JOHANNESBURG (miningweekly.com) – Midtier Africa-focused gold producer Pan African Resources is effectively building a new internally-funded underground gold mine on two levels of the Evander underground gold mine in Mpumalanga, CEO Cobus Loots said on Wednesday when the company reported record production for the 12 months to June 30 and distributed more than R400-million in dividends.

A video flighted at the results presentation described Evander as possibly one of the world’s largest unexploited gold orebodies.

The addition of 24 level, and now 25 level and 26 level, has given Evander Mines a life-of-mine of 14 years, with increased expected gold production.

The 25/26 level project will be funded by internal cash flows assuming a reasonable gold price environment.

“The Evander underground has been a real success story for Pan African in recent years and we look forward to ramping up this operation further in the years ahead,” Loots told Mining Weekly in a Zoom interview. (Also watch attached Creamer Media video.)

The underground team, which also delivered an excellent safety performance, produced almost 50 000 oz at the low all-in sustaining cost of $1 100/oz.

The 25 and 26 levels project will require two years of fairly elevated capital to execute and then have the benefit of the expenditure for more than ten years.

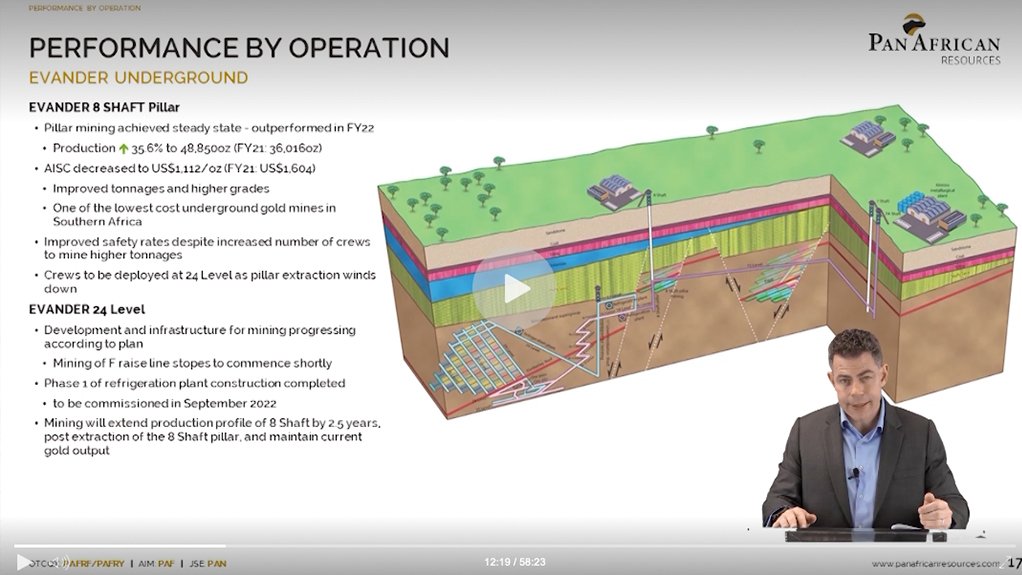

The current low-cost Evander 8 Shaft operation is focused on the mining of the shaft pillar, from which high-grade ounces are extracted.

Pan African’s use of underground support packs allows for extraction of the shaft pillar while providing permanent support for the shaft. This allows mining to continue at the lower 24, 25 and 26 levels.

This provides access to more than 500 000 oz of gold using infrastructure that is already in place, which allows the company to reap the benefits of sunk capital spent over a decade of mining.

Experience gained and the many upgrades already completed at Evander underground have laid the groundwork for further quick-payback life extensions, which is good news for investors, the surrounding communities and supply-chain companies dependent on the mine.

The 24/25 levels project is not only on track to deliver its first production on schedule in 2023 but is paving the way for the provision of 65 000 oz of gold a year for more than eight years – and significantly extends the life of the operation.

“What we're doing at Evander underground is very exciting. Evander underground is certainly not without a checkered past. In 2018, we had to press the reset button and basically put the underground on care and maintenance, and we looked at the options and we then commenced with pillar mining on a shaft pillar at 8 Shaft, and that’s been a fantastic success for Pan African.

“It’s safe, it's generated great cash flows, and it also has allowed us the opportunity of relooking at the design for 24 to 26 level, and [to] come up with development and execution plans, so that’s what we’re busy with now,” Loots told Mining Weekly.

“Two weeks ago, I visited the new fridge plant on 24 level. The F line is ready to be mined on 24 level, and there are a number of improvements. We've changed the layout to an on-reef development layout for 25/26, which means that there'll be very limited waste.

“We’re equipping a ventilation shaft that runs up to 17 level to do hoisting, which means you cut out a massive number of conveyors, so that improves your mine call factor and your ability to produce.

“You have a new fridge plant and new infrastructure close to the face and then a number of other improvements also in terms of ore storage etc. This will be a great operation for us in the years to come. It’s a world class reserve that we have there.

“To top it all off, we obviously have our first solar plant up and running at Elikhulu. It's been a great success for us and we'll expand that solar footprint to also take care of a lot of the underground energy requirements and that's going to also bring down the cost of production,” said Loots.

