JOHANNESBURG (miningweekly.com) – Amongst all our investors, there’s a very broad support for South Africa’s government of national unity initiative, says Pallinghurst co-chief executive and co-founder Arne Frandsen.

“I think it’s absolutely the right thing that the politicians are doing and I really hope that it’ll see the rand getting some muscles back,” an upbeat Frandsen told Mining Weekly in a Zoom interview. (Also watch attached Creamer Media video.)

Pallinghurst’s Sedibelo, which began operating the Pilanesberg platinum mine (PPM) on the western limb of South Africa’s platinum group metals- (PGMs-) rich Bushveld Complex in 2008, has been marking time on the wholly owned brownfield expansion of PPM into the contiguous deposits of Sedibelo Central, Magazynskraal and Kruidfontein – known as the Triple Crown properties, which have an estimated resource base of more than 60-million platinum, palladium, rhodium and gold, or four element PGM ounces.

The predominantly shallow deposits will allow for safe and sustainable mining activities for potentially more than 60 years.

The plan is for the expansion to be mined simultaneously, with ore from the existing opencast upper group two (UG2) and Merensky operation, using two decline shaft systems.

The existing PPM concentrator plant has the capacity to process the Triple Crown ore and ore from the openpits. With minimal reconfiguration, the Triple Crown UG2 and Merensky ore will be blended and processed through the existing Merensky plant, thereby significantly reducing capital expenditure and lowering operating costs.

Sedibelo also plans to commission a 110 000 t beneficiation plant at PPM using cost- and energy-efficient Kell Technology. Kell reduces energy consumption by an estimated 82%, with the associated significant reduction in carbon emissions also improving recoveries and lowering operating costs. Kell, unconstrained by concentrate grade, resistant to other impurities and not sensitive to chrome levels, is a ‘green’ hydrometallurgical alternative to traditional electricity-intensive smelting, the most environmentally harmful phase of metal production.

Sedibelo shares an interest in Kell with the South Africa’s State-owned Industrial Development Corporation and founder Keith Liddell, who conceived the smelterless concept in the late 1990s while working at South Africa’s State-owned mineral research organisation, Mintek, in Johannesburg.

Mining Weekly: In your view, are PGM prices coming off the bottom ?

Frandsen: If I had a dollar for each time I predicted the bottom of the PGM cycle, I would be rich man today. It has defied gravity so many times. But it doesn't change the fundamentals that the world as we know it will need platinum, and that platinum will predominantly come from the Bushveld Igneous Complex, so I remain positive. I guess the old saying that you either pick your timing or you pick your price is right. I believe that PGMs have a very bright future, especially if we go into the hydrogen economy and South Africa will play a very important role in that respect.

SOUTH AFRICA AND HYDROGEN

Minerals Council South Africa VP Paul Dunne announced at the council’s 134th AGM in Johannesburg last week that South Africa would be well represented at the upcoming Shanghai Platinum Week 2024, which takes place from July 8 to 11 amid the growth in PGM applications in China being extremely high.

“While it’s called Shanghai Platinum Week, in many respects it’ll be the hydrogen metals that we’ll be looking at,” said Dunne.

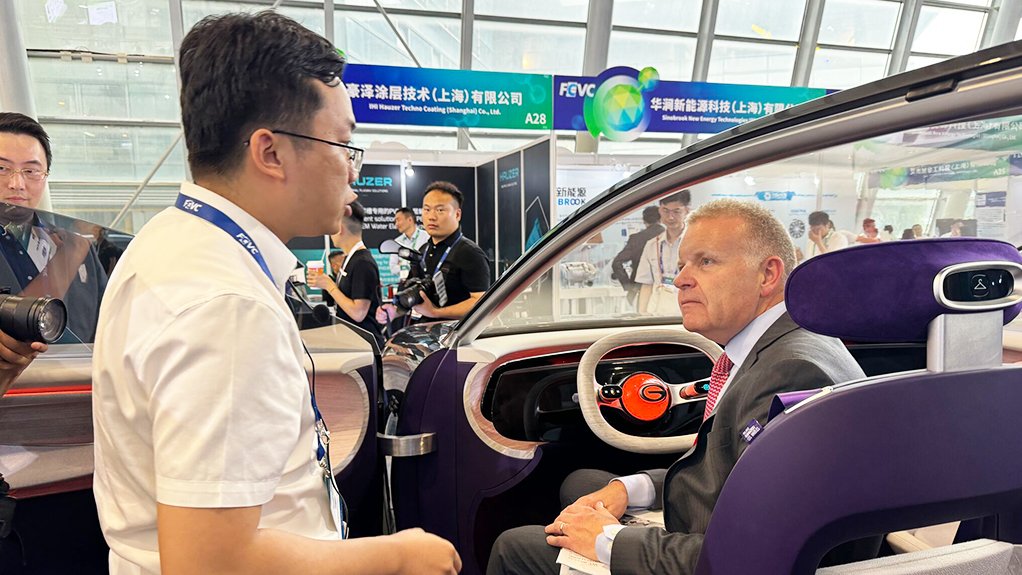

Moreover, as reported on LinkedIn on Monday, Anglo American Platinum CEO Craig Miller has just attended the Fuel Cell Vehicle Conference, also in Shanghai, organised by the International Hydrogen Fuel Cell Association.

