In the next two decades nuclear energy’s share of the world’s power generation mix is projected to increase by several percentage points from 11% currently, as countries strive to meet growing demand by deploying technologies that do not exacerbate global warming.

This is the view of World Nuclear Association director-general Agneta Rising, who told Engineering News Online in an exclusive interview here on Tuesday that while the proportion of nuclear-generated electricity had actually declined from 17% about 12 years ago, the trend was expected to reverse going forward.

She noted that half the world’s population did not have access to electricity and that there was a need to not only connect these people to national grids but also cater for projected increases in population.

The need to curb carbon emissions would lead to a significant proportion of the new generation capacity being nuclear, said Rising. She added that if the International Energy Agency’s goal to limit the increase in the globe’s average temperature to 2 oC by 2050 was to be achieved, the share of nuclear-generated electricity had to increase to 18%.

Rising said the expected increase in nuclear-generated electricity would be driven by, among others, its price competitiveness and round-the-clock availability, which was in sharp contrast to the intermittency of renewables such as wind and solar. Further, nuclear had a smaller footprint than solar and wind, which were “dispersed and more difficult to harness”. Its small footprint also gave it an advantage over coal. Whereas some coal-fired power stations required five truckloads of fuel a day, one truckload of fuel sufficed for a whole year for a nuclear power plant (NPP). The small amounts of fuel fed into NPPs also meant that it would take a very long time to exhaust known uranium resources.

While the 2011 Fukushima Dai-ichi disaster, in Japan, which led to the closure of the country’s 43 nuclear units, had impacted on public opinion on nuclear globally, Rising said confidence in this technology was now back to the levels it enjoyed before the mishap.

She said both developed and developing countries were favourably disposed towards nuclear. In the UK, for example, the public was in favour of replacing coal-fired generation capacity with nuclear capacity, while there was massive support in Sweden for new nuclear build instead of phasing out existing capacity. Even in the US, where public opinion was decidedly antinuclear about 30 years ago, many people were now in favour of the technology.

Rising cited Indonesia as one of the developing countries where the public was strongly pronuclear, with a recent survey indicating that 70% supported the building of nuclear plants in the country, which comprised dozens of islands. Indonesia signed a deal for a research nuclear reactor with Russian State-owned nuclear giant Rosatom on Tuesday, on the sidelines of Atomexpo 2015, an international nuclear energy forum that ends on Wednesday.

The massive support for nuclear in Indonesia contrasts with the unfavourable public opinion in Japan, where 60% of the population is opposed to the recommissioning of the country’s 43 nuclear generating units, which were closed in the aftermath of the Fukushima Dai-ichi disaster. However, Rising insisted that many people outside the regions that were directly affected by the mishap were not opposed to nuclear and that the attitude of those who were opposed to the technology would change with time.

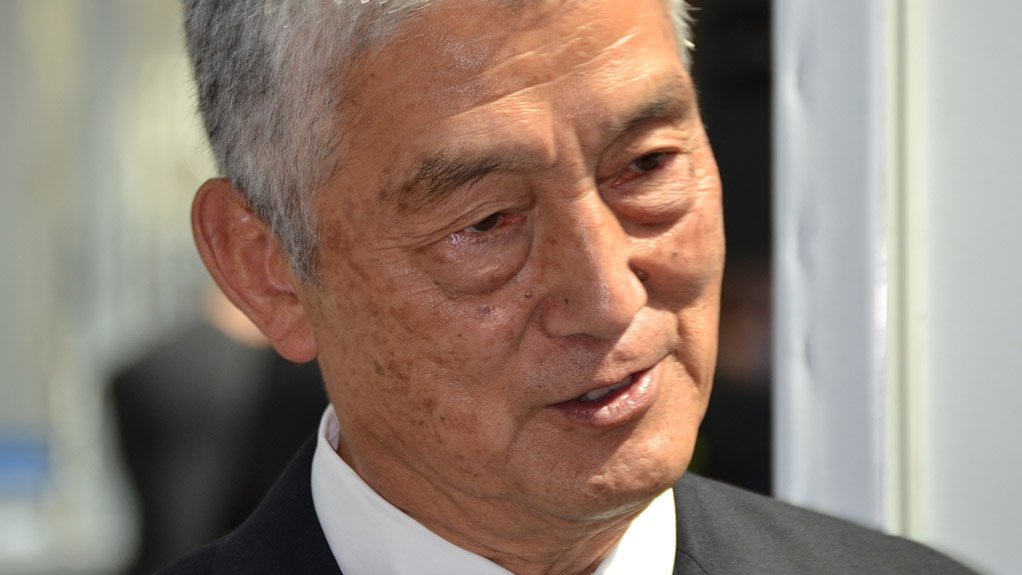

Japan Atomic Industrial Forum president Takuya Hattori told Engineering News Online here on Monday that two of the closed-down 43 units could be up and running in two to three months, having been granted permission for recommissioning, and that several others could follow suit by the end of the year. However, negative public opinion and a new stringent regulatory regime were expected to hamper the recommissioning process.

Rising noted that Asia and the Middle East were emerging as the new growth centres for nuclear power generation. Thirty nuclear power plants were currently under construction in China, while India was also pursuing a nuclear build programme, as were countries in the Middle East.

Rising said she did not believe that finance would hamper the development of nuclear electricity generation projects, noting that projects with attractive economics would always attract financial support.

Citing what was happening in Finland, she said customers could also put up the capital required to build an NPP and become owners of the project.

Other financing options included the models offered by Rosatom, which included export credits and loans from the Russian government as well as banks from that country.

Rosatom could also build an NPP on a build, own, operate (BOO) basis. The first NPP to be built by Rosatom on a BOO basis is the $20-billion Akkuyu plant, in Turkey, whose four units, with a combined capacity of 4 800 MW, are scheduled to come on stream in 2020, 2021, 2022 and 2023 respectively.

Martin Zhuwakinyu is in Moscow as a guest of Rosatom.

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here