JOHANNESBURG (miningweekly.com) – The appeal of platinum as an investment asset is being increasingly recognised by Chinese investors, which is resulting in China becoming one of the most important investment markets for platinum bars and coins.

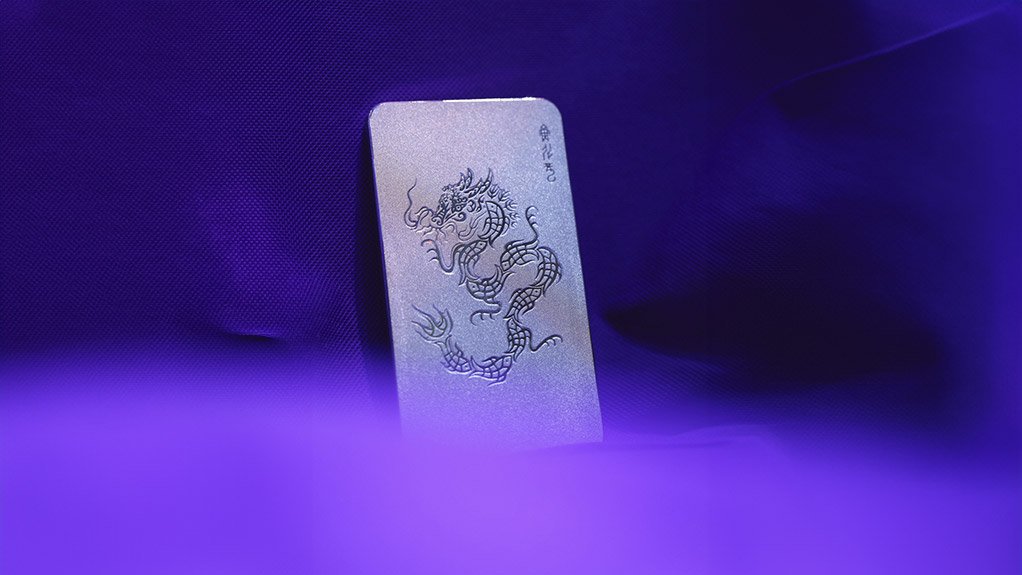

Debuted during a ceremony at the Beijing International Coin Exposition 2024 was the China Gold Coin Group’s first-ever large-size platinum investment bar – a 99.95% pure 1 kg platinum bar that carries a specially commissioned design inspired by the ‘Fish Transforming into a Dragon’ legend which is renowned in China.

China Gold Coin Group’s launch of the fish-to-dragon investment bar comes amid this year’s 34% year-on-year growth forecast to 250 000 oz, which follows demand increasing from 31 000 oz in 2019 to 186 000 oz in 2023.

A key driver of this growth is purchases of larger bullion bars, of 500 g or above.

This year’s platinum insight conference, the Shanghai Platinum Week 2024, served as a core platform for industry innovation and collaboration.

Held from July 8 to 11, the Shanghai event once again demonstrated the critical role that platinum group metals (PGMs) play.

The World Platinum Investment Council (WPIC) co-organises Shanghai Platinum Week with organisations including China Gold Association Platinum Committee and the Precious Metals Industrial Committee of the China Material Recycling Association. Members of the WPIC, which was established in 2014, include Anglo American Platinum, Implats, Northam Platinum, Sedibelo Platinum and Tharisa.

“The WPIC and our partners in China are unlocking the potential here,” the council’s Asia Pacific regional head Weibin Deng highlighted.

Supply chain improvement and rapidly escalating platinum investment awareness has resulted in what is described as “unprecedented growth in physical investment demand” for platinum.

The metal’s appeal is being bolstered by its increasing industrial applications, inclusion on the critical mineral lists of many countries, and its wide discount to gold, the latter being reflected in China Gold Coin Group’s launch of the fish-to-dragon platinum investment bar.

With an office in Shanghai since 2017, WPIC has been positioned to provide PGMs knowledge to China, which has helped investors to make more informed investment decisions.

“Our market development activities worldwide, including the annual Shanghai Platinum Week, have been instrumental in achieving significant growth in investment demand,” WPIC CEO Trevor Raymond stated in a release to Mining Weekly.

In expressing delight in the uplifting of investor choice through the introduction of the fish-to-dragon bar, he said: “More broadly, this landmark occasion underscores how platinum’s appeal as an investment asset is increasingly recognised by Chinese investors.”

The China Gold Coin Group is a State-owned entity that plans and coordinates domestic demand for investment metals in consultation with the Chinese Central Bank.

Last year, China Gold Coin Group included a 15 g platinum coin in its Zodiac series and earlier this year it produced 10 g and 100 g platinum bars as part of its year-of-the-dragon range.

The group’s fish-to-dragon investment bar features an artwork created by Professor Chen Nan of the Academy of Arts & Design at Tsinghua University that celebrates China’s cultural heritage.

In the artwork, the dragon has nine pictographic ‘fish’ characters in oracle bone script that transform into a mighty dragon. Oracle bone script is the earliest known form of Chinese writing dating back to the Shang Dynasty in the 1400s BC and the design symbolises the concept of self-transcendence and advancing toward life’s victories. Importantly, it conveys a compelling message on the improving fundamentals of the platinum market and the ascendant potential of investment.

Commenting on the decision to produce a large-size investment bar, Shenzhen China Gold Coin executive director Yin Xianmin pointed to the growing interest in platinum as an investment product presenting “an exciting opportunity for us. We have added our first 1 kg platinum investment bar to our range of platinum bar and coin products in response to investor demand. We believe that there is significant development potential for this segment of the bar and coin market.” Shenzhen China Gold Coin is the distributor of the 1 kg platinum bar.

Significantly, in addition to the investment sector, all current PGM uses are represented in China, where there is a strong growth of the metals in the automotive, industrial and jewellery arenas and great effort is being made to ensure that futures markets are available to enable local users to hedge price risk. Poised to transform domestic price risk management and boost demand for platinum products are new physically settled platinum and palladium futures, which the Guangzhou Futures Exchange has embedded.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here