JOHANNESBURG (miningweekly.com) – South African ilmenite used to manufacture titanium dioxide pigment in KwaZulu-Natal has received a major value boost with the signing of an engineering, procurement and construction (EPC) contract for the long-awaited sulphuric acid titanium dioxide project that has been championed over many years by Nyanza Light Metals CEO Donovan Chimhandamba.

The project highlights the huge opportunity for Africa and South Africa to move up the value curve by establishing advanced material production companies that make competitive use of locally mined materials.

The $750-million required for the far-reaching titanium dioxide (TiO2) project is no small change and has been awaiting the high-level EPC signing with East China Engineering Science and Technology Company (ECEC), a subsidiary of China National Chemical Engineering Group Company.

The signing was essential to give the many finance houses committed to funding the 80 000 t/y project the confidence needed.

This solace stems from ECEC having built 31 plants in China over 60 years, as well as the EPC signed being followed by an ongoing operational upkeep agreement.

The important backdrop to all this is that South Africa’s ilmenite, a heavy mineral sands derivative, sells at around $300/t on export markets, whereas using it to manufacture TiO2 pigment at the Richards Bay Industrial Development Zone (RBIDZ) will enable it to potentially fetch a ten-times-higher $3 000/t.

The first thing the R14-billion Nyanza project is seeking to achieve is to move Africa’s abundant raw materials up the value curve, Chimhandamba emphasised to Engineering News & Mining Weekly in a Zoom interview earlier this year.

The 80 000 t/y of TiO2 pigment is probably around half of Africa’s buying capacity and just over 1% in terms of the global market.

TiO2 is widely used in the fields of coatings, cosmetics, medicine, electronics and environmental protection. However, at present, there is not a single TiO2 factory in operation in Africa, China Chemical Industry News journalists Li Dongzhou and Wang Peng have noted in their article sent to Engineering News & Mining Weekly.

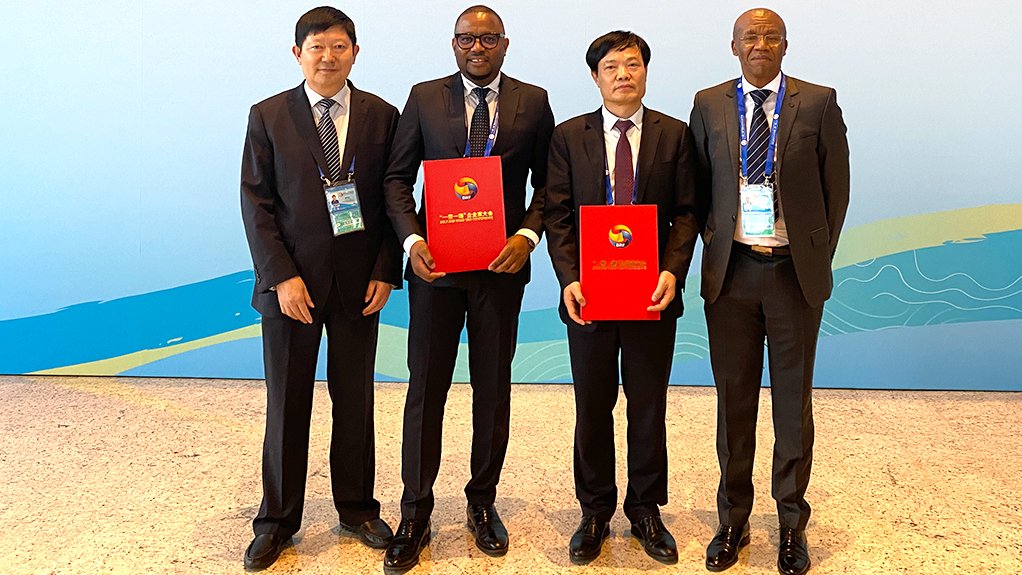

At last month’s third Belt and Road Forum for International Cooperation held in Beijing, the EPC signing breakthrough was finally achieved.

With shared technology and cooperation, Nyanza will produce TiO2 pigment in South Africa, demonstrating how the Belt and Road Initiative is benefiting development in Africa through cooperation with China, Dongzhou and Peng emphasised.

Nyanza will be sourcing its ilmenite from within South Africa and Mining Weekly can report manufacturing costs could be lowered further if a way is found to blend in the 45-million tons of stockpiled ilmenite-containing slag at Evraz, the former Highveld Steel and Vanadium, in eMalahleni, Mpumalanga. The blending in could conceivably be brought about with higher-content ilmenite, or synthetic rutile from Richards Bay Minerals.

