Law firm Hogan Lovells Africa head and partner Andrew Skipper on Thursday opened the firm’s Africa Forum conference by stating that, in Africa, there is an understandable combination of optimism and scepticism, but stressed that the available opportunities were enormous.

“Currency, corruption and certainty need to change; it is often not happening fast enough, but until that is sorted out, business should prepare for business accordingly. “

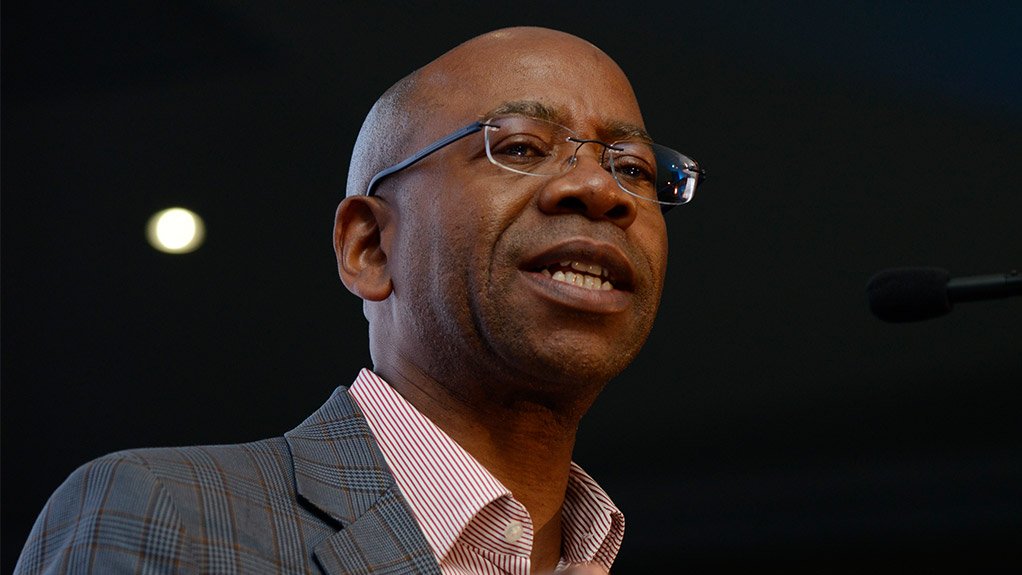

Business Leadership South Africa CEO Bonang Mohale delivered a keynote speech, noting that Africa is not a poor continent, just poor in governance.

“The continent is confronted with gender inequality (women get paid 73% of what men get paid for the same job) and [high levels of] unemployment.

“The continent is the most mismarketed and undermarketed in the world,” he said, adding that Africa exported too much of its raw materials and imported finished products at ten times the price.

“Africa is poor by choice, and it is owing to bad leaders, especially traditional leaders, who have plunged and plundered their people into poverty,” he stated.

Mohale said, on the upside, in South Africa, President Cyril Ramaphosa has already secured $34-billion funding from two summits held this year. He initially set a target of securing about $20-billion a year in investment over the next five years, for a total $100-billion.

A further two summits will be held before the end of the year.

Meanwhile, Skipper led a panel discussion on getting Africa fit for the future, during which Botswana Diamonds MD James Campbell called for more exploration in the continent’s resources sector.

He pointed out that, for example, 25% of Botswana’s gross domestic product was contributed from diamond mining, the country’s biggest employer. He warned, however, that in 40 years’ time, existing diamond resources will run out.

“Exploration needs to be kickstarted. In South Africa, for example, there are no listed explorers. Investing in exploration is riskier than investing in mining and, therefore, [there] ought to [be] different regulations [that will attract more] foreign investment [into exploration].

“Banks need to be briefed on how to invest in risk products. Additionally, Zimbabwe has had no exploration in 30 years, but still has high royalty rates, so government also needs to create enabling environments for exploration.”

ABN Group MD Roberta Naicker, meanwhile, said that getting Africa fit for the future would require the media to cultivate the right image and perception of Africa.

“[The] media often does not highlight the investment opportunities and economic growth potential, but rather highlights wars and corruption, which damages the image of all 53 African countries, and not just the one or two bad apples of the moment.”

Bridge Taxi Finance executive chairperson Vincent Raseroka stated that, to prepare for the future, the continent needs to understand how it got to the present.

“in South Africa right now, we need to understand how we got here. The Uhuru generation has come from freedom and reparation, but also expectation.

“The people [who] liberated us, [are] expecting us to pay them for it. In South Africa, we are at an inflection point; we can go the route of benevolent dictatorship, or the new dawn route.”

Raseroka stated that South Africa needed to change the narrative and “stop talking about the past and making ourselves victims. We have to develop new capabilities and stop political correctness to win tenders.”

He added that, in crisis, there is opportunity. “With technology right now and environmental responsibility, electric vehicles are the future. Battery minerals are in Africa. Africa could be made the destination of choice for minerals of the future.”

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here