Despite Africa’s huge sustainable energy potential, it still faces serious power crises which have crippled efforts to increase the manufacture of consumer goods and industrial equipments. African economies lose 3-4% of their gross domestic product (GDP) because of unstable energy, according to the World Bank.(2) Also, most African countries still rely heavily on traditional energy sources – coal, natural gas, and petroleum, although efforts are being made towards sustainability in light of growing concerns about high energy costs and global warming.

Energy derived from wind, solar, nuclear, hydro, geothermal and biomass is considered sustainable from the perspective of carbon emissions due to relatively lower greenhouse gas emissions from these sources compared with fossil fuels. In practice, the term sustainable energy, which is used synonymously with clean energy, has meant different things to different people. Some think of it as the energy generated from clean sources, clean technology, as well as efficiency in the consumption of energy and a reduction in energy-related greenhouse pollution. Although nuclear energy itself is a renewable energy source, the material used in nuclear power plants is not, hence, nuclear energy is sometimes considered non-renewable.(3) Some include natural gas under the heading of sustainable energy because of its more favourable environmental quality. Sustainable energy can thus be defined as energy which provides affordable, accessible and reliable energy services that meet economic, social and environmental needs within the overall developmental context of society, while recognising equitable distribution in meeting those needs.(4)

Although Africa is well-endowed with sustainable energy resources, they remain mostly untapped due to ageing infrastructure, outdated technology, financial mismanagement, lack of political will, under-investment, ineffective policies, and lack of reforms. This CAI discussion paper examines Africa’s energy shortages and transition towards sustainability. It analyses the economic transformation Africa could achieve by attracting investments in the sustainable energy sector. This paper recommends that stable and sustainable power supply is critical to Africa’s growth story and as such clear energy policies and regulations must be enacted and enforced to bolster the efficiency of investments and service delivery in the power sector.

Africa’s power crises

Electricity is Africa’s greatest infrastructural challenge, characterised by low access rates, high costs, and low-quality provision. Whilst Africa is blessed with a wealth of energy reserves, including 7% of the world’s conventional gas reserves, 8% of its oil reserves and 4% of its coal reserves, it does not enjoy the same access to electricity as the rest of the world, as it consumes only 3% of global electricity, indicating a high energy poverty.(5) Africa’s high energy poverty has crippled the continent’s productivity, and consequently, Africa’s contribution to global GDP stood at 2.4% in 2010, driven mainly by agriculture.(6)

Only 8% of the rural population in Sub-Saharan Africa has access to electricity, compared with 51% of the urban population.(7) Africa’s energy sector therefore needs regulatory and policy overhaul to attract the requisite investment to boost access to electricity. Traditionally, state-owned power utilities in Africa have enjoyed a monopolistic hold over their national electricity industry, and this monopoly has contributed to undeniable under-performance in the delivery of electricity services, particularly to the majority low-income groups. Private sector-led interventions, and realistic tariffs, therefore, remain critical in efforts towards deregulation of the power sector to eliminate inefficiency and improve service delivery. The economic growth desired by Africans can only be made possible with reliable, affordable and clean energy.

Africa’s energy shortage affects productivity

In 2009, only 42% of Africans had access to electricity compared to an average of 73% for all developing countries – 78% for developing Asia, and 93% for Latin America.(8) The figure is even lower for Sub-Saharan Africa, where it stood at 31% as at December 2012.(9) Furthermore, the most recent data shows that African countries endured on average 8.6 power outages per month.(10) Power outages are due largely to the lack of regional interconnectivity of electricity grids and shortages in affected countries. The costs of power outages to the continent are significant, with Africa losing almost 12.5% of production time compared to 7% for South Asia, which is the next worst case.(11) Therefore potential productivity gains from electricity supply, together with the associated income effect, point to a market with significant growth potential which requires appropriate regulatory and policy structure to attract investments.