“I left Shanghai with a renewed confidence in the future of PGMs and their pivotal role in the evolving automotive and energy sectors,” said Miller.

“I experienced the smooth and efficient operation of hydrogen vehicles and buses and saw firsthand the potential of hydrogen generation.

“This technology is essential for the global drive toward decarbonisation. PGMs are integral to the future of energy generation and mobility, and we are committed to being at the forefront of these advancements,” Miller added.

DEMAND NOT ELEVATING PGM PRICES

Interestingly, high PGM demand is ironically not being matched by high PGM prices. There have also been paradoxical periods of high lease rates, owing to significant imports by China. This has resulted in PGMs being undervalued.

Mining Weekly: What level of PGM price will be required to make it economically feasible to press ahead with the Triple Crown, Kell, renewable energy and other project developments?

Frandsen: I don't think that there’s a specific number. The thing that we are doing right now, and that our management teams are diligently working on, is really to try and optimise our mine, especially the lead time to get underground, where we have some of the most attractive grades that are still available on the western limb [of the Bushveld Complex]. I would say that it's maybe not as much price, but consistency. We don't like the kind of fluctuation in prices that we have seen. It's volatility, but unfortunately only in one direction, and what we really need to see is some stability and some positive views on the hydrogen economy. When that's there, we will start up as soon as we can.

How will Kell technology be implemented under these circumstances?

These circumstances make Kell even more relevant. I think that what we’re seeing here now is that we need to build an underground mine for the twenty-first century and that includes Kell.

What is the latest situation with Sedibelo’s Mphalele project on the eastern limb of the Bushveld Complex?

Again, we have used this downtime to focus on Mphalele and it remains a very attractive project and an integrated part of Sedibelo’s future. We will, for sure, mine that asset. The question is just when.

BATTERY SUPPLY CHAIN INVESTMENTS

Pallinghurst’s North American interests in the battery supply chain include investments in Nouveau Monde Graphite, which develops graphite-based materials to propel the energy revolution, Talon Metals, which has a nickel, copper and cobalt asset, and Nemaska Lithium, a lithium hydroxide asset.

Mining Weekly: To what extent, in your view, are battery materials succeeding in helping to bring about the clean energy transition?

Frandsen: I will say that there is no doubt that electrification is a fact of life. And I think there is no doubt at all that we will all be driving battery-powered cars in the future. The question is, just how near is that future? But I don't think that anyone believes that we can return to the other side of the Rubicon. We have crossed that. It is clear that in most countries, China especially, that battery-driven vehicles have cemented their position in the future. I don't say there will not be any internal combustion engines, but I have no doubt that the future will be green and the future will be EV. There are still a lot of question marks as to the speed by which this is going to roll out. But, in such a short period of time, we have a number of European countries that clearly are now selling more EVs than internal combustion engines and we see China really is driving this. We have obviously seen the Biden administration putting very big fines and very big tariffs on EVs coming from China. But even with those on, the new models of electrical vehicles coming from China are really superior in a lot of respects, and the prices that they are being sold at, are very attractive, so I think what you see here is that China is testing its EV capabilities for its home market, and once they master that totally, you will see them being the big force coming into Europe and North America. Battery materials are, for sure, here to stay and, for sure, going to be in high demand. The problem is the time between now and when that happens. We have seen nickel and lithium prices come under enormous pressure, and it's in virtually all the areas, including the anode material, like graphite, that we see the doubt about the speed of the rollout being reflected in depressed commodity prices.

What is the latest news coming out of Nouveau Monde?

We have been very successful in signing up Panasonic and General Motors, and we’re in the middle of negotiating a third party as well. I'm very impressed with the team. We have established a very good working relationship. Our relationship with Panasonic is really one of mutual interactions. I'm very excited about what we’re doing in Quebec. It's all guns blazing, and I'm really happy with the progress that we’re making in Canada. The plant that we’re building in Becancour is a very sophisticated plant that will be able to deliver the finest anode material.

What is the latest news coming out of Talon Metals and Nemaska Lithium?

If we take the last one first, Nemaska Lithium, we took the decision to put that together with alignment. The project itself is going ahead again, the building is going up, the mine is getting ready to produce spodumene. Everything on that front is full speed ahead and obviously we’re watching the prices of the commodities, which have been very depressed. But I think most observers are agreeing that, at this point in time, we have hit the bottom. With Talon, in some respects the biggest problem we have is that whenever we sink in new borehole, we find more nickel and the right type of nickel. At some point in time we’ll need to say, stop, take that footprint, and turn it into a mine. We’re doing a lot of exciting work around that, but obviously nickel prices right now are not very exciting.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here