JOHANNESBURG (miningweekly.com) – South Africa’s struggling ferrochrome industry has committed itself to far-reaching efficiencies and competitiveness initiatives, including the self-generation of 750 MW of wind, solar and cogenerated power, support of junior mining development and the encouragement of local coking coal production.

Describing itself in a media release to Mining Weekly as being under existential threat, the industry has committed to supporting new junior anthracite miners, pre-financing already approved reductant projects, lowering dependence on imported metallurgical coal by encouraging local production, and providing more competitive pricing to local ferrochrome consumers than export customers.

Currently, the existential threat to South Africa’s struggling ferrochrome industry, which has 6 851 direct employees, is extending to upstream mines as the country’s ferrochrome smelters are the largest local consumers of anthracite and metallurgical coal.

Already five of South Africa’s ferrochrome smelters have either been shut down, liquidated or placed in business rescue. These smelters supported more than 31 000 jobs along with a yearly contribution of R11-billion to South Africa’s gross domestic product (GDP).

Under threat now is the industry’s support for another 68 000 jobs, a R41-billion contribution to the GDP and R14-billion to Eskom.

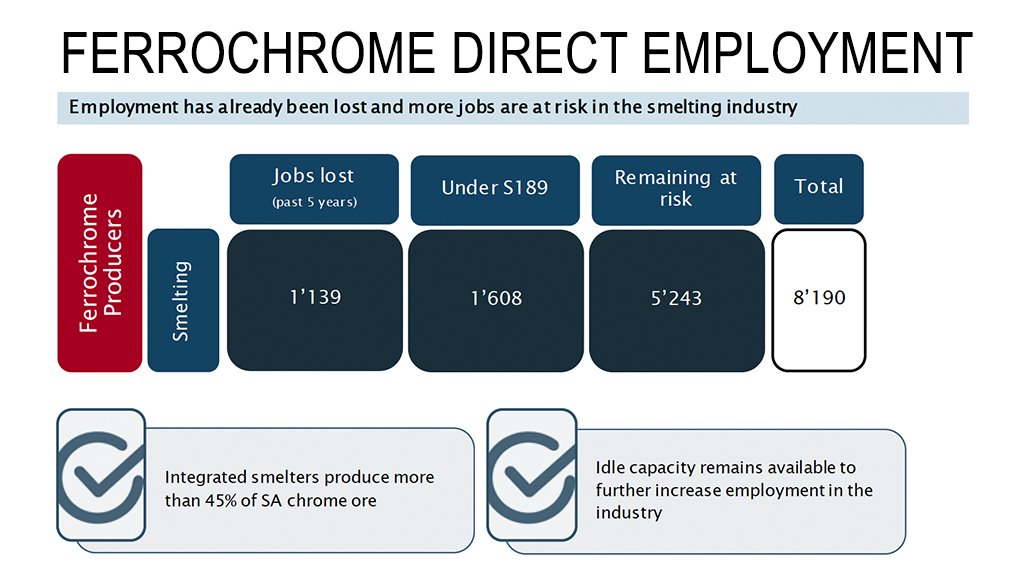

Direct employment lost in the past five years totals 1 139 jobs. Another 1 608 jobs are currently at risk under Section 189 of the Labour Relations Act, and remaining at risk are another 5 243 jobs.

VIABILITY OF REDUCTANT MINING COMPANY UNDER THREAT

Suppliers to the substantial South African ferrochrome industry expressed concern in the multi-faceted ferrochrome industry media release.

“As a reductant supplier to the South African ferrochrome industry, we’re very concerned by these developments as they have a direct impact on our viability,” the 1 177-employee Tendele Coal Mining stated.

Tendele is just one of the many anthracite producers dependent on demand from the ferrochrome industry. Others include Menar with 2 102 employees, Maloma with 600, Jindal Africa with 600, Nkomati Anthracite with 296 and Arcelor Mittal with 225 employees.

Sixty per cent of the 1.2-million tonnes of anthracite products and 500 000 t of energy product a year are supplied to the ferrochrome industry.

“We support initiatives that will assist in ensuring the survival of this important downstream consumer of our product,” added Tendele, in reference to the Minister in the Presidency Jackson Mthembu stating on October 22 that an export tax on chrome ore had been proposed by the Cabinet, a decision which has dismayed South Africa’s chrome producers represented by chrome producer organisation ChromeSA.

Eighty four per cent of cross-border chrome is exported from South Africa, with other lower-percentage participants including Turkey at 9%, Albania at 3%, Pakistan at 2% and rest-of-world countries at another 2%.

ChromeSA stated on November 5 that it remained committed to developing alternative solutions to the proposed chrome ore export tax, which, it said, boosted one industry, or one part of the value chain, at the expense of another, with flawed justification.

The chrome miners, ChromeSA added, relied on maximum value being realised from the natural resource to retain employees, business and community welfare.

SUPPORT FOR LOCAL FERROCHROME CONSUMERS

With ferrochrome the main ingredient of stainless steel, South African stainless steel producer Columbus Stainless provided these motivating statements in support of the imposition of an export duty on chrome ore in the ferrochrome industry release:

- stainless steel is the primary end-use for both chromium and nickel;

- as the only producer of stainless steel in Africa, Columbus Stainless is situated in Middelburg, Mpumalanga, where it directly provides employment to more than 1 500 people and contributes significantly to the GDP of the province; and

- a significant percentage of the stainless steel manufactured in South Africa is utilised in the automotive industry, which directly employs around 500 000 people, with almost a million people employed in industry-dependent jobs.

