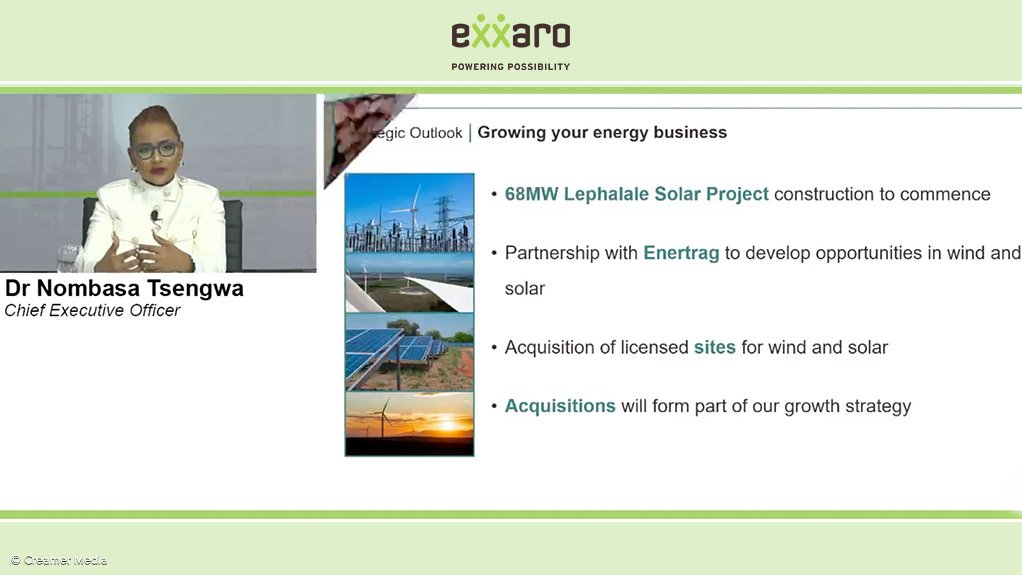

JOHANNESBURG (miningweekly.com) – Financial close is expected at the end of this month for construction in the second quarter of this year of a 68 MW solar power plant at a cost of between R1.52-billion and R1.56-billion, Exxaro CEO Dr Nombasa Tsengwa said during Thursday’s record-earnings presentation by the coal, energy and ferrous markets company.

“We have been building a pipeline of opportunities including the Lephalale solar project, which our board has already approved,” Tsengwa told the results presentation covered by Mining Weekly. (Also watch attached Creamer Media video.)

Lephalale is a coal mining town in the Limpopo province, immediately east of the Waterberg coalfield and South Africa’s other coal province of Mpumalanga is also in the JSE-listed company’s renewable energy sites.

Exxaro’s partnership with independent energy company Enertrag aims to develop wind and solar solutions for the mining industry in Mpumalanga, with the first preferred site already permitted.

“We are now focusing our attention on commercial and technical workstreams,” Tsengwa said following the reporting of 41% higher revenue at R46.4-billion, which was the main driver of the 78% increase in earnings before interest, taxes, depreciation and amortisation (Ebitda) to R19 002-million in the 12 months to December 31.

The partnership with Enertrag has a potential pipeline of 700 MW. Furthermore, Exxaro is in discussion with various parties to acquire near-permitted sites to further boost our entry into the energy market.

The potential pipeline ranges from 370 MW to 975 MW.

“We are quite mindful of South Africa’s electricity grid constraints, which really remain a challenge in our energy strategy, and a challenge for others in the country as well.

“There are around 9 GW of renewable energy projects under development in South Africa, of which the mining sector accounts for 6.5 GW.

“Closing the electricity gap requires concerted efforts from citizens at large but also more from the likes of our business to make meaningful investments,” said Tsengwa, who reported that the Ebitda margin of Cennergi was a high 80% in 2022, underpinned by the long-term offtake agreements. As Exxaro’s wholly owned energy arm, Cennergi last year generated 671 GWh of electricity.

Tsengwa revealed that, in the past 12 months, Exxaro has pursued eight wind and solar acquisitive growth opportunities, one of which was taken through the company’s formal processes but went no further for strategic reasons and very tight timelines.

Six opportunities were abandoned for not meeting Exxaro’s investment criteria, and one is still subject to a due diligence process review.

OPERATING IN SOUTH AFRICA

Worsening logistics constraints and rising electricity supply shortage have introduced new challenges to Exxaro, in a South Africa that Tsengwa said has become a difficult place in which to do business.

The increasingly difficult South African environment, she said, had demanded significant structural adjustments, which is compelling business to grow new skills of either being self-sufficient or relying on alternative means of doing business.

“This is all outside of the norm of how we used to do business in the country,” said Tsengwa.

Losses of volume were continuing to be faced owing to the loss of rail capacity.

The options of trucking coal to alternative ports were neither sufficient nor optimal to make up for the loss in rail capacity.

In addition, the alternative export channels came at a high cost, which the company had been able to withstand as a result of the high export price.

“As a responsible corporate citizen, we recognise the detrimental impact of the increasing number of trucks on the road, the damage that does to infrastructure and the social impact of that infrastructure damage to the communities around them,” said Tsengwa.

Appreciation was expressed for the collaborative effort being made by Minerals Council South Africa, the Transnet management, and their board, “wherein we are all full participants”.

“The worsening electricity supply shortage is compounding negative impact on business and particularly the small, medium-sized and microenterprises, as well as other faces of our society.

“A direct impact is firstly through small enterprises in our supply chain that are supported through our enterprise supply development programme. These small businesses are experiencing difficulties in deploying their services and fulfilling their financial obligation,” she added.

Moreover, the welfare and morale of Exxaro employees and their families has been severely affected.

“This is an unfortunate and evolving situation for all of us in South Africa. Due to this complexity, we do not by any means believe that solutions will be simple. However, it is quite encouraging for us to witness some of the actions that the government and the State-owned enterprises have taken.

“Transnet’s decision, for instance, to concession the Johannesburg to Durban freight line and National Treasury’s requirement for Eskom to do the same with some of its power stations. We really expect to see a little bit more as well from our government in this line of commitment,” said Tsengwa.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here