Despite the continent having about 14% of the world’s population and producing 7% of the world’s commercial energy, it consumes only 3% and exports more than half of its production.(12) While the population of Africa has grown by more than 3% annually for some years now, its global share of total primary energy supply has only increased from 3.5% to 5.2% between 1973 and 2003, indicating a reduction in energy access on a per capita basis.(13) Thus Africa’s economic growth and transformation is hinged on addressing its energy shortage. The challenge is converting the continent’s huge energy potential into an economically viable industry. Increased spending and energy consumption remain critical to the continent’s productivity.

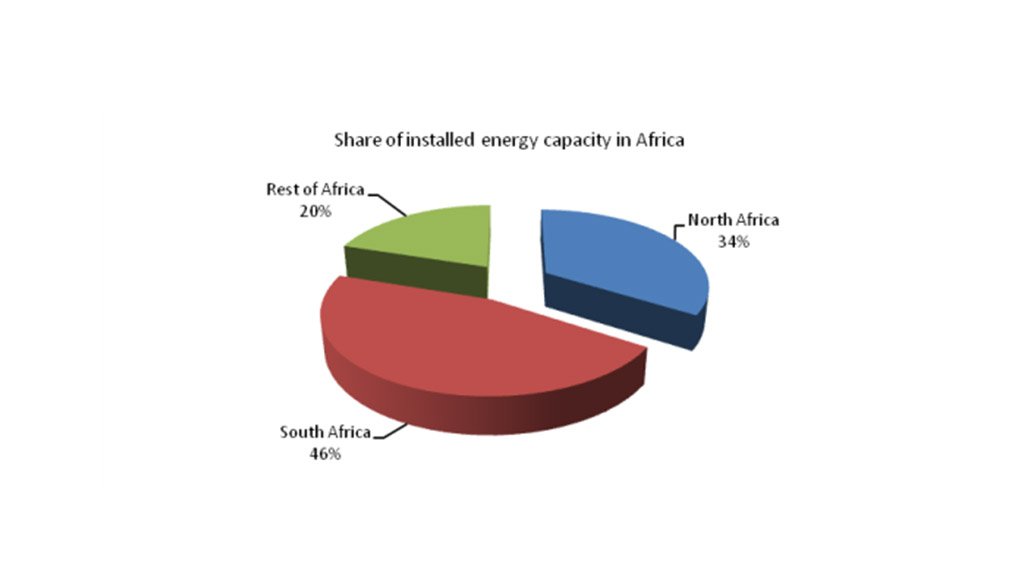

The African power sector is characterised by small systems, with over two thirds of the continent’s installed capacity coming from South Africa and North Africa as indicated in Figure 1.

Figure 1: Share of installed energy capacity in Africa (14)

It is worthwhile to note that the 48 Sub-Saharan African countries, which together total 800 million in population, generate 68 gigawatts (GW) of power, roughly the same amount of power as Spain, which has a population of just 45 million.(15) Without South Africa, the total falls to a mere 28 GW, equivalent to the installed capacity of Argentina.(16) As much as 25% of this 28 GW of installed capacity is not currently available for generation owing to a variety of causes, including ageing plants and lack of maintenance.(17) The situation calls for increased commitment and investment, as Africa needs to spend an estimated US$ 40.6 billion per year to solve its power crises, according to energy experts.(18)

Low carbon emission rate despite heavy reliance on fossil fuel

In overall terms, the bulk of the electricity produced in Africa is from thermal stations, because of the large coal plants in South Africa and oil-fired generation units in West and North Africa. Nonetheless, in spite of the massive exploitable hydropower capacity in Africa, its contribution to total power generation is relatively low. Hydropower contributes only 17.8% of the total power generation in Africa while thermal stations, nuclear and geothermal contribute 78.9%, 2.3% and 0.8% respectively.(19) Although thermal stations generate the bulk of Africa’s energy supply, the continent trails the world in carbon emissions rate per capita, with South Africa being the highest emitter. Sub-Saharan Africa emits less than a ton per capita whilst North Africa and the Middle East emit 5 tons per capita.(20) This compares to North America’s emission rate of 20 tons per capita, Europe and Central Asia at 13 tons per capita.(21) Africa’s low emission rate reflects its less industrialised economy, with the bulk of foreign exchange earnings derived from the export of raw commodities.

