The North West University Business School’s Policy Uncertainty Index (PUI) decreased from 53.4 in the first quarter to 52.9 in the second quarter.

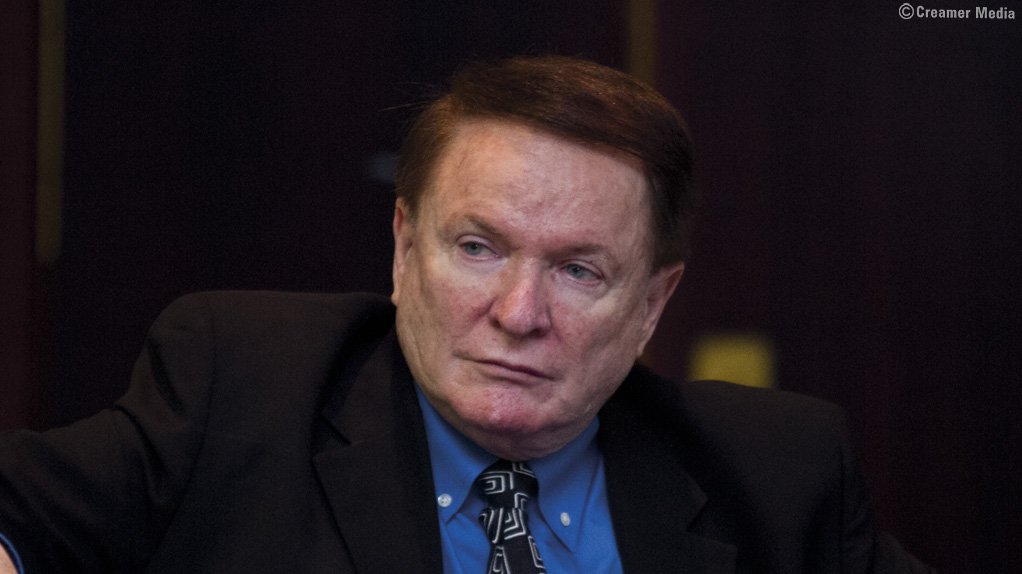

NWU Business School economist Professor Raymond Parsons on Tuesday said policy uncertainty remained strongly elevated and had stayed in negative territory during the second quarter.

However, he indicated that there was still potential to reverse the trend in the coming months.

Parsons posited that the biggest single factor that negatively affected the PUI in the period was likely the African National Congress’ controversy around the status and role of the South African Reserve Bank (SARB), which resulted in uncertainty in the markets and the economy during the quarter.

He noted that President Cyril Ramaphosa’s wide-ranging State of the Nation Address (SoNA) on June 20 offered an overall aspirational vision of the urgent economic challenges that had to be addressed in the country; however, the implementation plans to achieve these stated goals were perceived as lacking and uncertain.

He pointed out, however, that the SoNA’s reaffirmation of the importance of the National Development Plan and the role and status of the SARB was, on balance, favourable for future policy certainty.

Global economic activity, although still positive, was assessed by the World Bank as having slowed to its lowest pace in three years with downward risks, Parsons highlighted.

While a global recession was not expected, the World Bank had nonetheless urged developing economies to reinforce policy buffers to implement policy reforms that boost growth.

Parsons warned that should a ‘no deal’ Brexit occur, ultimately seeing the UK “crashing” out of the European Union (EU) by October 31, this would create widespread disruption and uncertainty in the existing trade relations of those countries, including South Africa, trading with the UK and the EU.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here