JOHANNESBURG (miningweekly.com) – Having reset its cost base, delivering new life-of-mine (LoM) plans with a smooth capital profile, the focus of Petra Diamonds is very much on refinancing its $250-million loan notes.

“We plan to get that done before the end of this calendar year,” Petra Diamonds CEO Richard Duffy outlined to Mining Weekly in a Zoom interview. (Also watch attached Creamer Media video.)

The refinancing of the loan notes will place the London-listed, Africa-active diamond mining company in a position to execute on the growth potential of its long-life assets.

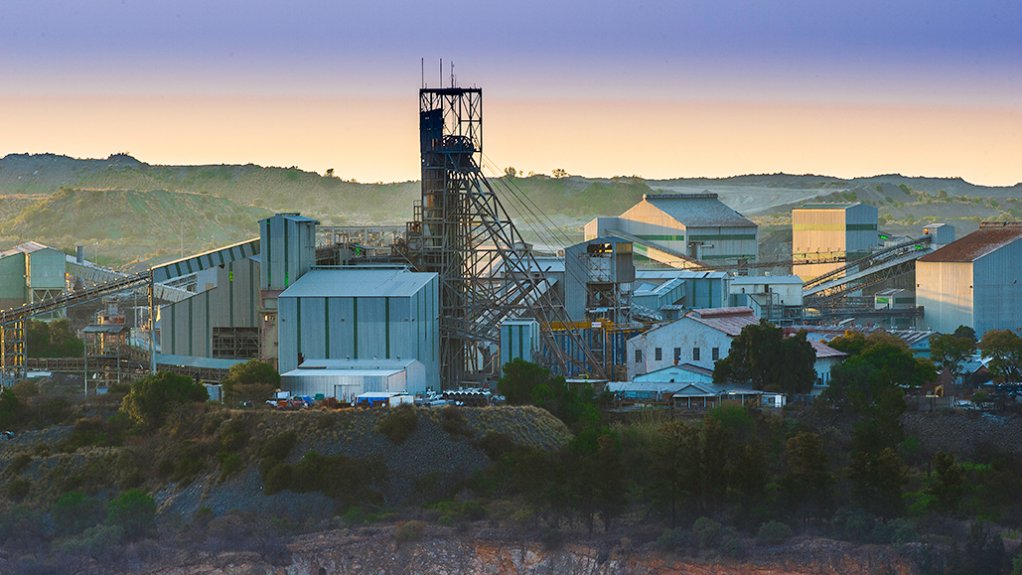

These are Petra’s historic Cullinan diamond mine, located 100 km north-west of Johannesburg, its Finsch diamond mine, which is 160 km north-west of Kimberley, and the Williamson mine, 140 km south-west of Mwanza, in Tanzania.

It will also allow the company to begin to execute on its value-led growth strategy presented by not only its existing asset base, but also through other opportunities.

“We’ll be able to deliver and leverage what we believe will be a much more supported market from next calendar year,” Duffy commented.

The main focus of Petra’s recent investor day was to demonstrate the resilience of the business through steps implemented over the recent months.

The key features were cutting the cost base by $30-million on a sustainable annualised basis.

Through mine replanning, Petra has also smoothed its capital profile going forward basis to around $100-million a year or less.

The main reason is to ensure that the business is cash generative from this financial year (FY) 2025 and to refinance its loan notes, which mature in March 2026.

Mining Weekly: What, specifically, were the LoM updates?

Duffy: In the case of Cullinan mine, we have a board-approved mine plan that goes through to 2033, and the potential through further extensions in the mine itself to be mining beyond 2050. At Finsch mine, we highlighted that the board-approved mine plan sees mining through to 2032 but with the potential to continue mining below the current Block 5 through to 2040. Williamson has an approved mine plan to 2030 with extension opportunities and growth opportunities well into the 2040s. We also provided guidance for the next five years so that we could create some visibility in terms of our production, which we see growing from the current levels of around 2.8-million carats annually to around 3.5-million carats a year by 2028. Most of that growth comes from increasing grade, both at Cullinan and at Finsch.

When you speak of a lower-for-longer diamond market, how does that impact Petra?

What we're seeing is a diamond market that we expect will continue to remain a little softer through to the end of this calendar year. We took measures towards the end of last year in recognition of what we expected to be a weaker-for-longer market. The steps we took back in October 2023 around deferring some of our capital spend and initiating that cost savings programme meant that we were able to reduce net debt by $11-million from the end of December 2023 to the end of June 2024, the end of our FY 2024. The measures taken ensured that we stopped any cash burn in the business, even in a tougher market. The steps we've taken around costs and smooth capital profile mean that we’ll continue to be resilient as a business, and be cash generative from this financial year 2025 onwards. So, we're well placed to benefit from an improving market, which we expect to see from next calendar year.

