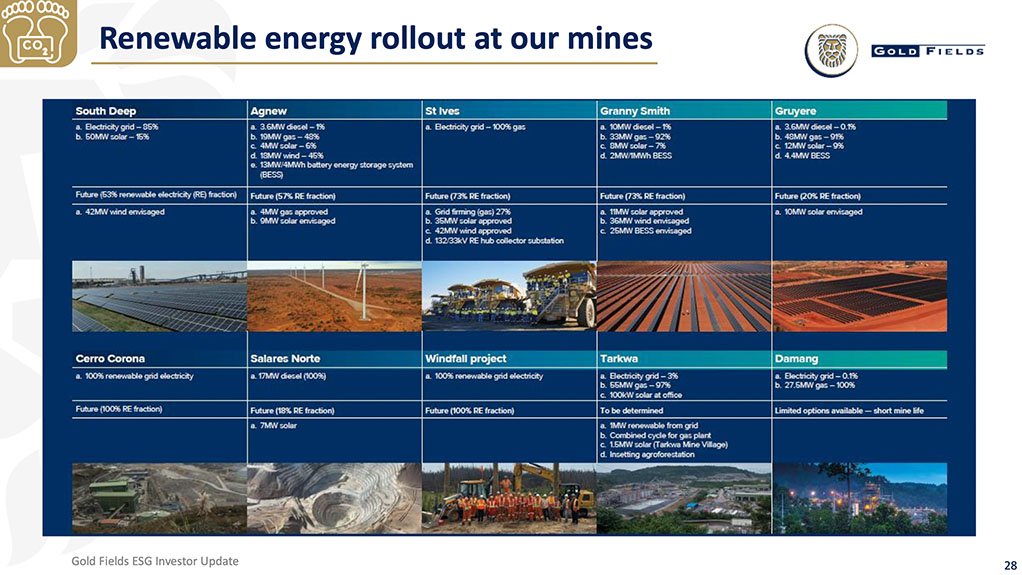

JOHANNESBURG (miningweeky.com) – Mining company Gold Fields expects to be in a position to decide on the establishment of a wind power project at the South Deep gold mine, west of Johannesburg, in the third quarter of this year.

The project is currently undergoing scoping and feasibility and one of the key pieces of work has been around its environmental impact in general and its effect on a bat colony that exists in the nearby area in particular, Gold Fields CEO Mike Fraser said in response to Mining Weekly at this week’s first-quarter results and environmental, social and governance (ESG) presentation. (Also watch attached Creamer Media video.)

“We believe, at an economic level, the South Deep wind project is viable but we just need to close out the full feasibility,” Fraser said.

Since early 2023, a metrological tower has been in place at South Deep, measuring wind availability at a number of different heights above ground level.

“We should have all the data we need during the third quarter, and we'll be in a position, at that point, with all of the wind availability data, and the environmental-impact assessment (EIA) having been completed, to then make a decision,” said Gold Fields VP environmental performance Andrew Parsons.

“We've now got a years’ set of data and that work is more or less done. We'll be getting the report quite soon,” Parsons added.

The EIA studies currently underway have got another three months or so to run.

BACKFILL ISSUE

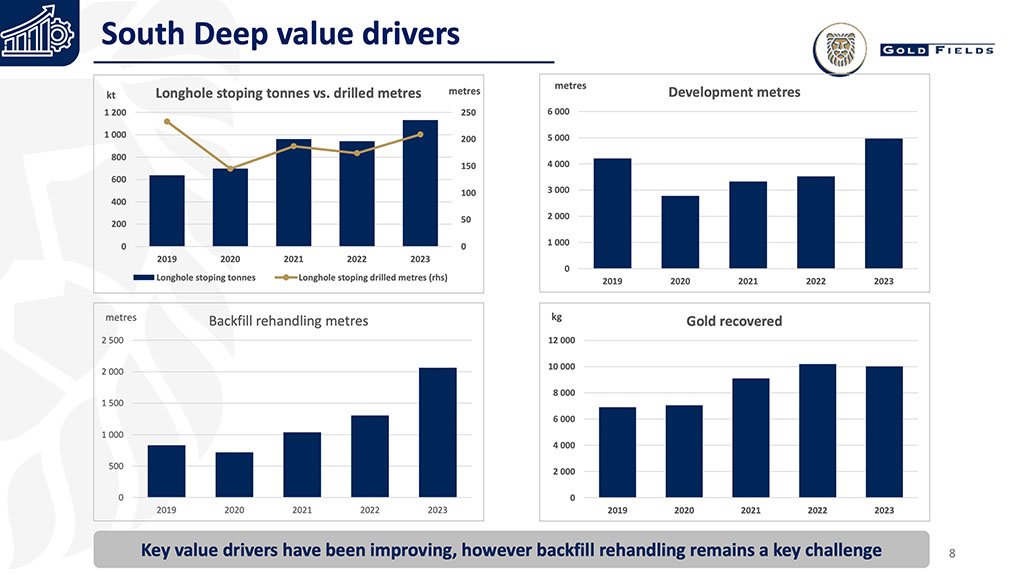

South Deep is finding that as it backfills its underground workings, there is significant leakage of backfill materials, which is restricting access to stopes and the availability of future stopes.