Despite Africa’s low carbon emissions rate, there are calls to explore the continent’s vast renewable energy resources, mainly to address the energy poverty emanating from high energy tariffs associated with fossil fuels. For instance users of fossil fuel-generated energy pay between US$ 0.60 to US$ 0.70 per kilowatt-hour (kWh), compared with an estimated cost of between US$ 0.10 to US$ 0.15 per kWh for wind generation, and between US$ 0.15 to US$ 0.25 for solar photo-voltaic.(22) In 2010, the average electricity tariff in Africa was US$ 0.14 per kilowatt-hour (kWh) compared to US$ 0.04 and US$ 0.07 per kilowatt-hour (kWh) in South Asia and East Asia respectively.(23) The high electricity tariff in Africa is mainly due to high costs from fossil-fuel based generation; hence, exploiting renewable sources could be feasible in the long term, despite the prohibitive short-term fixed costs. Affordable clean energy could boost energy demand and generate decent returns on energy investments without environmental worries.

Africa’s sustainable energy potential

Africa has a landmass of just over 30.3 million km², with renewable energy resource endowments – hydro, geothermal, solar, and nuclear.(24) Most of its renewable energy resources are yet to be exploited, which is a contributing factor in making the continent the lowest consumer of energy. There is an urgent need for a substantial increase in energy production in Africa as a whole if Africa is to be competitive with other developing regions of the world.

Africa’s sustainable energy future lies in hydropower, but at present 93% of the continent’s economically feasible hydropower potential, estimated at 937 terawatt-hours per year, or about a tenth of the world’s total, remains unexploited.(25) Much of this hydroelectric potential lies in the Democratic Republic of Congo (DRC) and Ethiopia, both of which are far from the main economic centres in southern, northern, and western Africa, and their economies are small relative to the multi-billion dollar investments needed to develop their hydropower potential. Also, significant geothermal resources exist along the Rift Valley in eastern Africa, in Djibouti, Eritrea, Kenya, Malawi, Mozambique, Tanzania, and Zambia.(26) The geothermal energy potential on the continent has been estimated to be in the range of 2.5–6.5 GW which can power more than 6 million households with renewable electricity, but at present only Kenya has exploited this resource with an installed capacity of 129 megawatts (MW).(27)

Development of these resources requires political will in the form of commitment from African governments, as well as large foreign and domestic investments. Africa’s addiction to non-renewable energy and vested interests in the fossil and mineral sector, along with the economic weight of the fossil fuel industry are major barriers to the development of renewable energy on the continent. The lack of nationally based expertise in smart energy technology is also a major drawback. Regulations on trading agreements, land access, environmental requirements, licencing and power purchase agreements should be streamlined to ensure they do not become barriers to the deployment of renewable energy in Africa. The vast energy potential, married with the right regulations and investments, will transform Africa’s economy and lift many Africans out of energy poverty. Investors also stand to gain decent returns, as the enormous challenges and potential in the power sector present even greater opportunity for impact.

Some interventions in the power sector: Light at the end of the tunnel?

According to Bloomberg New Energy Finance, renewable energy is surpassing fossil fuels for the first time in new power plant investments. Electricity from the wind, sun, waves, and biomass drew US$ 187 billion in 2010 compared with US$ 157 billion for natural gas, oil and coal.(28) Out of the US$ 268.7 billion invested worldwide in renewable energy in 2012, only about US$ 4.3 billion was invested in Africa, and most of this investment went to South Africa.(29) The overall value of private investment in the sector has averaged just US$ 300 million per year during the last decade, and flows have been highly volatile. Taking aid and private investment together, external capital flows to the power sector in Sub-Saharan Africa amount to no more than 0.1% of the region’s GDP.(30)