“Columbus Stainless therefore supports the concept of an export duty on chrome ore,” the company said.

TIMESCALED INDUSTRY COMMITMENTS

In the next 12 months, the ferrochrome industry has collectively stated that it will:

- remove the distinction between summer and winter Eskom tariffs to allow for improved maintenance planning;

- cogenerate more to reduce independently total power cost and load through heat recovery. Already installed are 8 MW of cogeneration and more projects to generate 15 MW have been approved at smelters; and

- continue to support existing anthracite miners, who have expressed grave concern at its plight.

In the next 12 to 36 months, the ferrochrome industry has committed itself to:

- linking Eskom power tariffs to commodity prices;

- introducing 75 MW of additional independent heat recovery projects as well as large-scale 675 MW of wind and solar photovoltaic projects currently planned;

- supporting new junior anthracite miners; and

- pre-financing projects already approved.

And then in 36-plus months, it will:

- consume competitive long-term Eskom power pricing in South Africa;

- use existing Eskom grid infrastructure as an independent power producer, and look to 200 MW of energy storage opportunities; and

- reduce dependence on imported coke by encouraging local coke production.

FERROCHROME INDUSTRY’S MAJOR CONTRIBUTION

The benefit of the South African ferrochrome industry not shrinking any further than it already has is that it:

- supports more than 68 000 jobs, pays R1.4-billion in pay as you earn taxes, procures R14-billion worth of goods and services locally, and earns the country $2-billion in foreign income;

- it provides 8% of Eskom’s revenue and supports 20 South African reductant mines by buying 2.5-million tonnes of product a year;

- it supports South African stainless steel producers and local stainless steel consumers as ferrochrome is the main ingredient of stainless steel; and

- it contributes R42-million a year in social support and local enterprise development.

MORE COMPETITIVE PRICING TO LOCAL FERROCHROME CONSUMERS

In the release, South Africa’s ferrochrome producers expressed strong commitment to providing more competitive pricing to local ferrochrome consumers than export customers.

South Africa’s 15 ferrochrome smelter sites are located from Boshoek and Rustenburg in the west to Lydenburg on the east, with Tubatse to the north and Mogale to the south.

The operating companies, some with several smelter sites, include Glencore-Merafe, Samancor, Hernic, Ore & Metal, Afarak, Moti and Richards Bay Alloys.

A collapse of the ferrochrome industry would have severe consequences for South Africa, where the industry contributes R41-billion to South Africa’s GDP and its shutdown would have severe consequences on South Africa’s chrome ore industry.

REPERCUSSIONS OF A SHUTDOWN ON CHROME ORE PRODUCERS

South Africa’s ferrochrome smelters consume 8.2-million tonnes of chrome ore a year and its collapse would result in those tonnes being exported.

This would increase South Africa’s chrome ore exports by 60%, would put 700 000 t a month more chrome ore supply into the international chrome ore market, would require 380 additional trucks a day to transport chrome ore to port and need seven additional vessels a month to be loaded at South Africa’s chrome ore terminals.

Integrated smelters produce more than 45% of South Africa’s chrome ore and idle capacity remains available to increase employment in the industry.

GLOBAL PRODUCTION AND RESERVES

Even if all other countries produced at historic high levels, South Africa would require a 6% production increase year-on-year to meet 2019 chrome ore demand, the ferrochrome industry release stated.

South Africa, it said, was currently a marginal producer of chrome ore, with uneconomic production forecast to be 2.8-million tonnes in 2020.

Demand for South African chrome ore would remain as there was no substitute for about 400 000 t of additional uneconomic South African production in an adjustment for export tax of 40%, it added.

SOCIAL INVESTMENT IN RURAL AREAS

The ferrochrome industry is responsible for ongoing contribution to social investment in local communities in areas including Steelpoort, Sekhukhune and Kroondal.

Among the industry’s social projects are:

- construction of the new dual carriageway concrete bridge to replace old steel bridge in Steelpoort. The old steel bridge across the Steelpoort River, serves as the only connection between Steelpoort and the vast Jane Furse area. Vital daily connection for thousands of residents commuting to and from work, schools and businesses. Current single carriageway steel bridge is very old and presents a serious danger to the safety of commuters. Sekhukhune district municipality and the Department of Mineral Resources and Energy requested mining companies to collaborate with funding to assist with the construction of a new concrete bridge, at a total cost of R85-million;

- electrification of 1 800 households in Sekhukhune at a total cost of R59-million. The electrification of 300 households in Ngwaabe, Sekhukhune has been completed at a cost of R8-million. The electrification of a further 1 500 more households, 600 in Kutullo, 300 in Tsakane, 300 in Tukakgomo and 300 in Mahlakwena from this year to the end of 2022 at a cost R50-million;

- the expansion of a power station at Ikemeleng, in Kroondal. Electricity supply and availability to the Kroondal and Ikemeleng communities outside Rustenburg is severely constrained and unreliable. The community and Rustenburg municipality requested this investment of R1-million as part of their integrated development plan. The expanded power station will augment and vastly improve electricity supply and distribution to the affected areas at a total cost of R11-million; and

- purification and reticulation of potable water to 18 villages as part of the Sekhukhune water distribution master plan, in Steelpoort. Hundreds of households still rely on the manual abstraction and transportation of water to households in the area. These current challenges remain despite the completion of the De Hoop dam in Steelpoort. This project commenced in May and is estimated to be completed by December at a total cost R18-million.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here