JOHANNESBURG (miningweekly.com) – The current global metals and minerals environment is reminiscent of 2015, when the mining industry stalled after a very good run – compounded this time, however, by inflation pressures, few or no new discoveries and a chaotic global order.

“Then, as now, it is plagued by the obsessive short-termism of governments and investors alike, who demand instant gratification and reach for immediate solutions, dismissing the long-term nature of mining,” Barrick CEO Dr Mark Bristow emphasised during the New York- and Toronto-listed gold and copper company’s presentation of higher third-quarter results, helped by higher production and lower costs in the three months to September 30. (Also watch attached Creamer Media video.)

“Whether you’re building a sustainable business or a better world, you need carefully considered strategies and practical plans to achieve your goal," Bristow highlighted, amid Barrick reporting 35% higher cash flow to $1-billion-plus and free cash flow growth of $359-million. At the same time, it maintained its quarterly 10c-a-share dividend.

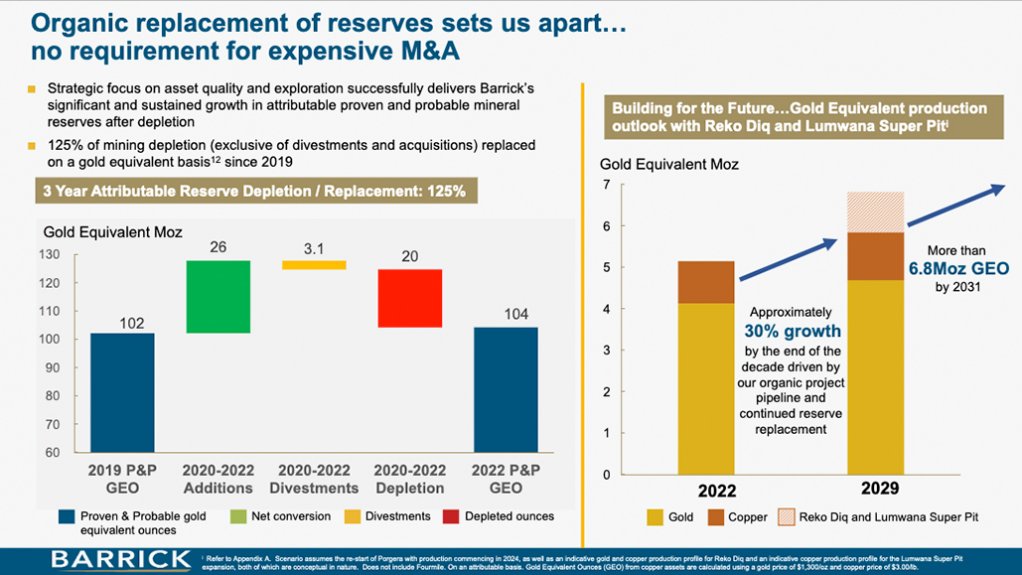

“Whether that’s the global transition to renewable energy or a business that creates and delivers real value for all its stakeholders, wishful thinking won’t get you there. That’s why Barrick has a long-term vision of its future and a strategy which is organically designed to deliver value today and growth tomorrow – by building real partnerships with our host countries and other key stakeholders,” Bristow added ahead of displaying a slide showing a 125% replacement of depleted gold-equivalent reserves since 2019.

That was the year of Barrick's merger with Randgold Resources and a time when the North Mara and Bulyanhulu gold mines in Tanzania were shut down by the government, Veladero in Argentina was under huge pressure, Reko Diq in Pakistan had been nationalised, Lumwana in Zambia was bleeding, Porgera in Papua New Guinea was closed, Nevada in the US was being high-graded, and Pueblo Viejo in the Dominican Republic was winding down.

Today, improvement has been so far-reaching that every one of those mines has considerably more than ten years of mine life.

In addition, Barrick now has a solid social licence to operate and a reopening submission in place in Papua New Guinea.

Furthermore, as a result of these assets being returned, an organic growth profile of 30% has emerged.

Sure, the share price of Barrick is languishing, but that is true of the share prices of many major mining companies across the board, even when their operational performance is well up.

Interestingly, the third-quarter gold production of the debt-free Barrick increased to 1.04-million ounces from one-million ounces in the second quarter and this was achieved at the lower all-in sustaining cost (AISC) of $1 255/oz. Copper output was also up, from 107-million pounds to 112-million pounds, at an AISC of $3.23/lb.

If a company is selective in making profitable investments, it begins making more money than needed to continue to be sustainable, and the returns start flowing, as Barrick shows.

When the gold and copper prices were well down in 2015/16, the stagflation of today was not there, nor were emerging markets down as they are now, and nor did the US have a debt level five times its gross domestic product, as it does now.