What makes you more confident about the market in the medium- to long-term?

What we've seen in the market is the culmination of a number of factors that have created some headwinds for us, and that really has been on the back of the higher interest and inflation rates that have been a little more stubborn than expected, the slower return of demand from China, which is an important market for diamonds, and the disruption caused by the rapid growth of lab-grown diamonds. Those were the factors that led to the softer market, which we expect to continue through to the end of December. Why we’re more encouraged in the medium to longer term about what we expect to be a supportive diamond market is around some of the underlying supply-demand fundamentals. If you look at projected supply, or global production of diamonds, all the way through to 2033, the projections are that we’ll see an average 1% decline on an annual basis over that period. When you look at the demand side, there's projected growth to 2033, of 2% to 4%, so from a fundamental supply-demand perspective, there’s a structural supply deficit. The US buys around 50% of all diamonds, and the projections are that US demand will continue to grow through to 2033. Interestingly, China isn't projected to grow at the same rate as the US, but India is emerging as a very strong consumer, with 30% growth forecast through to 2033. We see India and its growing middle class as a new, increasingly important market for diamonds that is likely to overtake China.

How are natural diamonds faring against laboratory-grown diamonds?

If you look at lab-grown diamonds, the disruption they caused initially was largely the result of consumers not properly understanding this new lab-grown diamond category. Over the last few years, we've seen the price of lab-growns collapse to now sell at a discount of 80% to 90% of a natural diamond. As a result, lab-growns are now firmly established as a different product category in the diamond space. They're a cheap early entry point and that differentiation will become more discernible and clearer over time. Also, importantly, retailers, jewellers are shifting back to natural simply because the price of lab-grown has collapsed. The margins have collapsed, and it doesn't make economic sense for them to continue to push lab-growns. We see, in a sense, some reversal of the displacement of lab-grown that we saw previously, in favour of natural diamonds. Another important point is a number of lab-grown producers have stated that they're moving out of producing gem lab-grown diamonds, and they’re shifting their lab-grown production to industrial applications, around semiconductors, etc. This is led by De Beers’ Lightbox business, where they've indicated they're no longer going to be producing gem lab-grown diamonds, and the same is true of a number of other large lab-grown producers. For all of those reasons, we see inventory levels starting to come down across that value chain going into next year, a shift away from lab-grown back to natural, and the general economics starting to shift in favour of diamonds with the structural supply deficit providing the support.

How do you see traceability unfolding?

We see traceability technology as being part of the differentiation between lab-grown and natural diamonds. What this technology allows us to do, and we’re busy piloting this at the moment, in collaboration with De Beers’ Tracr™ and Sarine Diamond Journey™ technology, is to map all of our half-a-carat gem-quality diamonds, and half-a-carat in the rough and larger. The data around a diamond gets block-chained in a register, and we then trace that diamond through the cutting and polishing. Our clients link the polished diamonds back to the original rough, and that enables traceability all the way through to the retail jeweller – essentially from mine-to-finger. For a consumer who then walks into a jewellery store in New York to buy a one-carat engagement ring, there would be a certificate associated with that, stating that the diamond was recovered from, for example, Cullinan mine in 2020. It would set up the number of employees that the Cullinan mine employs, provide details on all of the social and community projects undertaken by the mine, and include the carbon footprint associated with that polished diamond. So, there's a whole story around the diamond that reinforces that purchase experience for the consumer, creating an opportunity to grow margin as part of that story, around the mine-to-finger journey.

DIAMOND VERACITY

The traceability that Petra expects to implement during the course of this calendar year will enable it to clearly verify that the diamonds:

- are from a Petra mine;

- are natural and not lab-grown; and

- are not subject to any sanctions.

The application of Tracr™ means that the diamonds from these mines will be subjected to the Internet of Things, AI and blockchain technology to provide comprehensive supply transparency.

In addition, the application of Sarine Diamond Journey™ begins with three-dimensional scanning to establish a verifiable image of the physical diamond and a definitive link to its digital report.

This enables the creation of an unbroken chain of authentication at every stage of the diamond’s journey – from rough to rough, rough to polished, polished to report.

Securely stored in the cloud, this data provides the foundation of end-to-end traceability.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here