JOHANNESBURG (miningweekly.com) – Platinum group metals (PGMs) and chrome co-producer Tharisa, which on Tuesday reported considerably higher production in the 12 months to September 30, has achieved seven fatality-free years.

“We continue to strive to be a zero-harm company,” said Tharisa CEO Phoevos Pouroulis.

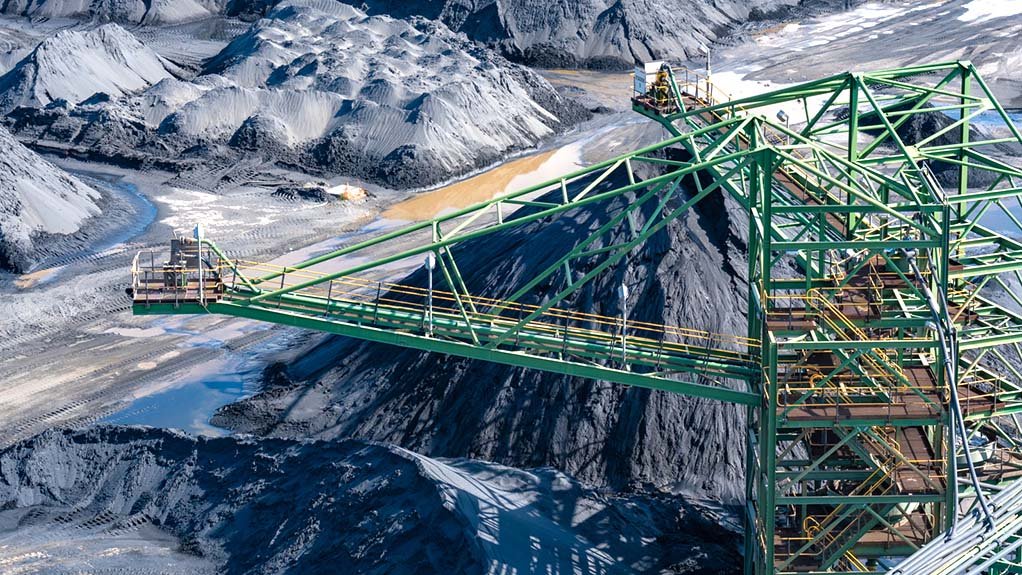

Production increased across the board at the flagship Tharisa mine, with improved recoveries at the Vulcan plant.

The Johannesburg- and London-listed Tharisa, in its financial year (FY) 2022, produced 13.6% more PGMs totalling 179 200 oz and 5.1% more chrome totalling 1 582 700 t.

The company’s PGMs basket price in the 12 months was 16.6% down at $2 564/oz but the annual metallurgical grade chrome price 35.7% up at $209/t.

A cash balance of $143.4-million and positive net cash position of $78.6-million is reported ahead of ground breaking at the Karo Platinum growth project in Zimbabwe in December, with inaugural production expected within the next 24 months.

In FY2023, six-element PGMs production is forecast at between 175 000 oz and 185 000 oz and chrome concentrates production at 1.75-million tons to 1.85-million tons.

Pouroulis described FY2022 as being a rewarding year operationally that would translate to a strong set of financial results.

“This operational performance is built on key decisions we made some years ago with the goal of accelerating our growth strategy,” Pouroulis stated in a release to Mining Weekly.

Although PGM prices were trading in the lower half of their 12-month range, Tharisa described them as not retreating as much as anticipated.

The company saw demand-supply fundamentals, particularly for palladium and rhodium, remaining in deficit, and platinum being in deficit within the next 18 months.

It noted that primary supply from South Africa was slowing, owing to a lack of development, rising costs and electricity curtailments, which was affecting deep level mines in particular.

“At the same time, the increasing importance of PGMs for the future of the hydrogen economy underpins our conviction that the fundamentals for these precious metals remain strong,” the company added.

“Chrome prices were volatile during the quarter where they retreated in line with expectation, mostly due to stainless steel and ferrochrome production curtailments in China. Consequently, port inventory rose slightly, albeit off a very low base. Inflationary cost pressures, supply chain constraints and the Covid policy in China remained key macro issues to the market. Towards the end of the quarter, increased demand stimulated a higher price environment as production of steel and alloy normalised.

“Policy announcements from the Party Congress on 16 October 2022 in China relating to the relaxation of Covid policies, and more stimulus packages being announced, would bode well for demand of Tharisa’s chrome concentrates.

“We believe that supply disruptions will mitigate a price retreat, in the face of pricing risks and slowing economies heading towards a recessionary environment,” the company added.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here