JOHANNESBURG (miningweekly.com) – The sale by Southern African diamond mining company Petra Diamonds of an exceptional blue diamond in its fifth tender cycle lifted the average prices per carat received 22% higher than those of the prior Tender 4 sale.

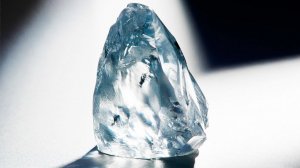

The London Stock Exchange-listed company, headed by CEO Richard Duffy, reported on Tuesday that the price upliftment was the result of a remarkable14.76 ct exceptional clarity diamond, recovered from Cullinan diamond mine in Gauteng, fetching $8.2-million.

The Cullinan resource, which is famous for hosting the largest 3 106 ct gem diamond ever, has the potential to extend beyond 2050.

The fifth tender yielded an overall $49-million from the sale of 362 000 ct, with these proceeds more than offsetting the increase of quarter-three net debt.

Last month, the first of the 78-level second phase production tunnels at Petra’s Finsch underground diamond mine in the Northern Cape was successfully commissioned. It is expected that the commissioning of the remaining six tunnels will be completed by June.

Production guidance of 2.75-million carats to 2.85-million carats for the 2024 financial year has been confirmed.

Petra reports that it is continuing to update its life-of-mine plans to support a transition to a smoother capital expenditure profile. This includes a replanned ramp-up of the deferred capital projects from the first quarter of the 2025 financial year.

The signing of a definitive transaction agreement for the sale of the Koffiefontein diamond mine in the Free State is expected to result in Petra avoiding closure-related costs of $15-million to $18-million.

The company has also announced an increased cost savings target of more than $30-million a year.

Half of these savings are expected to arise from a rebasing of fixed and variable costs in line with reduced throughput at Finsch, and the remaining half from savings across operating costs and overheads at group level and Cullinan.

During the quarter, Petra repaid $23-million of revolving credit facility finance to reduce interest costs. It had available liquidity of $104-million at the end of the quarter.

The average price of diamonds from Petra’s Williamson diamond mine in Tanzania was lowered by reduced prevalence of higher-valued single diamonds, which is expected to be temporary in nature.

Petra's strategy is to focus on value rather than volume production and only operates in countries that are members of the Kimberley Process.

The company aims to generate tangible value for each of its stakeholders, thereby contributing to the socio-economic development of its host countries and supporting long-term sustainable operations to the benefit of its employees, partners and communities.

The company’s loan notes due in 2026 are listed on the Irish Stock Exchange.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here