades rose 6% to 6.11 g/t and total gold production also hit a 6% higher mark at 1 561 815 oz or 48 578 kg.

Production at Mponeng gold mine, the world’s deepest, was up 17%, the surface operation of Mine Waste Solutions was up 34% and improved grades lifted Hidden Valley in Papua New Guinea to 17%.

The increase in all-in sustaining costs was held down to a 1% increase at $1 500/oz (R901 550/kg).

The average gold rice received was 16% higher at $1 999/oz (R1 201 653/kg).

Group revenue rose 25% to R61 379-million and operating free cash flow of R2 188-million was generated by Hidden Valley compared with R615-million in financial year 2023.

“We've got very good momentum at all operations and if one could look at the year just passed, we had very, very good results at most of our operations.

“The big one to stand out is Hidden Valley, and Mponeng’s grade was much higher than planned. But that grade is still sustainable and doing well.

“At Doornkop mine, which is very small in our business, we’ve looked at restructuring the plan to allow us to do all the projects because there is a hoisting bottleneck, so we’re confident that the plans that we have are unfolding well.

“The teams are doing well, we've got the right leadership in place on all the mines, and obviously all the operations are in good momentum going forward,” Steenkamp said in response to Mining Weekly.

Doornkop development is taking place on two levels, which is the new Doornkop going forward.

“To give ourselves a little bit of breather, we choked back the stoping from about 22 000 m2 to 18 000 m2, 10% to 15%. We just want to make the plan achievable and to get more stoping from Doornkop,” Steenkamp added.

COPPER

“As we transform into a global gold/copper producer, the foundations are in place which will enable us to continue in this growth trajectory through the extraction of safe, profitable ounces and value-accretive acquisitions,” added Steenkamp.

Copper represents 21% of Harmony’s total declared mineral resources of 136.5-million ounces, while mineral reserves increased by 2% to 40.3-million ounces.

On the back of operational consistency and strong free cash flows, Harmony has declared the final dividend of 94c a share.

Most project capital continues to be allocated to higher-grade, higher-quality, and lower-risk assets, aligned with improving margins through operational performance and value-accretive acquisitions.

Stronger growth is targeted through investment in higher-grade gold mines, expansion of gold recovery through surface retreatment, and growing international gold and copper assets.

RENEWABLES

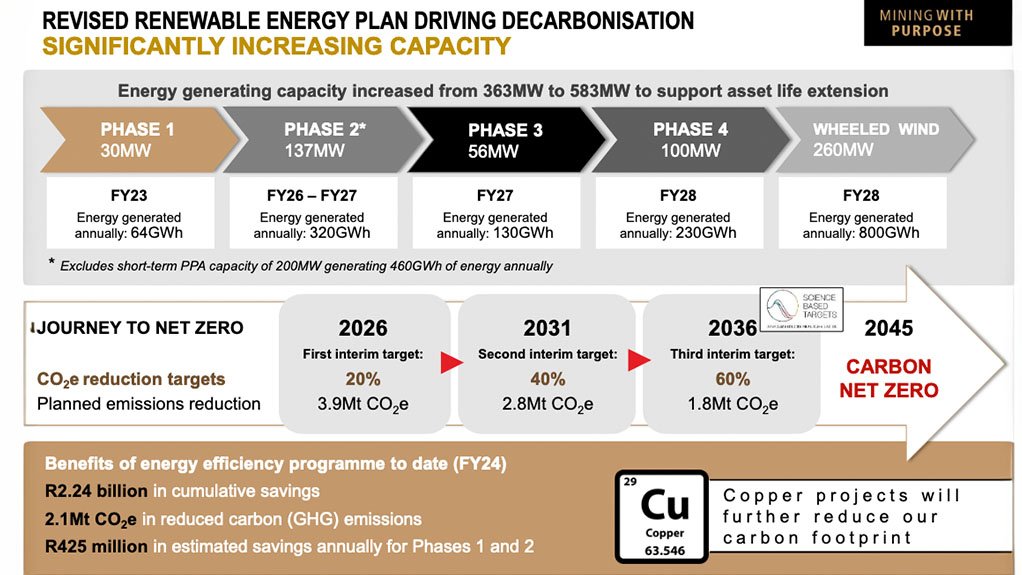

The renewable energy programme has been expanded to more than 500 MW to support life-of-mine extensions

The first phase 30 MW is generating clean energy. The company received a very favourable green loan with which to pursue thae100 MW project.

Life-of-mine extension plans have resulted in Harmony relooking at its renewables capacity, and plans for generation capacity have been increased to 583 MW, which includes the solar and wind wheeling. Incorporation of small-scale solar is also under consideration.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here