- “No Way Out” – Debt Imprisonment in Tunisia6.75 MB

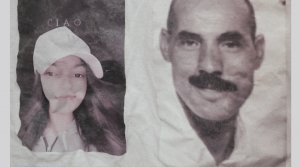

Mejid Hedhli, 58, is serving a 122-year and 9 months sentence in Nadhour prison in Bizerte. This former contractor used to have a viable business and was even hired by the state to renovate a ministerial building in the historic Kasbah district of Tunis. His business provided a decent living for him and his family and employed dozens of construction workers.

Unforeseen events at the beginning of 2011 slowed down the project, resulting in financial losses that left him unable to pay his debts to several suppliers, to whom he had handed over checks, which he had pledged to pay on a timetable. But he could not fund those checks within that time, and so a public prosecutor initiated legal proceedings against him. He was arrested in 2015 and convicted in 2016 by a Tunisian court for dozens of unpaid checks that were due past the mutually agreed upon timing.

Acquiring goods from a supplier in exchange for a check to be cashed at a designated later date is a widespread practice in the Tunisian commercial sector. It enables both registered and unregistered entrepreneurs to carry out commercial transactions at a given time, even if they are unable to pay for the goods or services right away. Under this practice, a supplier provides a merchant with an informal loan that is secured by a check intended to be cashed on a mutually agreed upon later date.

This practice allows merchants to carry out their transactions at any given time, even if they lack funds or the ability to obtain a bank loan or another form of credit. On the other hand, suppliers charge a disguised interest rate on the price of the goods or services because of the risks associated with accepting a check to be cashed later.

In some cases, the account holder may not have sufficient funds in their bank account to cover the check. In such cases, the bank may not honour the check and may return it to the payee unpaid. This is known as a bad check, a bounced check, or an NSF (not sufficient funds) check, and is considered as a criminal offence in Tunisia. The Tunisian Commercial Code punishes the writing of NSF checks with up to five years’ imprisonment. However, article 11 of the International Covenant on Civil and Political Rights (ICCPR), to which Tunisia is party, states that "no one shall be imprisoned merely on the ground of inability to fulfil a contractual obligation." Thus, it is a violation of international law to imprison a person solely for providing a check when they lack the means to fund it.

Report by the Human Rights Watch

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here