JOHANNESBURG (miningweekly.com) – Sibanye CEO Neal Froneman on Monday showed off the low-cost performance of this gold and platinum-mining company to a top-level audience in America at a time when the South African company’s proposed acquisition of Stillwater Mining Company of the US is edging forward.

In an address to the BMO Metals and Mining Conference in Miami, Froneman graphically illustrated the company’s low-cost performance in rands and dollars as well as its low-debt position, multibillion dollar market capitalisation and blue-chip shareholding.

Flashing on the screen was a pie-chart showing the US shareholding of the Johannesburg- and New York-listed company as the biggest single block with 36%, eight percentage points higher than the 28% South African shareholder base that includes South Africa’s State-owned Public Investment Corporation with 9.28%.

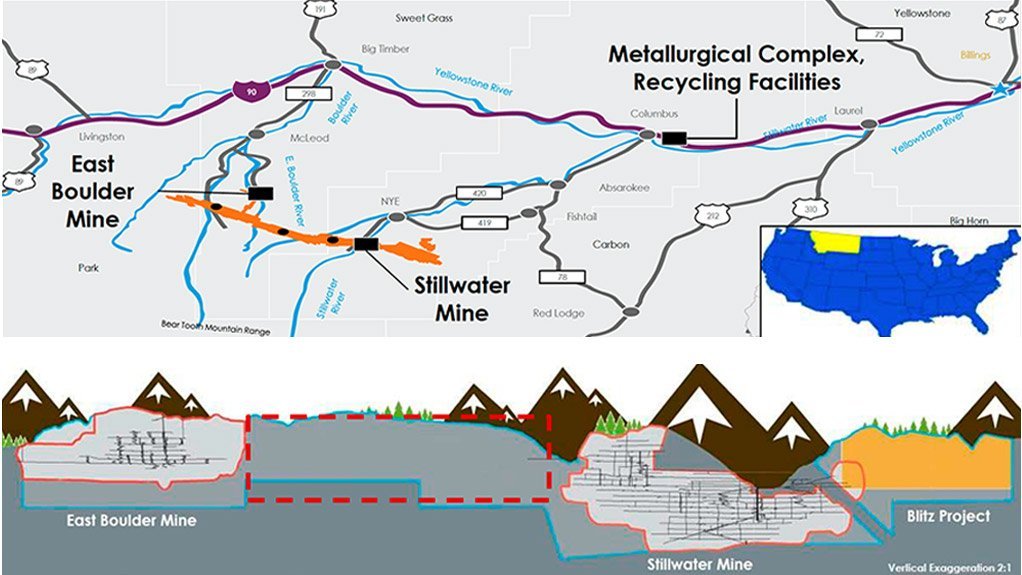

Following its foray into platinum with last year’s absorption of Aquarius Platinum and Rustenburg Platinum, Sibanye’s new acquisition target is the New York Stock Exchange-listed Stillwater, the platinum group metals (PGMs) mining company headquartered in Colorado.

The R30-billion deal is on track for a second-quarter close.

Froneman outlined the value-accretive nature of this transaction, which has secured bridge financing as well as South African Reserve Bank approval.

After last week’s reporting of record 2016 operating profits of $717-million, Froneman reiterated the company’s goals of becoming a mine-to-market PGM business in South Africa and securing further gold acquisitions.

He emphasised palladium’s strong market fundamentals and Sibanye’s fundamental bullishness on PGMs, despite diesel and electric vehicle headwinds, which he described as being offset by growth in the overall global car market.

He positioned Sibanye’s acquisitions of Aquarius and Rustenburg as being set to unlock synergies worth R400-million by the end of 2017, and spoke of the contribution to revenue of chrome already being above expectations.

Enhancing the Stillwater investment case is the cash its Blitz project is expected to generate as it ramps up, positioning Sibanye’s platinum division further down the cost curve through its mechanised operations and access to low-cost global financial.

Froneman concluded that Sibanye’s upcoming rights offering supported capital structure flexibility.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here