Municipal debt remains one of Eskom’s biggest challenges, says Eskom CFO Calib Cassim.

“At the end of March, we were sitting at around R75-billion of municipal arrears owing to us. That has grown in the last financial year in the region of R15-billion.

“Clearly any business cannot sustain carrying R15-billion of debt.”

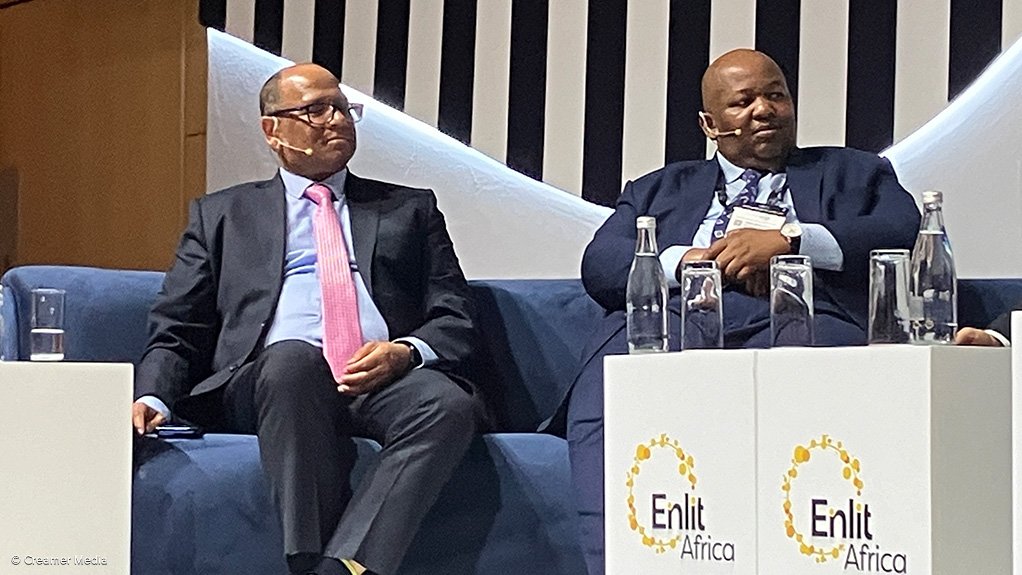

Cassim was speaking at Enlit Africa 2024, held in Cape Town this week.

He noted that the municipal debt relief programme offered by government to municipalities had proved unsuccessful.

This programme allows municipalities to have their Eskom debt written off systematically over three years. To qualify, municipalities have to comply with 14 conditions, including keeping up with their current account payments to Eskom.

Out of 72 municipality applications for debt relief, 70 have been approved.

“Many [municipalities] have signed up,” said Cassim, “but in order to get a third of their debt off, they need to comply for 12 consecutive months in terms of paying their current accounts.

“I think, in terms of compliance, we are sitting at 10%. Some of them are partially compliant.”

Cassim said the programme had not “delivered the change we were looking for”.

He added that a mechanism had to be put in place through the National Energy Crisis Committee (Necom) workstreams to ensure “that Eskom gets paid for what it delivers”, as this “would take pressure off the fiscus”.

“Because, if we can’t meet our requirements, we have no resort but to go to the shareholder and burdening government and National Treasury and, effectively, the tax payer.

“We need to make the same amount of effort we have taken with the Necom process [to restore power generation] and put our minds together and find a permanent solution for municipal debt.”

Cassim added that Eskom’s own debt relief programme, in which government had taken on R254-billion rand of the utility’s debt over the medium term, had been able to stimulate Eskom’s recovery – with the country currently approaching day 60 of no loadshedding.

“[The Debt Relief Bill] has freed up time and our ability to allocate capital expenditure to divisions three years in advance. We have not been able to do that for six years.

“When I started in this role, I looked at cash flow every day to see if we could meet the salary account at end of month for 40 000 people,” noted Cassim.

“Where we are sitting now, I can look six months ahead and I’m not stressing.

“That means we can focus on the turnaround and many other things.”

Cassim said the improvement in generation efforts had also strengthened Eskom’s financial position.

“In seven weeks we went from an open-cycle gas turbine [diesel] spend of R5.2-billion to R1.2-billion – that is a R4-billion swing in seven weeks.

“I told Bheki [Eskom Generation CEO Bheki Nxumalo] that you’ve stopped loadshedding, and I want to now stop making losses,” quipped Cassim.

“I’m tired of it. Morale has increased significantly…to know that we are not loadshedding. When I told my son to do his homework in the past, he would reply: Can you stop loadshedding? Now he has to do his homework.”

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here