/ MEDIA STATEMENT / The content on this page is not written by Polity.org.za, but is supplied by third parties. This content does not constitute news reporting by Polity.org.za.

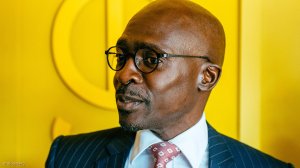

The Minister of Finance, Malusi Gigaba, has amended the Money Laundering and Terrorist Financing Control (MLTFC) Regulations, and withdrawn Exemptions made in terms of the Financial Intelligence Centre Act, 2001 (FIC Act), effective 2 October 2017.

The Government Notices to this effect were published in the following Gazettes:

a) 29 September 2017, No. 41153; (link) and

b) 29 September 2017, No. 41154 (link).

The amendments to the MLTFC Regulations and the withdrawal of exemptions were previously published in draft form for public consultation, and the comments received were considered. In addition, the amendments to the MLTFC Regulations were amended where necessary.

These amendments to the MLTFC Regulations and the withdrawal of exemptions coincide with the commencement of a number of amendments to the FIC Act, which the Minister had announced on 13 June 2017 (link).

This provides the legal basis for a shift in the measures to protect the integrity of the South African financial system to a risk-based approach, which modernises the manner institutions undertake customer due diligence and encourages innovation in the way they deal with their customers.

Single transaction threshold and withdrawal of exemptions:

Institutions should determine what constitutes single transactions in the context of their own business, and provide for the application of a single transaction threshold in so far as they accommodate such transactions. The Financial Intelligence Centre (FIC), in collaboration with the National Treasury, the South African Reserve Bank and the Financial Services Board, has issued guidance in Guidance Note 7 (link), in this respect, that may be of assistance to institutions.

While the withdrawal of exemptions may impact institutions’ compliance approach to the customer due diligence requirements of the FIC Act; nevertheless, institutions may continue to be guided by the content of the withdrawn exemptions in the implementation of their compliance approaches. This is also addressed further in the guidance issued by the FIC.

Although a few objections were received on the withdrawal of some exemptions, these were not supported by adequate empirical data; consequently, sufficient information was not provided to retain the exemptions in question.

Further consultations on new exemptions may be considered in sectors where it can be clearly demonstrated that such exemptions are necessary and will not undermine the objectives of the FIC Act.

Mandatory reporting and implementation of a risk-based approach:

Certain comments indicated a concern that to prescribe information sets for reporting in accordance with the FIC Act precludes institutions from applying a risk-based approach to customer due diligence.

To address this concern, the proposed amendments to the MLTFC Regulations concerning the new reporting requirements have been aligned with the introduction of a risk-based approach in the FIC Act.

Furthermore, to clarify the expectations regarding mandatory reporting, the FIC has issued guidance in Guidance Notes 4A (link), 5B (link), 6 (link) and 7 (link) on how institutions should best manage their mandatory reporting obligations within the context of a risk-based approach to customer due diligence.

Issued by National Treasury

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here