JOHANNESBURG (miningweekly.com) – The Glencore-Merafe Chrome Venture is exploring renewable energy projects to mitigate power shortages and power costs, Merafe Resources CEO Zanele Matlala said on Monday, when the Johannesburg Stock Exchange-listed company elevated its dividend declarations for 2023 to a total of R1 050-million, well up on the R625-million of 2022.

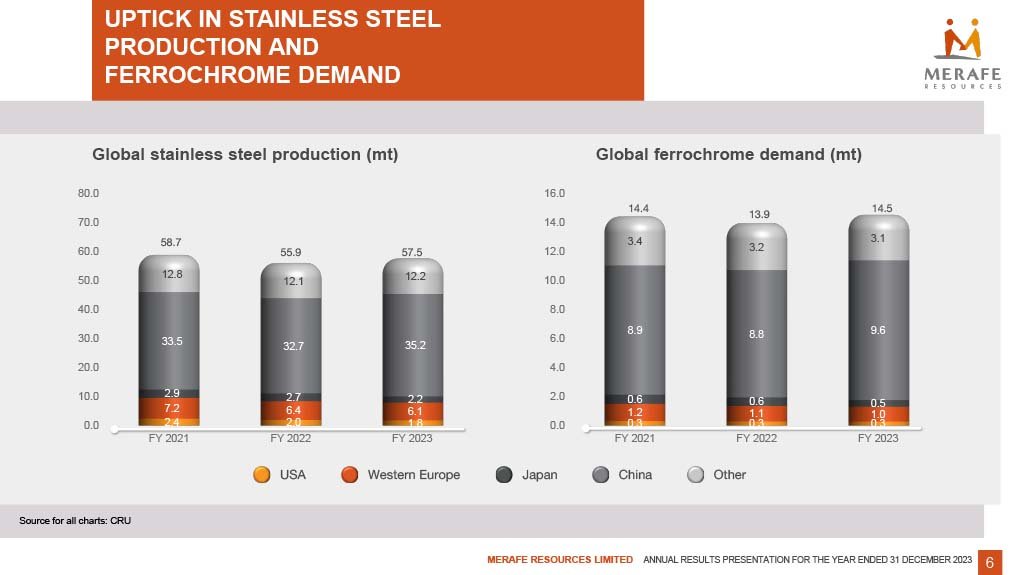

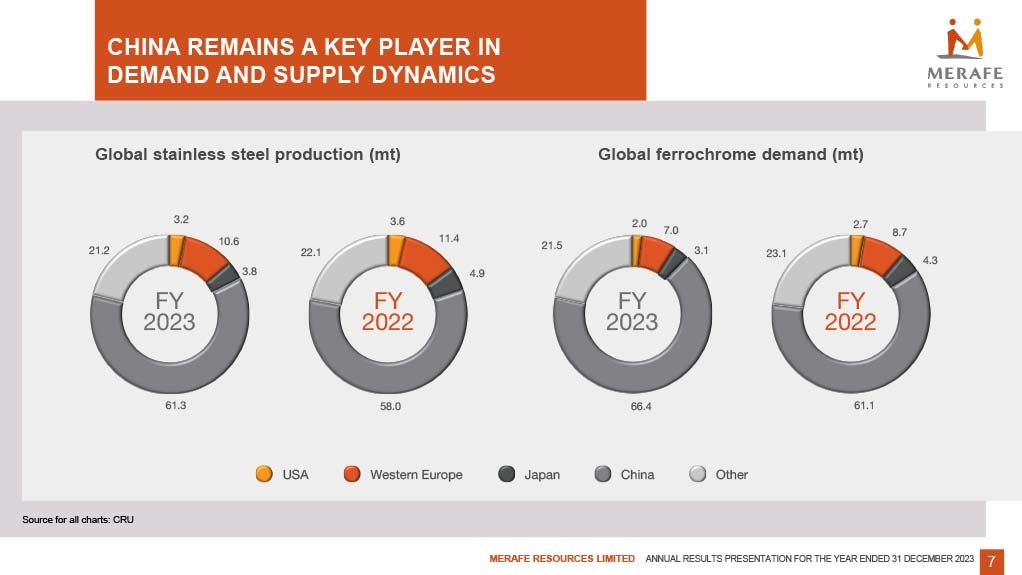

In addition, Merafe FD Ditabe Chocho reported a 114% year-on-year upward leap in chrome ore revenue to R2 222-million as well as a 1% year-on-year ferrochrome revenue increase to R6 885-million. (Also watch attached Creamer Media video.)

Through its wholly-owned Merafe Ferrochrome subsidiary, Merafe has a 20.5% participation in the earnings of the Glencore-Merafe Chrome Venture in which Glencore Operations South Africa has a 79.5% participation.

Regarding 2024 venture-level opportunities, Matlala cited the development of green energy solutions as one of them, along with the implementation of the negotiated pricing agreement with State power utility Eskom and the National Energy Regulator of South Africa.

However, already at an advanced stage of consideration are alternative technologies for producing electricity from off-gas generated as part of ferrochrome production process, as well as a combination of solar and wind projects that include on-site behind-the-meter projects as well as off-site wheeling projects.

