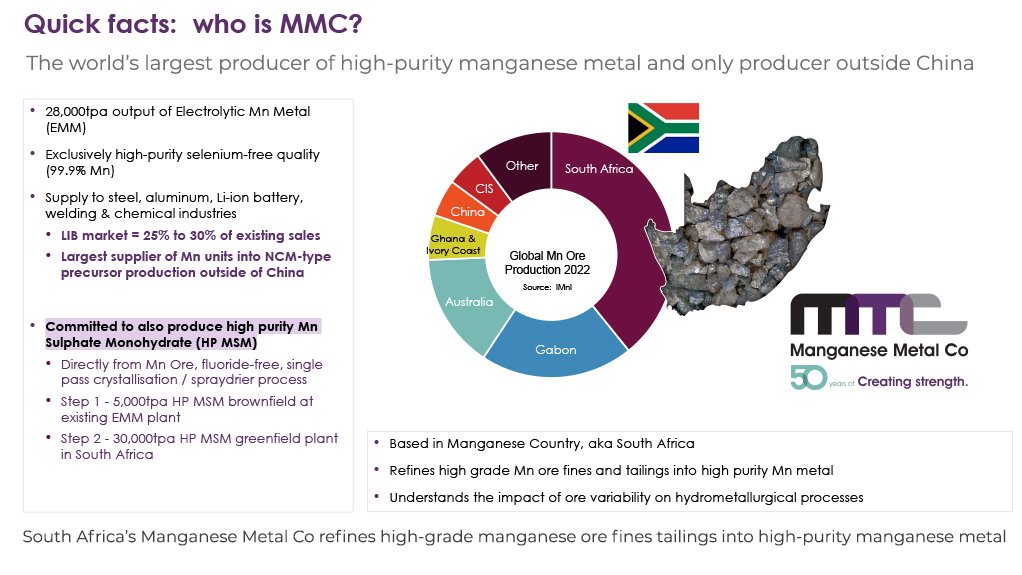

JOHANNESBURG (miningweekly.com) – Close to half a century of local manganese mastery by Manganese Metal Co of Mpumalanga is placing South Africa – a manganese mining and refining country – in pole position, amid a flurry of global high-purity manganese sulphate monohydrate projects, to meet upcoming battery demand.

With industrialisation of manganese-rich battery materials technology having already commenced, manganese for cathode active material will be a low-cost recyclable critical energy transition material.

Moreover, being more affordable and greener, cathode active material with higher manganese content is being pursued by key battery electric vehicle (BEV) manufacturers.

Although non-Chinese manganese sulphate would require a premium, the overall effect on battery cell cost would likely be limited, with the material representing a relatively minor input cost in battery chemistries.

In a presentation to the Fastmarkets European Battery Raw Materials event in Amsterdam, Manganese Metal Co market development executive Madelein Todd highlighted the commitment of her company to produce the sought-after high-purity manganese sulphate monohydrate in Mbombela (Nelspruit) directly from manganese ore, in addition to being the producer of the world’s highest 99.9% pure manganese metal going back to 1974.

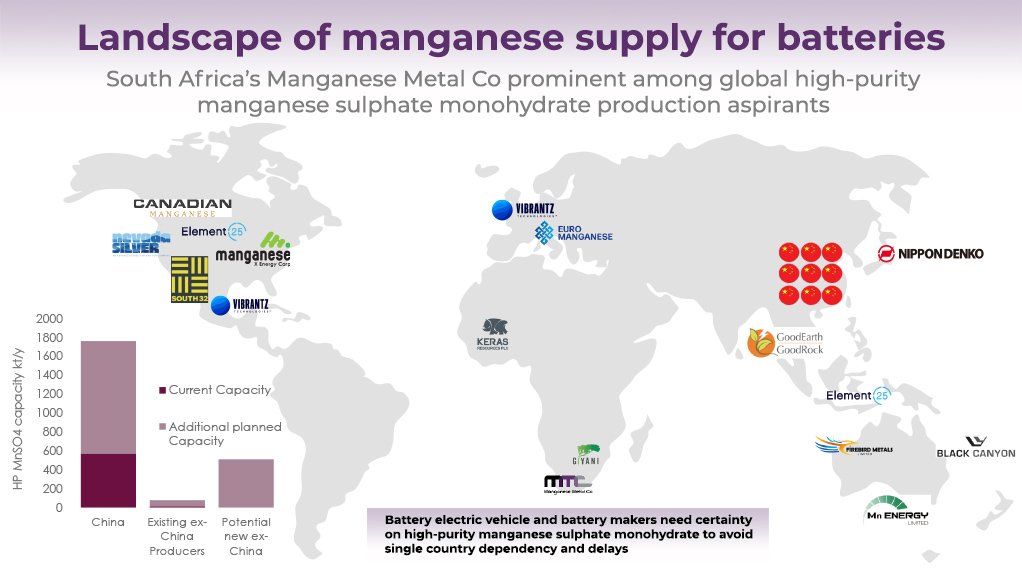

This is being done at a time when BEV and battery makers outside of China need certainty on non-China high-purity manganese supply to avoid single-country dependency.

Four good news items Todd spotlighted to the world at the event are that:

- even if the cost of non-China sustainable and traceable manganese product is three times higher, it still results in a lower-cost cathode active material;

- Manganese Metal Co’s production of high-purity manganese sulphate monohydrate, together with its lower overall cathode cost, will also be using only renewable energy, giving it substantially lower carbon intensity;

- manganese ore is widespread and of much higher grade than nickel ore, the key input material for more expensive cathode active material; moreover, the use of manganese ore results in less mining waste being generated; and

- increased manganese sulphate monohydrate production will have insignificant impact on total demand for manganese ore and no new manganese mines are needed.

The incentive price needed for non-China high-purity manganese sulphate monohydrate is calculated to be around $2 500/t to cover the cost of capital, cost of low-carbon emissions and cost of meeting European Union and North American environmental standards.

The site of Manganese Metal Co’s existing 28 000 t/y high-purity manganese metal plant is being earmarked for the construction of a 5 000 t/y brownfield plant to produce manganese sulphate monohydrate followed potentially by a 30 000 t/y greenfield project.

Fifty-five per cent of the high-purity electrolytic manganese metal that the company produces on the existing site is sold to Japan, 25% to the US, and 10% to Europe.

For some time, its customers in the battery segment have been buying and then dissolving the high-purity electrolytic manganese metal to make manganese sulphate monohydrate, which presents a huge opportunity for the company to grow into that space itself, but using manganese ore as the feed.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here