JOHANNESBURG (miningweekly.com) – Although Glencore’s earnings contributions from recycling activities are not material at this stage, the growth potential to the diversified mining and marketing company from circular economic activity is seen by Morgan Stanley analysts as being “very significant”.

This follows Glencore’s hosting of equity analysts at its recycling operations in the US and Canada.

The importance of the circular economy to the London- and Johannesburg-listed Glencore was on clear display, with the level of recycling already “equivalent to the contribution of a small mining company” in the view of Citi analysts.

Glencore CEO Gary Nagle and CFO Steve Kalmin, with heads of recycling and copper, anchored the trip that took in Li-Cycle’s Rochester hub and East Providence in the US, and the Sudbury Basin, where the company owns and operates a nickel mining-smelting complex (INO), as well as Canada's Horne copper smelter, which is undergoing an emissions reduction project that will improve its environmental footprint.

At present, the North American receiving, sampling and preparing (RSP) capacity stands at 123 000 t/y, which is poised to hit the 250 000 t/y mark by 2028, with copper contained in RSP being roughly 50%, Morgan Stanley calculates.

Li-Cycle's activities focus on end-of-life battery recycling and recovery of materials, with the value proposition being the conversion of black mass to battery material. The engineering works at the Rochester Hub are 98% completed, with long-lead items on the site, promising processing capacity of about 35 000 t/y of black mass.

Electronic scrap processing in Canada employs 9 000 employees and contractors, who work across seven industrial assets producing and recycling mainly nickel, copper, zinc and cobalt. Electricity supply at Horne is 100% from renewable sources.

Canada’s Sudbury INO complex includes the Nickel Rim South and Fraser mines, the Strathcona mill, and the Sudbury smelter. The Onaping Depth underground project being developed at present would extend the mine's life through the 2030s.

With a focus on raw material and processing, the Sudbury smelter takes in material from especially Sudbury and Raglan as well as third parties and international mines. It is able to process notably end-of-life materials, production scrap, and other recycling feeds with a high cobalt content.

Cooperation with Brazilian mining and metals company Vale, which operates next door, is limited to discussions about jointly developing a prospect in-between their respective boundaries.

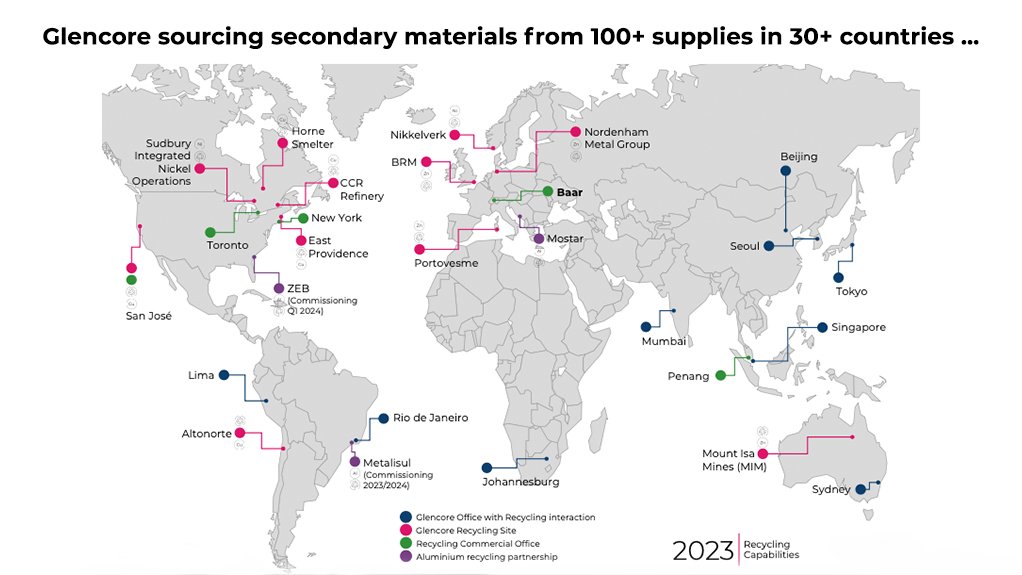

Glencore, which sees its marketing capabilities as a competitive advantage given its long experience in buying and selling commodities, is looking to leverage its position by repurposing existing facilities to cater to the rapidly growing recycling market. Conversions similar to the repurposing of zinc and lead producer Portovesme in Italy are being explored for other sites.

Copper, nickel, zinc and lead are being recycled at present with plans to grow lithium and aluminium. Other by-products being recovered include gold, silver, cobalt and platinum group metals.

Recycling, notes Citi, is arguably the closest business to the marketing DNA of Glencore – sourcing feed from thousands of suppliers and selling processed material to all possible types of customers.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here