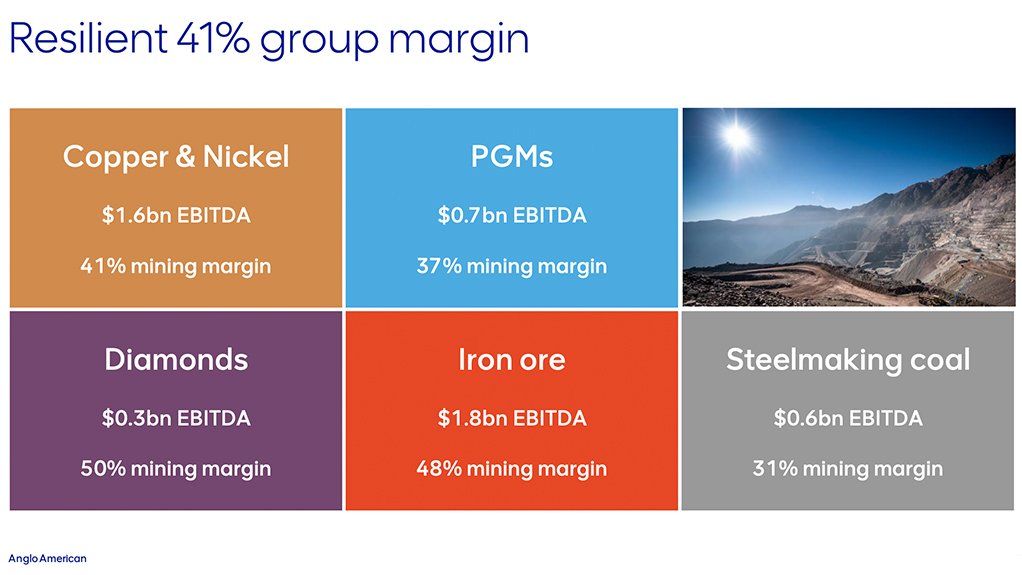

JOHANNESBURG (miningweekly.com) – The De Beers Group faced off tricky macro-economic conditions to record first-half earnings before interest, taxes, depreciation and amortisation (Ebitda) of $0.3-billion, with the diamond company’s 50% mining margin the highest within the Anglo American stable.

“Operational performance at De Beers has been really good,” Anglo CE Duncan Wanblad told investment analysts and journalists at this week’s half-year results presentation, where Anglo’s overall half-year Ebitda was reported to be a 49%-lower $5.1-billion. De Beers half-year Ebitda fell to $347-million from $944-million in the corresponding first six months of 2022.

“The macro-economic conditions have indeed impacted on rough diamond demand, as they always do, and we are likely, given what’s happening in China, to remain challenged during the second half of this year. The consequent result of that is there will be a little bit of build-up in midstream inventory levels,” said Wanblad.

In producing 16.5-million carats in the half-year, De Beers achieved increases across most assets.

An exception was South Africa’s Venetia in Limpopo province, which, as planned, transitioned from openpit to underground, in what is described as “a really hard-earned milestone”. (Also watch attached Creamer Media video.)

Regarding the macro headwinds faced, De Beers Group CFO Sarah Kuijlaars told Mining Weekly in a Teams interview: “The macro-economic conditions have been tougher than we would like. It's easy to forget, but 2021/2022 were outstanding for the diamond industry, and we've come off that a bit. You'll recall there was fiscal stimulus in the US and as that's unwound, it has provided softer conditions in the diamond market.

“India demand has been strong and then if you look across to China, where we all hoped for the pent-up demand to come through, as it had in the US, that's been a bit slower than we expected, so overall tough macro environments for us in the first half,” said Kuijlaars.

Diamonds are a discretionary purchase and consumers have got to feel confident to go out and purchase their diamonds.

“We're looking for signals, particularly in the US and China, to see how that flows through to the end of this year. If we take a step back, we still remain confident of the long-term supply/demand fundamentals. We know demand is going to grow. We know more middle-class income people are going to aspire to buy diamonds, and supply is going to support that demand growth in the longer term.”

Mining Weekly: What benefits are on the way from the Venetia Underground Project now that first production has been achieved?

Kuijlaars: I think we've got to be very conscious that we've got quite an extensive ramp-up coming through the system, but I'm really proud of how the team has worked together and delivered this key milestone.

