South Africa’s first interest-rate cut since 2020 quickly divided economists over how much further it will go after making a cautious 25 basis point start to the easing cycle, despite the Federal Reserve going twice as big the day before.

Rand strength, softer oil prices and slowing inflation, which has dipped below the midpoint of the reserve bank’s 3% to 6% target range, was enough to convince the monetary policy committee to reduce the benchmark rate from a 15-year high to 8%.

Goldman Sachs Group sees the central bank lowering its policy benchmark a further 150 basis points, but others only expect a shallow adjustment with at most two more quarter-point moves.

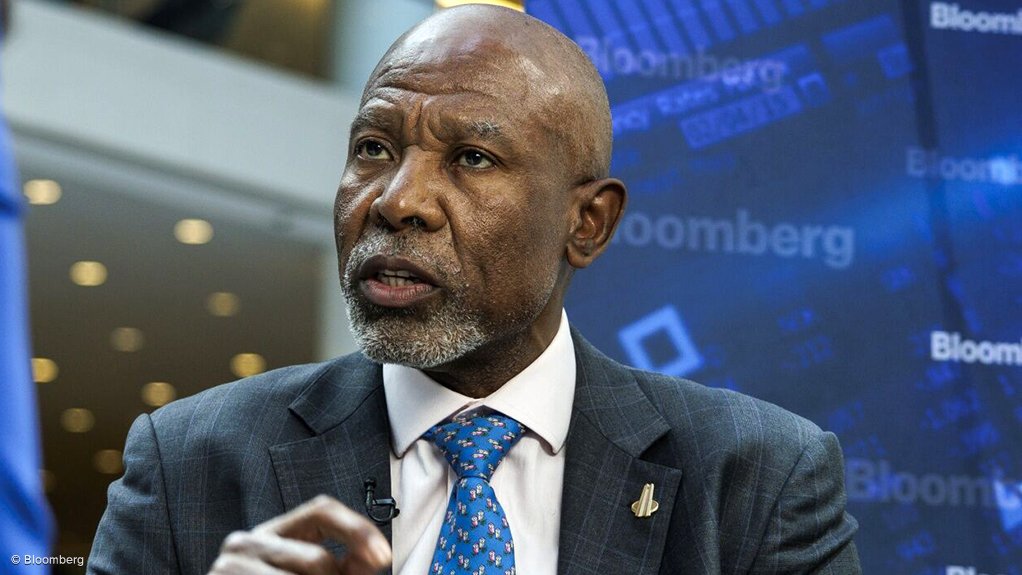

Governor Lesetja Kganyago said that a half-point cut, as well as leaving policy on hold, had also been discussed and that consensus yielding a unanimous vote was “ultimately” achieved, suggesting a spirited debate among the six-member MPC.

Still, the South African Reserve Bank’s model-based forecast show its policy benchmark declining to 7.17% by the end of next year and 7.09% by end-2026.

Its forecasts also show inflation slowing to 4% in 2025, based on assumptions including a rand at 18.04 per dollar. The unit, which has rallied strongly since the Fed acted and signalled further deep cuts ahead, was trading at 17.56 per dollar at 12.53 pm in Johannesburg on Friday.

Kganyago himself gave little away on how much further rates would ease, though he didn’t sound impressed by calls for bolder action.

“You have got to be cautious, adventurism is not part of our monetary policy toolkit,” he reminded a press briefing on Thursday north of Johannesburg after announcing the decision.

Here’s what some economists are saying:

Goldman Sachs

Goldman has one of the boldest calls and anticipates a cumulative 150 basis point cut to 6.5% in which the SARB takes a “front-loaded” approach.

“Forecast revisions were dovish and large,” economist Andrew Matheny said in a note. “Given the downside surprises to South African inflation in recent months, strengthening of the rand, and supportive external backdrop, we revise our policy rate forecast by front-loading rate cuts.”

Governor Lesetja Kganyago

The MPC “still thinks that the risks are reasonably high,” said Elna Moolman, Standard Bank Group’s head of South Africa macroeconomic research, who expects a further 75 basis points of easing to 7.25%.

“This is likely to be quite a shallow cycle,” she said.

Nedbank

While there was a clear dovish shift, the MPC is wary, said economists at Nedbank Group. The lender forecasts another quarter-point reduction at the November meeting, followed by a cumulative 100 basis points next year.

The MPC “remains cautious, stressing the upside risks to inflation emanating from the unpredictable geopolitical environment, political uncertainty in various parts of the world and domestic electricity prices.”

Foord Asset Management

The MPC “pushed back on aggressive pricing of cuts”, Rashaad Tayob, portfolio manager and macro strategist at Foord Asset Management said, pencilling in a 25 basis point reduction in November and a further two to three cuts in 2025.

“The bar to cut aggressively towards the 7% level or lower will be very high,” Tayob said. “The SARB is aware that the spread to US rates remains low by historical standards, and the US is unlikely to be as aggressive as it has been post the 2008 crisis where rates were mostly at zero.”

RMB

“The MPC’s careful strategy indicates that future rate reductions will be gradual, prioritising the alignment of inflation expectations and offering clear guidance on policy decisions,” RMB said in a client note.

Keabetswe Mojapelo, macroeconomist at RMB, said that given the reserve bank’s inflation outlook, “if they want to be at 4%, they won’t be comfortable.” He expects two more cuts, lowering the policy rate to 7.5%.

It also “speaks to how they have a desire for a lower target. So, they’ll do it artificially.”

The reserve bank and National Treasury are mapping out a framework on a new inflation goal to improve the country’s competitiveness. The central bank has said there’s a case to be made for a lower single point target.

Barclays UK

Barclays Plc sees three 25 basis point rate cuts in November, March and May, taking the benchmark to 7.25%.

“We continue to expect the cycle to be short and shallow,” said economist Michael Kafe. “We expect CPI to rise above the midpoint of the target band after the second quarter of 2025.” The SARB forecasts CPI in the second half of next year to hover around 4.3% and 4.4%.

Momentum Investment Group

Momentum sees 75 basis points of cuts by the end of 2025.

“The governor indicated that the SARB is not behind the curve and does not intend to be ahead of the curve,” Sanisha Packirisamy and Tshiamo Masike wrote in a client note. “This implies that the bank is confident about the timing of the first interest-rate cut and suggests that we may not see big” reductions.

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here