Being finalised are commercial structures and associated risk allocation on the renewable energy project negotiations with the first 100 MW off-site solar projects heading for financial close in the first half of this year.

“We’ve got co-generation at some of our operations but there are new, more efficient technologies and we’re pursuing the use of gas as a continuous process enhancement in terms of generating electricity,” Glencore Alloys CEO Japie Fullard highlighted in response to Mining Weekly.

“We’ve already pulled the execution tigger at one of our operations in terms of behind-the-meter, so we’ve got a very good model already in place,” said Fullard.

At the same time, the venture is also mulling independent power producer (IPP) and power purchase agreement (PPA) options.

“The third initiative is our IPP versus PPA and in that regard, we’re very close to signing our first bankable PPA solution. But in the meantime, we’re also continuously looking at other and more potential solutions out there.

“By doing that, it allows us then to wheel. A PPA is where there’s, let say, a plant being built in the Northern Cape and then you wheel it, so it’s a virtual wheeling agreement and all those agreements with the authorities are already in place.”

While no price differentiation for green ferrochrome and green chrome was currently in sight, the carbon abatement cross-border C-band mechanism was, Fullard said, being pushed quite hard through Europe.

It is through that mechanism that price differentiation is expected and until cross-border tariffs are enforced, price differentiation is seen as unlikely.

Questions are coming through, however, about how the ferrochrome is being produced, and the clear decarbonisation pathway, with set targets, in place is providing the answer.

Using 2019 levels as a base, a 15% reduction of total scope 1, 2 and 3 emissions is targeted for 2026, a 25% reduction of total emissions for 2030, a 50% reduction by 2035, and net zero by 2050.

On potential reversion to green hydrogen to process the ferrochrome accompanied by the use of the platinum group metals (PGMs) now being produced in-house, Fuller said a commercialised green hydrogen example would need to be in place for others to seriously consider such a solution.

“Also, the PGMs area in which we are playing is small compared with the bigger PGM players. We have various offtake agreements, we don’t convert our PGMs concentrate into metal and we don’t see that currently as a focus area. Our clear focus is on solutions that are already workable, which are solar and wind,” Fullard emphasised.

Ferrochrome production decreased by 22% to 300 000 t, which translates to 78% of available capacity being utilised. Only the energy-efficient Lion smelter operated during the winter months, from which the Rustenburg smelter has not been returned to operation, while sale of Boshoek mine is at the regulatory approval stage.

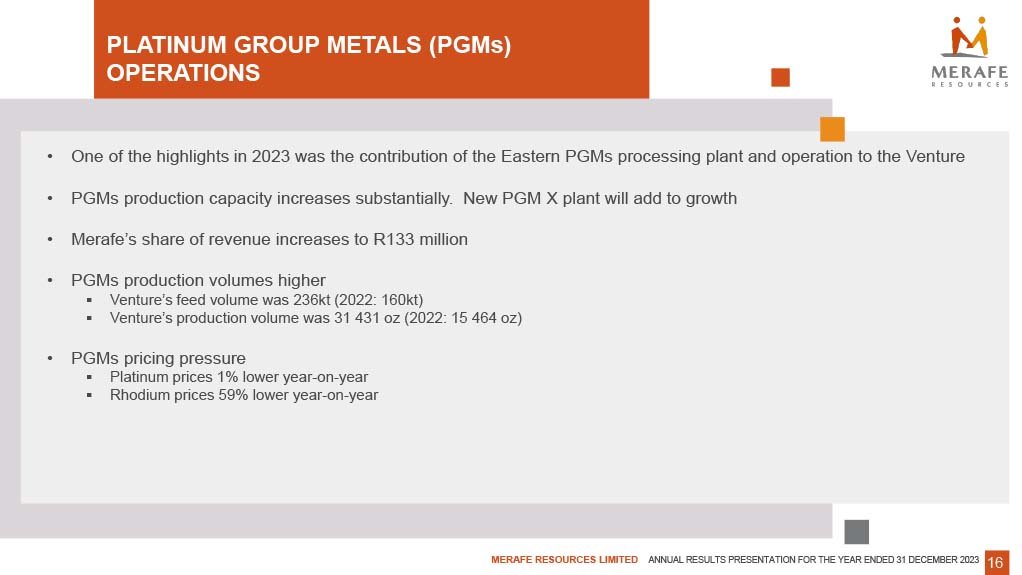

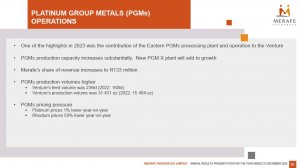

One of the highlights of 2023 was the contribution of the Eastern PGMs processing plant and operation, Matlala told attendees of the company’s 2023 results presentation.

Some R71-million has been spent so far on the new PGM X plant under construction, with PGMs production volume doubling to 31 431 oz and revenue rising to R133-million.

A 15% reduction in total carbon emissions by 2026 and a halving of emissions by 2035 are being targeted by the venture as a whole.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here