On top of that is a mining industry with too few discoveries and also one that in several instances became accustomed to advancing on the back of rising prices.

Spread across all this now is also global disorder, deglobalisation and supply-chain fragmentation.

Demands for instant gratification have resulted in many companies paying out dividends and taking on debt when they should have been investing in their own futures.

After failing to engage in organic growth through exploration, many have sought to replace depleted reserves through expensive mergers and acquisitions (M&A), with negative financial consequences.

At government level, targets have also tended to be set that few can meet. It is also a time when a large percentage of people on every continent are living below the poverty line.

The first thing that companies should be doing in these circumstances, in Bristow's view, is to shore up the balance sheet so that they do not become over-dependent on financial institutions or the market.

“If you’ve got debt in this world today and it goes against you, you get slaughtered. If you try and recapitalise when things are bad, you get slaughtered,” Bristow commented to Mining Weekly.

POSTER CHILD FOR RENEWABLE ENERGY

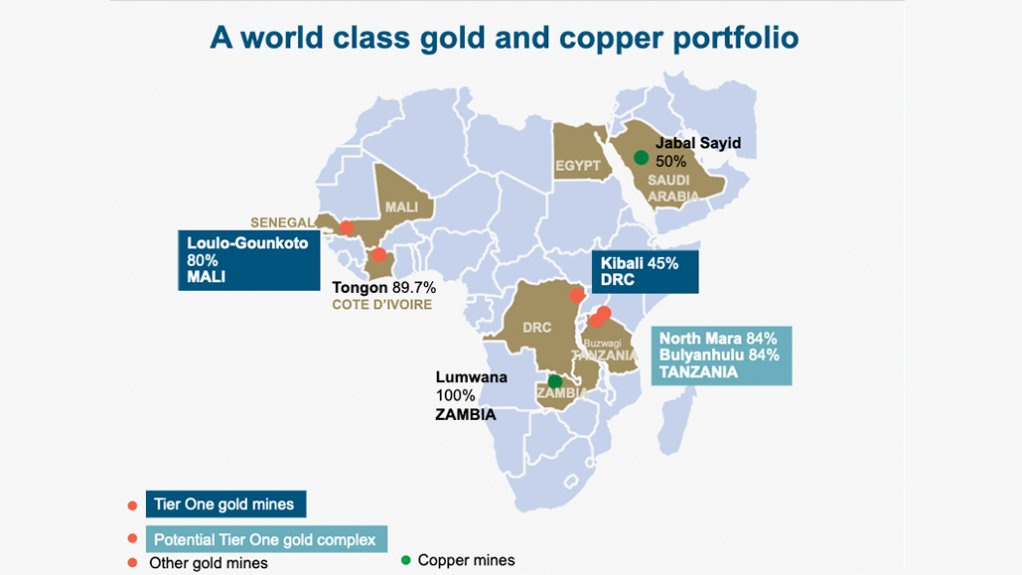

The Africa portion of the Barrick presentation, which consistently features impressive quarterly performance, showed that the latest quarter was no exception.

The Africa region, which has been Barrick's most consistent performer since the merger five years ago, continues to be a highly prospective exploration destination and a core growth engine for Barrick.

The Loulo-Gounkoto complex in Mali, which delivered its usual strong performance, has a record of ongoing reserve replacement and brownfield exploration indicates that it is likely to sustain this.

Deep drilling is currently testing for repetitions of the high-grade Yalea system and elsewhere on the Loulo-Gounkoto site, new targets have been identified and new opportunities are emerging.

The impressive greening of the complex grid is continuing and the second phase of the solar farm is scheduled for completion before the end of this year.

Barrick is Africa’s largest gold miner and Kibali in the Democratic Republic of Congo is the continent’s largest gold mine. The highly automated Kibali is a poster child for renewable energy.

Since operations began at Kibali, three hydropower stations have been built and together, these stations meet more than 70% of the mine’s electricity needs.

"Once Kibali's 16 MW solar facility is commissioned with battery storage, the mine’s electricity needs will be met entirely from renewable energy for six months of the year, reducing its greenhouse gas emissions by over 19 000 t of carbon dioxide equivalent annually,” Bristow pointed out to Mining Weekly.

The life-extending North Mara and the long-life Bulyanhulu mines in Tanzania remain on track to meet their guidance, with the strategy of brownfield growth continuing to deliver at both mines.

“There’s still great potential for world-class discoveries around our operations and further afield with the Africa and Middle East region, from Zambia in the south to Saudi Arabia in the north," said Bristow.

Tanzania, with its wealth of resources, is a particularly strong candidate for Barrick's next million-ounce discovery.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here