Plans by African governments to raise money on China's domestic debt markets via so-called panda bonds could be undone by their heavy debt loads and a wider lack of market infrastructure, investors and analysts said.

African governments seeking to tap fresh pools of money have sold bonds in currencies other than their own, mostly US dollar and sometimes euros, for three decades.

But gaining a foothold in the world's second largest bond market has proven elusive. Changing that is high on the agenda for both Beijing and cash-hungry African governments.

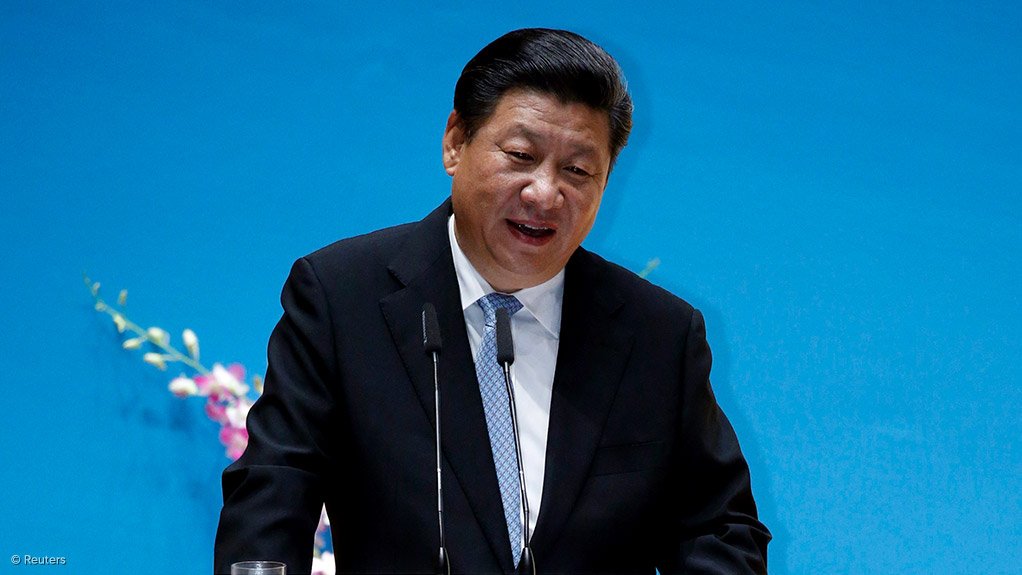

At a China Africa summit in Beijing this month, President Xi Jinping said he wanted to "encourage and support Africa in issuing panda bonds in China."

But there are some very basic hurdles to issuing on the Chinese mainland for African issuers.

"The Chinese yuan isn't freely traded worldwide, which makes these bonds less attractive," said Lynda Iroulo, assistant professor at Georgetown University in Qatar.

Panda bonds are a growing market. Issuance in the first three quarters of 2023 surged to $18-billion, data from the National Association of Financial Market Institutional Investors showed, surpassing $11-billion for all of 2022.

The boost followed Beijing relaxing the rules early last year to make issuance easier. One major change is that issuers can choose to spend the proceeds in China or repatriate them.

Lower interest rates make China an attractive market, compared with the US, with the 3-year bond offering a 150 basis points differential.

"We expect onshore funding costs will remain cheaper even with the cuts in US interest rates, as China's central bank could have more flexibility in cutting interest rates," said Christopher Lee, S&P's chief analytical officer for Asia-Pacific.

TRADE TIES

African States looking for closer trade ties with China could tap the market, said Jack Buffington, professor at the University of Denver in the US.

"Most of the African nations that have a potential for growing in manufacturing and supply chain are interested in having balance within both the US and China spheres of influence," he said.

Panda bond issuance could add a new thread to the financial ties between China, which is Africa's largest bilateral creditor.

Kenya, whose President William Ruto asked China at the summit to reprofile Africa's debt to include longer grace periods and longer loan tenures to ease its debt burden, is one prospective panda issuer.

The East African nation wants to issue a debut $500-million panda bond this financial year, Bloomberg reported in March.

Kenya had joined the Asian Infrastructure Investment Bank (AIIB) this month, a prerequisite for panda issuance.

"The membership will enable Kenya to access concessional funding," Ruto said.

AIIB provided guarantees for Egypt's issuance of 3.5-billion RMB sustainable panda bond last year, Africa's first. The bank did not respond to a request for comment.

Its website showed other African nations like South Africa and Ghana have joined it in recent years, while others like Tanzania and Senegal are waiting to join.

LIQUIDITY

The dollar's dominance might also slow an African pivot to Chinese domestic bond markets.

Although the greenback's share as a global reserve currency has dropped to 59% from 70% over the last decade, it continues to dominate global trade and financial markets.

A shift to Chinese currency funding for frontier issuers would require "a major transformation in the currency and financial system," said University of Denver's Buffington.

For government debt managers, liquidity concerns - which in turn could increase the premium demanded by investors to hold such less frequently issued bonds - also raise issues.

"It is better, at least in the short-term, to concentrate in the dollar that is quite liquid," said Otavio Medeiros, Brazil's undersecretary of public debt, when asked if Brazil would consider issuing a Panda bond.

Others are less worried. Hungary, which has close political and trade ties with China, has been issuing panda bonds since 2017.

But Hungary's multiple issuance has not settled questions about how trades in those bonds are settled and their liquidity depth, said Sergey Dergachev, a portfolio manager at Union Investments.

"It is very difficult (for) me as of now, to imagine many emerging markets corporate and sovereign issuers to actively issue in renminbi," he said.

African countries, however, should continue with their push to issue panda bonds, said Banji Fehintola, executive director at Africa Finance Corporation (AFC), a continental development financier, by enlisting partners to smooth the path.

He cited the example of Egypt, which last year issued a $500-million Japanese samurai bond with the help of the AFC, a deal that proved that Africa can successfully tap new markets.

"If we all traditionally go west to raise capital all the time without looking at alternative sources of funding, that is not the right strategy," he said.

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here