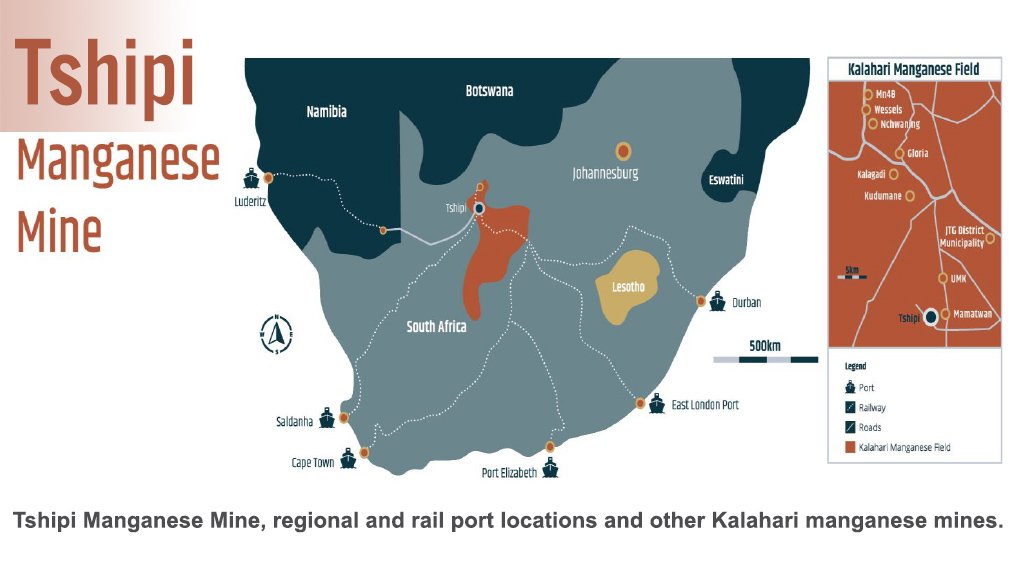

JOHANNESBURG (miningweekly.com) – Australia-listed manganese company Jupiter Mines, which has a 49.9% beneficial interest in Tshipi é Ntle Manganese’s Tshipi mine in South Africa’s Kalahari manganese field, on Thursday reported strong production but weak pricing in the three months to September 30.

The spot price of manganese ore fell 34% in the period, which was attributable to persistent weakness in global steel demand coupled with an increase in manganese ore supply, particularly that of South African origin.

The average spot price for the September 2024 quarter was $4.24 per dry metric tonne unit (dmtu), compared with an average spot price of $5.50/dmtu for the June quarter. The spot price as of September 30 was $3.74/dmtu.

Tshipi’s earnings before interest, taxes, depreciation and amortisation were A$21-million, compared with A$60.4-million in the previous quarter, and net profit after tax was A$13.7-million compared with A$38.7-million on 12%-higher sales volumes.

Meanwhile, improved equipment utilisation and performance elevated ore and waste mining 27% to ensure the building of stockpiles before the expected rainy season commences.

Tshipi’s cost of production on a free-on-board basis was 7% lower.

The operation reported its first lost-time injury in nearly eight months, following an incident in which a team member was injured while climbing stairs on mobile plant equipment.

To reinforce safety awareness ahead of the upcoming holiday period, Tshipi’s management team is implementing a critical season campaign which will include slip and fall prevention initiatives to enhance safety across operations.

Looking ahead, the World Steel Association has updated its forecast to predict 1.2% steel production growth in 2025 compared with a 0.9% contraction in 2024. This, combined with moderated supply levels, should provide a more supportive outlook for manganese prices in the second half of the financial year, Jupiter outlined in a release to Mining Weekly.

“While market fluctuations are normal in any commodity market, Tshipi remains resilient, with no debt, comparatively low operating costs and over 100 years of remaining mine life,” Jupiter, whose main focus remains supporting operational optimisation at Tshipi and the execution of its five-year strategy, pointed out.

Going forward, lower manganese exports from South Africa in the last three months of the calendar year are expected to translate into positive support for port stock levels in China.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here