Some 2 000 m of backfill, which is causing significant challenges across different working and open areas, needs to be cleaned up before advanced development can be achieved.

Graphs displayed showed the considerable re-handling that is having to be done.

“I almost look at this as an opportunity for South Deep,” said Fraser. This is because if successful rework can be achieved, it sets South Deep up for getting well ahead of what's perceived to be possible at the mechanised, long-life mine.

“We're working with a number of experts to help us. It's hard for me to give you a clear answer as to when the backfill issue will be solved.

“We have forecast lower production this year because we expect this to take some time and if we can fix it, the opportunity is there for South Deep to get to where it needs to be as an asset,” added Fraser, who will provide an update in the second quarter.

DECARBONISATION COMMITMENT

Johannesburg- and New York-listed Gold Fields this week reiterated its commitment to decarbonisation across the business.

“I do believe that Gold Fields is one of the leaders in our sector when it comes to mitigating its climate change impact. The programmes and projects that are underway to reduce our carbon footprint demonstrate our willingness to make a difference,” said Fraser.

“We all have a role to play in combating climate change, and the impact that it is having on our planet, our mines, and our people.

“We can just see by the report that we've spoken about in terms of production, the impact of severe weather events is having and we certainly believe that that is going to become more prevalent,” he said.

Targeted is a 30% net emission reduction and 50% absolute emission reduction by 2030, based on an assumed production volume of around 2.8-million ounces by 2028.

Like many other corporates, it is committed to net zero by 2050, against its 2016 baseline.

“We also re-baselined our Scope 3 emissions during 2023 and set a 2030 target to reduce our Scope 3 emissions by 10%, against our 2022 baseline.

“The Scope 3 emissions make up around 37% of our total emissions. And whilst not in our direct control, we will continue to be working with our major suppliers to achieve this target.” Fraser added.

The capital expenditure (capex) that will be required over the next six years to achieve the decarbonisation targets remains uncalculated because of the option of doing power purchase agreements or looking at other financing solutions.

“Once we’ve completed feasibility studies, we’ll provide guidance on the capex required,” Parsons said.

RENEWABLES PROJECTS

The contribution of renewables in the electricity mix of Gold Fields continues to grow and last year totalled 17% of the group’s total energy requirements, primarily because of the contribution of South Deep and the new solar plants at the Gruyere gold mine in Australia.

As a result of renewables, net Scope 1 and Scope 2 emissions in 2023 were 4% below the baseline and absolute emissions fell by 12%.

At St Ives in Australia, construction of solar and wind plants is set to provide more than 70% of the mine’s electricity requirements, as well as reduce electricity costs by 30% annually and group emissions by 6%.

At Granny Smith also in Australia, 11 MW of solar power and 7 MW of battery storage are being added to the existing 8 MW of solar and 2 MW of battery storage.

In Chile, construction of a 7 MW solar farm is also underway at Salares Norte, the company’s newest gold mine.

Since the gold production outlook for the long term is not guaranteed, Gold Fields is preferring to start focusing on emissions intensity per ounce, which it sees as a potentially more appropriate way of reporting on emissions reduction.

The company is committed to diesel replacement and will be going beyond the introduction of a battery electric fleet to other opportunities on bulk materials handling.

TAILINGS TREATMENT

Another critical component of Gold Fields’ environmental strategy is tailings management, which is centred on implementing and adopting the Global Industry Standard on Tailings Management conformance.

As part of this conformance process, self-assessment reports were published last year for the Cerra Corona mine and Tarkwa mine tailings storage facilities (TSFs), which have extreme or very high consequence category rating.

The other TSF reports, which are due by August 2025, remain on track, Gold Fields reported.

Gold Fields has five active upstream raised TSFs in the portfolio and with the transition of the Tarkwa TSFs 1 and 2 from upstream to downstream, its raised facilities are on track for completion later this year.

WATER MANAGEMENT

On schedule are two 2030 water management targets, involving the recycling of 80% of the water used and reducing freshwater use by 45% against a 2018 baseline.

During 2023, 74% of water was recycled and reused compared with 75% in 2022, and freshwater use was reduced by 39%.

Water-saving initiatives are implemented at all mines, especially those in countries with scarce resources, or where the water is shared with host communities.

GOVERNANCE, ARTIFICIAL INTELLIGENCE

Gold Fields sets out to ensure that everything it does is underpinned by sound governance and compliance structures and processes.

Governance is seen as the cornerstone of building trust with stakeholders, and key issues faced in the last 12 months are the increase in the quality and quantity of ESG reporting requirements.

During 2023, this included the International Sustainability Standards Board’s international financial reporting standards sustainability disclosure requirements, which seek to consolidate many of the leading reporting standards.

The US Securities and Exchange Commission has also indicated its intention to launch new climate-related disclosure rules, which are being contested within the US and held up in courts.

The emergence of artificial intelligence (AI) is seen as both an opportunity and a risk to the business, with AI having been the subject of several discussions within Gold Fields to ensure that AI is managed through what the company describes as the right opportunity and risk lens.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here