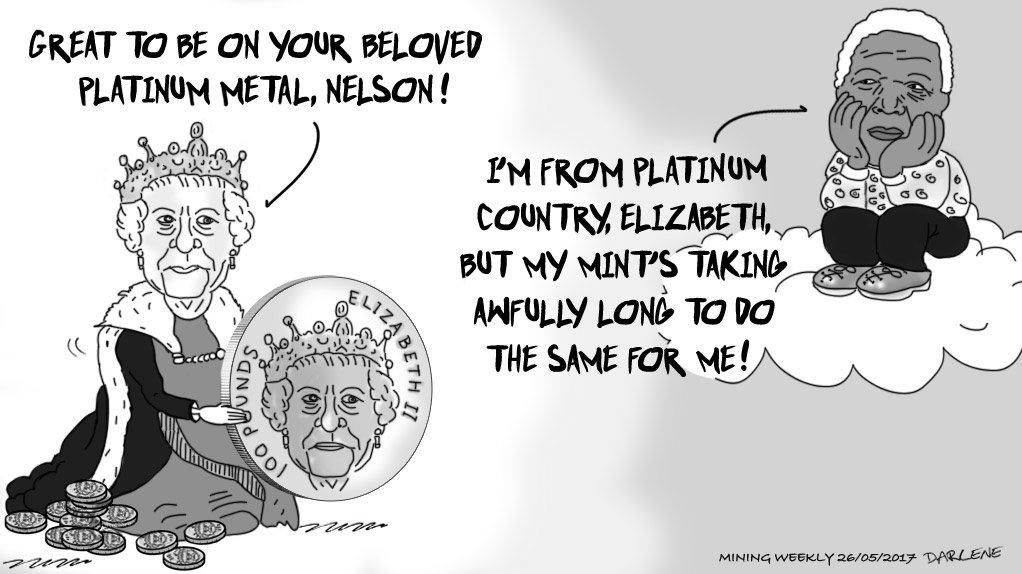

JOHANNESBURG (miningweekly.com) – The decision of the Royal Mint, in the UK, to launch its first-ever platinum bullion products has rekindled hopes that the South African Mint will wipe the dust off its plans for a Mandela coin in platinum and mimic some of its gold coin success.

In what is potentially a beneficial measure to boost platinum demand, the 1 000-year-old Royal Mint last week launched 500 g and kilo platinum bars as investment-grade precious metal and will within a matter of weeks bring out a 1 oz ‘Queen’s Beasts Lion of England’ coin, the first platinum coin to be launched in the popular heraldic series.

A platinum mining and refining major revealed to Mining Weekly as long ago as September 2015 that it was providing full technical support to the South African Mint on the development of a platinum coin and, in a separate initiative, on the feasibility of platinum being held as a reserve asset by the South African Reserve Bank and potentially other global central banks.

While the company did emphasise at the time that decision-making on these two separate matters was the total preserve of the South African Reserve Bank, which also controls the mint, and that its role was to provide technical support alone, it is appropriate for the viability of coinage development to be raised once more in view of the decision by the Royal Mint.

One senses that a coin made from African platinum and bearing the image of the late, great Nelson Mandela could be a winner if given the correct marketing thrust.

One can imagine that there would be demand for Mandela coins in platinum, not only in South Africa, but throughout the African continent and in all the major centres of the world.

Mining Weekly was recently shown an image of a Mandela coin in platinum and told that a foreign mint had produced it in 28 days.

Royal Mint bullion director Chris Howard described platinum investment as an exciting marketplace for the Royal Mint, so why not the South African Mint and other global mints?

Platinum needs every bit of help it can get. It is a marvellous metal that is never consumed and, in the words of Royal Bafokeng Platinum CEO Steve Phiri, needs “marketing, marketing and more marketing”.

What has the South African Mint done with the platinum supplied to it for coins? It would be great to see.

The work done with the South African Mint was said to be “very successful” and the timing of decisions on coin production was the mint’s call.

It would also be interesting to hear the case that the World Platinum Investment Council could make for holding platinum as a reserve asset.

A holding level of 500 000 oz of platinum as a reserve currency would represent less than one per cent of the $47-billion worth of reserve assets that the bank holds and one expects that a case could be made for such a holding on a risk-adjusted basis.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here