Self-generation of 12 MW of solar power supported by battery storage is planned, augmented by 8 MW of cogenerated electricity from the sulfuric acid plant.

Already commissioned is a R200-million product testing and development centre will be used to train over 200 young graduates, operators and artisans, who will eventually be transferred to the main plant, which will have more than 850 employees at full operation.

Offtake agreements for more than 60% of the 80 000 t/y capacity have already been signed and while the main plant is being built, the testing and development will be used to train employees, who will be brought in early for upskilling.

Africa Finance Corporation of Nigeria and African Export-Import Bank of Egypt are co-funders of the project’s feasibility phase, and a third multilateral international finance institution is going through concluding the agreements. Senior debt is already oversubscribed, equity players have expressed interest, and financial close is likely in the second quarter of 2024.

RBIDZ site preparation works will commence in the first quarter of next year, where activities such as site clearing, bulk earthworks and piling are scheduled to happen, prior to the major plant construction works in being done by the EPC contractor in the third quarter of next 2024.

Arkein Industrial Holdings is the founding shareholder of Nyanza with 70%, while DBF Capital holds the remaining 30%. At financial close, arrangements with multilateral banks to allow for the conversion of investments into equity or debt are already in place.

As noted by China Chemical Industry News journalists Dongzhou and Peng, Chimhandamba began contemplating this project 16 years ago.

This followed his learning about titanium as a 28-year-old manufacturing operations GM for Vesuvius International, which manufactured and supplied refractory bricks to Evraz. In its steelmaking process, Evraz was generating a waste slag that contained 30% titanium dioxide, which presented a recovery opportunity and the production of a value-add titanium product.

Later, as Rare Metals Industries chairperson, Chimhandamba was involved with the Kroll process, used in producing titanium and zirconium sponge. However, an intended related project did not materialise, owing mainly to its energy intensity at a time of growing energy scarcity.

This disappointing experience, Dongzhou and Peng report, stimulated Chimhandamba’s continued pursuit of TiO2, resulting in the founding of Nyanza in 2011.

“Regrettably, we took long to identify and engage with ECEC, now our Chinese partner. If we had set out with this engagement earlier, this project would have been complete by now," Chimhandamba is quoted by Dongzhou and Peng as saying.

Engineering News & Mining Weekly put these questions to Chimhandamba in our earlier interview:

What are the benefits to the South African economy of the local manufacture in Richards Bay of titanium dioxide pigment by Nyanza?

Chimhandamba: In general, Africa has not taken advantage of its abundance of raw materials. It’s not only in titanium, but you will find across many minerals we’re generally a miner and maybe some concentration of certain minerals, but with very little value addition. In the titanium space, for example, South Africa, and Africa at large, has an abundance of heavy mineral sands. In heavy mineral sands are companies such as Tronox, Rio Tinto, Base Resources, Masirah Rutile. Some mine heavy mineral sands and then export either ilmenite, zircon, monazite, without any value addition. We use ilmenite, which Africa currently exports at prices as low as $300/t. It goes to Europe, Asia or America, where it’s put through a chemical process by the likes of DuPont spin-off Chemours, which produces TiO2 pigment, and we, as Africa, import that at prices of $3 000/t, as an example.

With TiO2 pigment used in paints, industrial coatings, plastics, papers, inks, foods, medicines, toothpaste and the like, how much of it will be exported by Nyanza and how much used domestically?

As you’ve correctly pointed out, it’s literally in almost everything that we touch from the moment we wake up. The paint for your house, a paint for your car, your toothpaste as a whitener, sunscreen for UV protection, the inks that are used to colour your clothes. It’s the most widely used mineral. South Africa currently consumes about 35 000 t of titanium dioxide pigment and all of that is imported. If you put the price at $3 000/t, you can understand the size of what it costs us to import TiO2 pigment. If you look at what we’re exporting as ilmenite or unbeneficiated material, the number pales in comparison with what we pay, so we end up being a net importer of titanium and yet the titanium comes from our country. At a continental scale, Africa consumes about 150 000 t/y of TiO2 pigment. The global industry is at about seven-million tons in terms of demand and supply, so Africa is still a small consumer when you look at it from that perspective. But if you look at Nyanza now putting together a plant for 80 000 t/y, that’s probably around about 50% of Africa’s capacity. While it’s a phenomenal project, it’s just over 1% in terms of the global market. When we started the project in 2011, we had an estimated capital cost of R4.5-billion for just the titanium plant without the infrastructure and utilities. At that time, the exchange rate was R7 to R8 to the dollar and today it is over R18 to the dollar, so today we’re looking at financial close for the EPC and construction costs of about $500-million, which is R9-billion and that covers not only the titanium pigment plant, but also a sulphuric acid plant that has to be built next to it, plus gas boilers, wastewater infrastructure and solar power and cogenerated power to manage our energy security. If you look at the $500-million just for construction, there are still financing costs that we will incur. You have interest during construction and working capital, so we’re looking at a peak funding close to $750-million, which is just under R14-billion in today’s numbers. I know that R4.5-billion comes from 2011 and I see that number continues to appear, but again, the story remains that we have a huge opportunity as Africa and South Africa to move up the value curve and start bringing in these advanced material production companies.