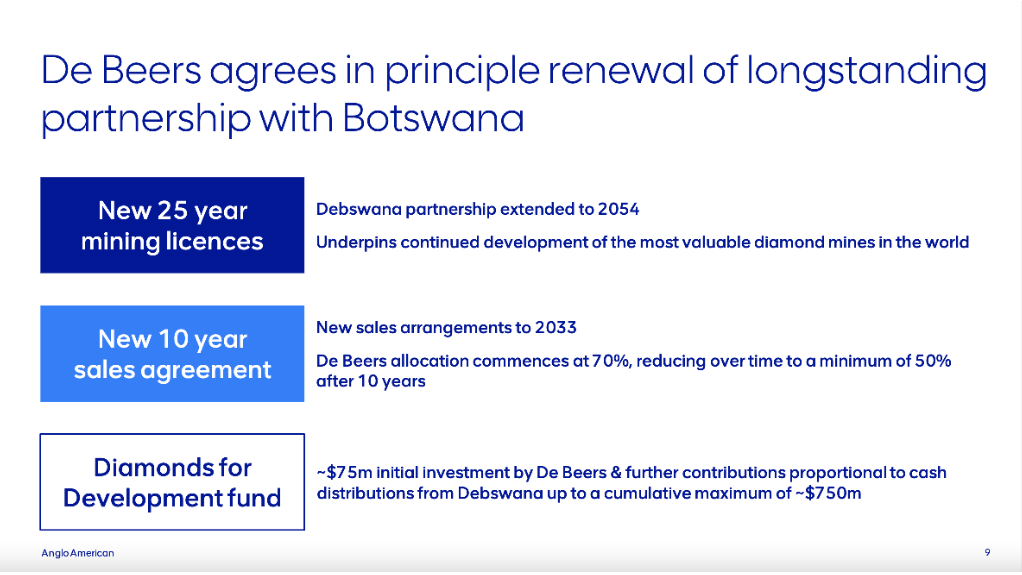

When will all the i’s be dotted and the t’s be crossed in the extension of the Botswana agreement to 2043?

The agreement with the government of Botswana is a really important agreement. I'm delighted that we reached agreement in principle at the end of June, but, as you say, that was an agreement in principle, and we have to work through the long form agreements, which will take months, not weeks, and then ultimately will go to both shareholders for support.

Why is the new 25-year Debswana mining licence so important to De Beers?

It secures our access to real tier-one assets, some of the best diamond mines in the world. We've been a partner with the government of Botswana for 50-odd years and we look forward to the next 50 with the people of Botswana.

When will all the details be sorted out in the new sales arrangement to 2033?

For us, it's been very much a negotiation of two halves, of the sales agreement and the mining licence, and they were both being progressed in parallel, but it was great that at the end of June, we did agree to maintain the sales agreement on the previous terms until the new sales agreement is fully signed.

Regarding the Diamonds for Development Fund, and the benefits that will accrue to the people of Botswana from De Beers’ initial $75-million, one billion pula, investment, Kuijlaars reported that the fund’s website is open for Batswanans to begin expressing their interest and for the fund to then decide how it will invest in the future of Botswana. The fund will run independent of De Beers and will have independent governance.

“We really look forward to taking those first steps of setting up the fund and the governance,” Kuijlaars enthused.

Sadly, Mining Weekly has been told of an incident in which a pilot doing exploration work on De Beers leases in Angola lost his life in a plane accident. What have investigations revealed about the aviation fatality so far?

Yes, a tragic accident while exploring in Angola, and a pilot very sadly lost his life. It's a terrible incident for the whole De Beers family. We're working with the Angolan authorities to really distil learnings.

GEOPHYSICAL SURVEYING

Mining Weekly can report that the incident has drawn added attention to the risk associated with diamond prospecting in challenging terrain and unpredictable weather.

The small aircraft prospecting for diamonds in Angola’s Minas Gerais region reportedly crashed on June 22 between the municipalities of Cambula and Lucapa, in Lunda-Norte, Angola.

Journalist Emmanuel Abara Benson reported on BNN that the circumstances surrounding the aviation accident point to a possible collision with a tree, likely due to poor visibility.

The findings of the investigation under way are expected to contribute to improving safety protocols and preventing similar incidents in the future.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here