China has emerged as a major financier of power infrastructure in Africa. Over the period 2001–06, Chinese financing commitments to the Sub-Saharan African power sector averaged US$ 1.7 billion per year — equivalent to around 0.2% of the region’s GDP and more than official aid and other private investments combined.(31) The major focus of Chinese support has been the development of six large hydropower projects with a combined generating capacity of over 7,000 MW of electricity, and these projects should increase the region’s installed hydropower capacity by 40%.(32) Although current energy infrastructure spending is on the downside, compared to an estimated US$ 40.6 billion per year spending needed to lift Africa out of energy poverty, it is laying the groundwork to attract further investment into the sector.

South Africa, Morocco, Kenya, and Ethiopia were the major energy investment destinations in Africa in 2012. South Africa raised its investment in renewable energy from a few hundred million dollars to US$ 5.7 billion – some US$ 1.5 billion of this went to wind farms, and US$ 4.2 billion to solar projects, such as the 75MW Solar Capital De Aar PV plant phase 1 at US$ 270 million, and the similarly sized Scatec Solar Kalkbult PV plant at US$ 259 million.(33) The biggest wind transaction was the Rainmaker Dorper wind farm I, at 100MW and US$ 251 million. In North Africa, Morocco also saw a jump in outlays, to US$ 1.8 billion from US$ 297 million. There were two large projects financed in 2012: the Masen Ouarzazate solar thermal plant phase 1, at 160MW and US$ 1.2 billion; and the Nareva and International Power Tarfaya wind farm, at 300MW and US$ 563 million.(34) In east Africa, Kenya attracted US$ 1.1 billion of commitments, up from almost nothing in 2011. Kenya saw an estimated US$ 900 million committed for the 400MW Menengai geothermal project phase 1, helped by loans signed by the African Development Bank (AfDB), and US$ 180 million from the Overseas Private Investment Corporation (OPIC) for the 36MW Ormat Olkaria geothermal project expansion phase 1. Ethiopia was the destination for US$ 345 million for the 153MW Electric Power Adama wind farm phase 2, with support from China’s Export-Import (Ex-Im) Bank.(35)

Earlier this year, US President Obama announced a US$ 7 billion American investment in energy projects to expand energy access across Sub-Saharan Africa.(36) Critics, however, argue that the initial investment may not help the African economy as promised, pointing to the White House's own admission in a fact sheet that “Sub-Saharan Africa will require more than US$ 300 billion in investment to achieve universal electricity access by 2030.”(37) Nonetheless, the US intervention is certainly a small first step, and Africa needs more such initiatives to boost its power sector.

The keys to attracting the capital shortfalls include sounder power sector institutions, achievable through a smart new approach to reform and greatly expanded cross-border trade in power coupled with robust development finance and bilateral donor support.

Concluding remarks

Africa’s energy poverty is a major obstacle to doing business, as it curtails the continent’s competitiveness, and has a negative impact on foreign direct investment flows. Nonetheless, the power shortage also presents rewarding investment opportunities to the private sector and investors willing to tolerate severe risks in frontier markets in exchange for long-term value.

Electricity is needed both to industrialise and provide basic energy for the majority of people living off the grid in rural areas. This requires major changes, not only because of development demand, but also for the continent to be economically competitive with other developing regions of the world and to realise its sustainable development goals. Given Africa’s current sustainable energy potential in hydropower and geothermal, coupled with solar, wind and nuclear, the right mix of regulatory and policy overhauls, combined with increased spending, could trigger robust economic transformation and increase the continent’s fortunes.

Written by Samuel Amanor (1)

NOTES:

(1) Samuel Teye-Larbi Amanor is an Africa-focused financial and economic analyst. Contact Samuel through Consultancy Africa Intelligence's Finance & Economy unit ( finance.economy@consultancyafrica.com). Edited by Nicky Berg.

(2) Eberhard, A., ‘Underpowered: The state of the power sector in Sub-Saharan Africa’, The World Bank Group Background Paper 6, Phase 1, 1 May 2008, http://www-wds.worldbank.org.

