JOHANNESBURG (miningweekly.com) – With the global macroeconomic environment remaining challenging, Sibanye-Stillwater is continuing to assess the positioning of its operations for optimal performance and sustainability through the cycle, CEO Neal Froneman said on Thursday when the company provided a third-quarter operational update.

“Our financial position remains robust and our capital allocation framework remains the guiding principle for growth and diversification opportunities aligned with our strategy,” Froneman highlighted.

“We have maintained our capital discipline in anticipation of weaker market conditions, as highlighted in February 2022. We remain prudent with capital investment and utilising our balance sheet to fund external growth during this challenging period.

“We are conscious of the necessity of appropriately managing debt, mindful of our leverage position during periods of decreasing, or volatile, profitability and earnings,” Froneman added in a release to Mining Weekly.

After a difficult start to the third quarter, with three tragic fatalities recorded in the first five weeks, the remainder of the three months to the end of September was fatality-free.

Noted was that the gains in safety performance indicators since 2021 had been maintained, with the other lagging indicators generally stable year-on-year.

The platinum group metals (PGMs), gold and green metals company is looking forward to ongoing safety improvements over the remainder of the year, with an intense focus on ending the year without any high-impact incidents.

Sibanye reiterated its mindfulness of the commercial environment as well as its intention, where necessary, to consider restructuring in areas where commercially viable operations cannot be sustained.

In this regard, potential restructuring at the South African gold and the South African PGM operations was announced.

“Potential closure or rightsizing of high-cost and underperforming shafts will ensure that operations remain profitable and sustainable at current precious metal prices and beyond, while retaining significant leverage to improvements in the commodity price outlook,” said Froneman.

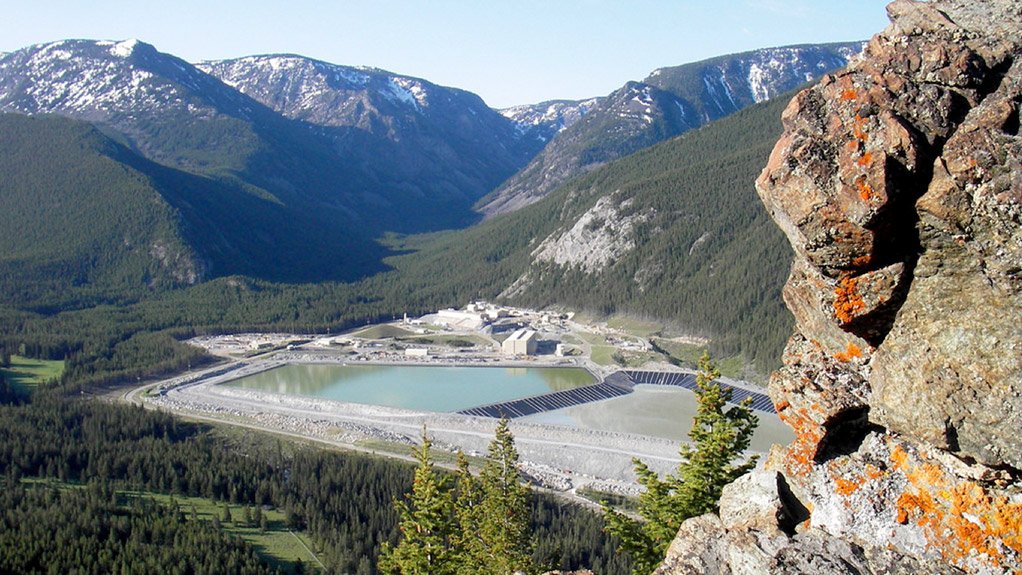

Although the US PGM operations were repositioned in mid-2022 in anticipation of the changing macro environment and worsening medium-term outlook for the palladium price, the decline in the palladium price during 2023 has surpassed expectations, dropping lower and faster than anticipated.

While the mine production volume run rate at the US PGM operations improved during October, persistent inflation and the continued impact of skills shortages, have resulted in costs remaining significantly higher than planned. Further repositioning is being considered to address these factors which have kept costs at elevated levels.

As guided, the third-quarter operational performances of the Sandouville nickel refinery in France and the Century zinc retreatment operation in Australia improved, with both operations recovering from first-half disruptions. This improved operational performance resulted in the Century operation contributing positively to third-quarter group adjusted earnings before interest, taxes, depreciation and amortisation (Ebitda), a turnaround from adjusted Ebitda losses in the second quarter.

But despite the improved third-quarter operational performance, the Sandouville refinery remained loss-making, owing to continued inflationary cost pressures, elevated maintenance costs and a further decline in the average nickel price.

The current operations are not commercially viable at current nickel prices, and management has made notable progress with optimisation studies aimed at securing a sustainable future for the Sandouville refinery.

“Positively, during these optimisation studies, the European region and Sandouville teams have identified an innovative alternative to the current process and are currently assessing its commercial and technical feasibility. In parallel, we continue to advance the studies on recycling and production of battery grade nickel products,” said Froneman.

Addressing losses from these operations will ensure ongoing delivery of Sibanye’s strategy and position the company for future value creation.

In this regard, the construction of the lithium concentrator and the development of the Syväjärvi openpit mine in Päiväneva in Finland have been initiated.

This places the Keliber lithium project in pole position as an integrated lithium hydroxide supplier of battery grade metal into the European battery ecosystem by 2026, at a time when there are expected to be increasing lithium supply deficits.

US PGM RECYCLING OPERATIONS

The global autocatalyst recycling industry remains depressed mainly as a result of the uncertain global economic outlook, recessionary concerns, and higher interest rates that have inhibited consumer demand for new vehicles. Light duty vehicles are remaining in service for extended periods of time with fewer vehicles being scrapped.

Reflecting on these factors, the recycling operations were 46% down on last year’s third quarter in processing 873 t of material. At the end of the third quarter, about 24 t of recycle inventory was on hand, an 18 t decrease on the corresponding quarter of last year.

Recent increases in global auto sales have led to upward revisions in 2023 sales forecasts, offering a promising indicator of an uptick in future recycling volumes. Despite these positive developments, the recycling segment continues to face short-term challenges, driving efforts to pursue and achieve volume-driven growth. This includes exploring opportunities beyond the traditional autocatalyst feed sources.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here