JOHANNESBURG (miningweekly.com) – Northam Platinum, which benefits from a full mine-to-market value chain in chrome, sold around 1.3-million tons of chrome for the year, which contributed 12.5%, or R3.8-billion, to the revenue of this Johannesburg Stock Exchange company best known for its platinum group metals (PGMs) production.

Chrome production improved by 24% with higher upper group two (UG2) tonnages treated and improving chrome yields at all operations.

Northam has a well-capitalised UG2-dominant resource base, located in prime areas of the Bushveld Complex.

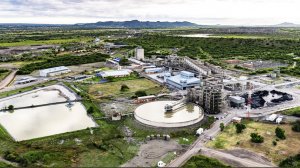

The company’s Zondereinde mine, primarily a PGMs mine, is expected to produce 450 000 t of chrome concentrate in financial year 2025, with chrome sales for the group expected to improve to around 1.4-million tons.

Seen as being on its way to becoming a significant chrome producer in the coming years is the developing Eland mine, a shallow hybrid UG2 asset located in the south-eastern portion of the western limb of the Bushveld Complex, 12 km east of Brits, in South Africa’s North West province.

“Don’t underestimate Eland,” Northam CEO Paul Dunne remarked to analysts while displaying a slide showing a strike drive into the UG2 of the Eland mine, which has a 1.6-m-wide orebody that hosts approximately one ounce of PGM per square metre mined and two tons of chrome per square metre mined.

“Based on current pricing, we believe that as soon as Eland reaches an excess of 100 000 oz, it will start breaking even,” Northam CFO Alet Coetzee calculated. Guidance for next year shows it won’t be far off 100 000 oz.

Eland’s ramp-up has begun in earnest and production growth there is leading to margin improvement. The 26 production teams now at its rockface will grow to 64 teams at steady state.

“Eland made its targets this year and as long as it keeps doing that, it’ll be a good mine. It has a strong orebody with high chrome, high platinum. We're only one-third up the mining ramp-up, and we've got most of the fixed cost in place.

“It’s unit cost performance will be below that of Zondereinde, mainly because it's only, on average, 200 m below surface, whereas the deepest portions of Zondereinde are ten times that, at 2.3 km. The need for refrigeration, ventilation and so on is not there. We also do not backfill at Eland.

“In its physical characteristics, the orebody itself is very similar to Zondereinde’s UG2, and there's absolutely no reason why Eland will not, by volume but by cost, overtake the Zondereinde effort,” Dunne commented.

Northam acquired Eland from Glencore for R175-million in 2017.

CHROME LOGISTICS

Logistically, Northam’s chrome goes through the Port of Maputo in Mozambique as part of a signed back-to-back long-term arrangement.

The chrome is shipped to China and then transported inland to Inner Mongolia, where there are large ferrochrome producers with access to low-cost electricity and customers.

Even though the chrome travels a long way to get to its final destination, it remains profitable.

FULL MINE-TO-MARKET OWNERSHIP

Both Dunne and Coetzee emphasised the benefit of having full mine-to-market chrome ownership, which is described as a differentiator for Northam.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here