(3) Morse, E., ‘Non-renewable energy’, National Geographic Education, 25 November 2013, http://education.nationalgeographic.com.

(4) Davidson, O., et al., ‘Energy policies for sustainable development in South Africa’, Energy Research Centre, University of Cape Town, 1 April 2006, http://www.iaea.org.

(5) Moolman, S., ‘Small-scale distribution may be key to alleviating Africa’s energy crisis’, Engineering News, 13 April 2013, https://www.engineeringnews.co.za.

(6) ‘Africa factsheet’, United Nations, NEPAD-OECD Initiative, November 2013, http://www.oecd.org.

(7) ‘The energy challenge for achieving the Millennium Development Goals’, UN-Energy, 22 July 2005, http://www.un-energy.org.

(8) ‘An integrated approach to infrastructure provision in Africa’, African Development Bank (AfDB), April 2013, http://www.afdb.org.

(9) Ibid.

(10) Eberhard, A., ‘Underpowered: The state of the power sector in Sub-Saharan Africa’, The World Bank Group Background Paper 6, Phase 1, 1 May 2008, http://www-wds.worldbank.org.

(11) Ibid.

(12) ‘Making Africa’s power sector sustainable’, United Nations Environment Programme (UNEP), 1 September 2011, http://www.un-energy.org.

(13) Ibid.

(14) Ibid.

(15) Ibid.

(16) Eberhard, A., ‘Underpowered: The state of the power sector in Sub-Saharan Africa’, The World Bank Group Background Paper 6, Phase 1, 1 May 2008, http://www-wds.worldbank.org.

(17) Ibid.

(18) ‘Needs assessment for risk mitigation in Africa: Demands and solutions’, Initiative for Risk Management in Africa (IRMA), 1 March 2013, http://www.icafrica.org.

(19) Okanlawon, L., ‘The African energy mix: Adopting renewables’, The African Business Review, 6 September 2013, http://theafricanbusinessreview.com.

(20) ‘Sub-Saharan Africa as paragon for carbon emissions’, Real Clear Energy, 14 November 2011, http://www.realclearenergy.org.

(21) Ibid.

(22) Mosiah, N., ‘Renewable energy offers Africa chance to see the light’, Business Day, 28 October 2013, http://www.bdlive.co.za.

(23) ‘The high cost of electricity generation in Africa’, African Development Bank (AfDB), 18 February 2013, http://www.afdb.org.

(24) ‘Making Africa’s power sector sustainable’, United Nations Environment Programme (UNEP), 1 September 2011, http://www.un-energy.org.

(25) Eberhard, A., ‘Underpowered: The state of the power sector in Sub-Saharan Africa’, The World Bank Group Background Paper 6, Phase 1, 1 May 2008, http://www-wds.worldbank.org.

(26) Ibid.

(27) Turner, C., ‘Sustainable energy in Sub-Saharan Africa’, International Council for Science (ICSU), 6 March 2007, http://www.icsu.org.

(28) Morales, A., ‘Renewable power trumps fossils for first time as UN talks stall’, Bloomberg New Energy Finance, 25 November 2011, http://www.bloomberg.com.

(29) Hankins, M., ‘Why Africa is missing the solar power boat’, Renewable Energy World, 20 November, 2013, http://www.renewableenergyworld.com.

(30) ‘Eberhard, A., ‘Underpowered: The state of the power sector in Sub-Saharan Africa’, The World Bank Group Background Paper 6, Phase 1, 1 May 2008, http://www-wds.worldbank.org.

(31) Ibid.

(32) Ibid.

(33) ‘Global trends in renewable energy investment 2013’, Bloomberg New Energy Finance, 23 November 2013 http://www.unep.org.

(34) Ibid.

(35) Ibid.

(36) Basu, T., ‘Obama Africa energy project seen as small first step’, USA Today, 9 August 2013, http://www.usatoday.com.

(37) Ibid.

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here