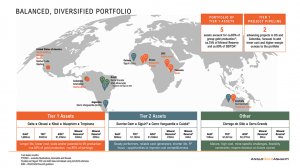

JOHANNESBURG (miningweekly.com) – Four out of the five top-tier gold-mining assets of AngloGold Ashanti are in Africa.

As the cornerstones of the company, these tier 1 mines are Geita in Tanzania, Obuasi and Iduapriem in Ghana, and Kibali in the Democratic Republic of Congo. (Also watch attached Creamer Media video.)

The fifth tier 1 mine is Tropicana in Australia. In all metrics, the top-tier mines form part of the first quartile of big assets in the world and account for 80% of AngloGold’s earnings and 75% of the mineral reserve.

Collectively, the five tier 1 assets account for 1.7-million ounces a year at a total cash cost of $940/oz and an all-in sustaining cost (AISC) of $1 200.

These are the longer life and lower cost companies that have potential to increase their production.

When it comes to projects, the advancing tier 1 project pipeline is in the US, where five projects are being progressed in the Beatty District, where there is potential to produce more than 300 000 oz/y of gold over multi decades at an AISC in the high $900/oz, with first production planned at the end of 2025.

In a reassessing of its portfolio, AngloGold Ashanti has subdivided its assets into tier 1 assets, tier 2 assets and ‘other’.

The second-tier assets include the shorter life Siguiri of Guinea, Sunrise Dam of Australia, Cerro Vanguardia of Argentina, and Cuiaba of Brazil. The focus on these is to lower the cash costs.

These collectively produce 889 000 oz a year at an AISC of $1 598/oz and have a 23-million-ounce resource.

These tier 2 operations are run for cash and come second in the rankings when it comes to new capital, with the tier 1’s likely receiving priority, but still being nurtured with sustaining capital expenditure (capex).

Falling into 'other' are Córrego do Sitio and Serra Grande in Brazil with a decision on their future course required. These are mature, high-cost operations with flexibility constraints. They produce 158 000 oz a year at an AISC of $2 377/oz and a mineral reserve of eight-million ounces.

“By scale, they don’t belong in a portfolio like AngloGold but we are still responsible stewards. They are very high in the cash cost category and they are causing a significant drain and loss of competitiveness,” AngloGold CEO Alberto Calderon said during last week’s results presentation covered by Mining Weekly.

“Córrego do Sitio is a complex mine and at some point this year we’ll take a decision. We’ll try to sell it, as we did before, and if we can’t, we’ll take other decisions like putting it in care and maintenance.

“Serra Grande is different. We expect it to be cash positive in the second half. It was slightly negative in the first half but it’s small in nature. If at some point in the future we can find a good home for it, we will do but there is not urgency on Serra Grande because we don’t expect any losses in the second half. It’s back to covering its own costs and sustaining capex,” Calderon explained.

RENEWABLES PROJECT

At the Tropicana mine, AngloGold has entered into an agreement with Pacific Energy to construct and operate 62 MW of wind and solar power generation capacity at the site.

Pacific Energy will construct a renewables project and continue to operate the combined renewables power station under a ten-year power purchase agreement.

Once complete, the project is expected to deliver a 50% reduction in overall natural gas consumption.

The capital cost of constructing the renewables infrastructure, made up of 24 MW of wind turbine capacity, 24 MW of photovoltaic solar capacity and 14 MW of battery energy storage capacity, will be incorporated into the ongoing power costs charged to the Tropicana joint venture partners.

The project, which is designed to maximise the emission reduction while retaining power costs at current levels, is scheduled for completion in early 2025, with on-site construction expected to begin in the second half of this year.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here