From which mining companies will you source the ilmenite for the manufacture of titanium dioxide pigment – the Ti02?

In South Africa, there’s quite a couple that already mine that. You have Tronox that mines that in KwaZulu-Natal and Richards Bay Minerals, in Richards Bay. Up in Mozambique, is Kenmare and in Madagascar is QIT. The region has multiple sources and depending on the final product we’re making, you find different sources give you different kinds of product capability. We will be sourcing locally from within South Africa and the region.

In addition to the ilmenite, I believe you’re going to use titaniferous slag and acid from Evraz Highveld Steel and Vanadium. Tell us about that.

The Evraz Highveld Steel operation used to mine and process titanium ferrous magnetite. That steel operation was extracting iron and vanadium with typically about 30% titanium in the slag waste stream, whereas ilmenites start from 44%, 46% and going as high as 52%. There are more than 45-million tonnes available that have been stockpiled. It would be advantageous if we can find a way of blending in some of this low titanium content slag with the higher content ilmenite from, for example, Kenmare or maybe switching in with Richards Bay Minerals synthetic rutile, so Evraz, formerly Highveld Steel, presents an opportunity for the country to lower manufacturing costs by bringing in what would typically not have been usable in typical pigment production processes.

What are Nyanza’s energy and logistics plans at a time when South Africa is still experiencing electricity blackouts and rail disruptions?

The advantage we have is these things are happening while we are putting together a project and we have an opportunity to bring in all the required infrastructure upfront. For example, on the energy side, we’re putting in 12 MW of solar power. We’re also working with the national government and the RBIDZ to look at putting in battery energy storage solutions. These solutions would also look at trying to convert solar energy to baseload capacity. In terms of rail and logistics, we’re at the port and we’re working again with the RBIDZ and the Department of Trade, Industry and Competition in terms of connecting the zone to the mainline rail networks. Our rail connections generally are centred on access to the port, but also if we’re going to be moving Highveld Steel slag to Richards Bay, rail becomes quite critical. We cannot look at building the titanium plant in isolation, we have to look at an integrated approach where we’re bringing in other infrastructure and utilities that we typically should not have been investing in, but in partnership with the government and other institutions, we’re developing these utilities.

Already commissioned is a R200-milion product testing and development centre, which is able to handle 700 t/y of TiO2 pigment. Why have you adopted this phased approach?

For customers to sign offtake agreements, they need to have samples, so the first important thing was to be able to produce, not at commercial scale, but at a significant volume, to enable customers to actually offtake and run in their paint formulations, as an example. That gives the customers confidence and because of that, we have managed now to sign some offtake agreements for more than 60% of our capacity. We have observed that there is a long-term structural shortage of titanium dioxide pigment globally caused by two things – shrinking supply capacity in Europe due to plant closures and rationalisations driven by high energy costs; and production capacity addition lagging behind demand growth. The first thing is to give us the capability. The second thing is that while we’re building the main plant, you need a facility that enables you to train employees. Probably half of our 850 permanent employees will be at operator skilled level and those people have to be brought in early to make sure that they are aligned or upskilled to what is needed.

In the long term, do you ever anticipate that you may list your company on the Johannesburg Stock Exchange?

Listing always comes with its own challenges. When you’re still in a growth phase, our view, in the short term, is if we can avoid listing and try and get the operation to steady state, that’s what we would typically do, and the multilaterals we’re working with also prefer these private assets. Once we’re at steady state and we’re looking at expansion, we’ll have to revisit our strategy in terms of the capital markets – and also we may create some exit strategy or platform for some of the shareholders. But right now, what you’re seeing is the bulk of the shareholders are multilateral financial institutions, which have more patient capital and are looking to ten years plus in our case.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here