In addition to the Evander expansion and current operating assets, the London- and Johannesburg-listed Pan African has several other near-term organic and acquisitive growth projects.

The transaction to acquire the Mintails tailings retreatment assets is expected to be concluded by September 30. Pan African entered into conditional sale of shares agreements to acquire Mogale Gold and Mintails’ SA Soweto Cluster in November 2020.

Both gold assets are 100% owned by Mintails SA, which was placed into provisional liquidation in 2018.

On the environmental, social and governance (ESG) front, the 9.9 MW solar photovoltaic renewable energy plant at Evander is fully commissioned, 30 MW are planned and the first commercial harvest at Barberton’s Blueberry project is in progress.

Mining Weekly: During the presentation, you also referred to a decline shaft project at your Fairview gold mine in Barberton. What will that contribute?

Loots: The decline is a stop gap. We've been talking about a sub-vertical shaft at Fairview for some years - the Main Reef Complex, or MRC, and Rossiter orebodies at Fairview open up at depth. These are world-class orebodies. If you remember, Fairview’s average grade at MRC is an order of 25 g/t, but sometimes we cut off at 100 g/t. It extends as far down as we care to look for it. So clearly, we need to figure out a way of continuing to mine this optimally and, as an interim measure, the team has come up with a decline that will be done in the next two to three years. Capex is about R120-million to R130-million a year to get this done. That will allow us to continue our current run rate at Fairview and on top of that, we're also expanding the cooling infrastructure to make sure that those conditions work in terms of the production activities.

Mintails – we’ll know by month-end if that’s going ahead. What can it bring if it does?

We're very excited about the Mintails project. Nowhere else can you go and buy two-million ounces on surface for what we’re paying – $3-million, plus assuming the rehabilitation liabilities over time. Mintails can deliver 50 000 ounces a year, and we've modelled our definitive study on only the Mogale resources. If you include Soweto, you’re looking at a 20-year life or more than 50 000 oz a year, with all-in sustaining cost at the very competitive $1 000 circa an ounce. We need to work together with all stakeholders including the Department of Mineral Resources and Energy, the Department of Water and Sanitation and everybody else to get this going. If we do, then clearly it'll benefit our group but it's going to have a massive positive impact on that area in terms of cleaning up legacy liabilities, creating more economic opportunities and jobs - so it's in all of our interests to get it done.

And what’s the latest on Blyvoor?

We’re still busy with our studies on Blyvoor. It’s sort of on the back burner while there’s just massive focus on ticking the boxes at Mintails and I think once that is done, hopefully we can proceed with execution on Mintails, then we need to refocus on Blyvoor as well.

You spoke of 30 MW of your own solar power being on the way and your pioneering 10 MW saved R4-million in one month. Sounds like self-generation has an excellent business case.

We've proven it. The plant’s performing in excess of our expectations. We're very proud to have been a first miner to commission a plant at that scale, and economically, and over the medium to longer term, it just makes sense to build as much of those as you can.

Exploration in Sudan caught the ear. What are the early indications there?

One of the grab samples we picked up, I think, was like 120 g/t or something. That's clearly wishful thinking. It's unlikely you're going to find that but in the areas where we are exploring, there is a lot of artisanal activity. There are a number of milling centres, they stretch as far as I can see, so there's definitely gold. We've embarked on probably a fairly measured process. We're doing a lot of desktop work first and you would have seen, as part of the presentation, we highlighted the work on remote sensing, which effectively identifies anomalies we think are prospective, and then comparing those anomalies to current mining areas. We found areas that we are very excited about. We have this assaying laboratory, first in the country, that's arrived, we’re assembling it currently, so hopefully in the next six months, we'll be able to come back to you with some exploration results, but it's very prospective, as evidenced by certainly the one other large transaction that’s happened in that jurisdiction

What is the size of Pan African's reserve/resource base in South Africa?

Well, the market doesn't give any value to resources. The market wants to see you being able to economically extract those resources and then paying dividends, so that's really our focus. We have more than enough reserves and resources. What is key is bringing those assets to account, like we are doing with the 24 to 26 level project at Evander, like we are doing with the Egoli project – measured, slow development, now only dewatering, and then we'll do a bit more drilling at Egoli, and like we’re also doing with Royal Sheba, at Barberton.

What, in your view, should be the biggest takeaway from your results today?

Well, I think it's a steady performance, despite challenges. I think we’re well positioned for exciting growth and balanced growth with continued cash returned to shareholders. With continued cash return to shareholders we're doing our best from an ESG perspective, making a really positive difference where we are operating. That's important to us. It's part of our DNA, and we're doing so safely. Very proud of our safety statistics and we need to keep that up.

RECORD GOLD PRODUCTION

In the 12 months to June 39, record gold production increased by 1.9% to 205 688 oz at 1.8%-higher all-in sustaining costs of $1 284/oz.

Net cash from operating activities rose 45.1% to $110-million, after-tax profit was $75-million, and net debt fell 66.7% to $13-million.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here