Africa has experienced a rise in the establishment of sovereign wealth funds (SWFs) over the past decade. The Sovereign Wealth Fund Institute, a United States (US)-based research organisation, defines the term sovereign wealth fund as “a state-owned investment fund or entity” often set up from balance of payments surpluses, official foreign currency operations, privatisation proceeds, government transfer payments, fiscal surpluses and receipts from resource exports.(2) SWFs can be based on either commodities or non-commodities. Commodities-based SWFs are established from revenue derived from commodity exports, which are owned or taxed by the government. Non-commodities based SWFs are established from revenue raised through, for example, the transfer of assets from official foreign reserves.(3) The recent spate of African SWFs are mostly commodities-based as they are being established by resource-rich countries looking for new and more effective ways to manage excess revenues derived from natural resources, mainly oil.

African SWFs lag those of the rest of the world, representing only about 0.3% of global SWF assets.(4) Nonetheless, more African countries are considering SWFs as a revenue management and investment vehicle. As such, they have become somewhat of a ‘must-have’ for any natural resource-exporting country hoping to commercialise reserves of oil, gas or minerals in the near future.(5) African countries have become motivated to establish these funds in recent years, firstly, due to the rise in commodity prices, particularly before the 2008 financial crisis, and secondly, the increase in revenue from higher quantities of commodity exports, especially those raised by oil and gas exporters.(6) The discovery of oil in regions such as East Africa is also fuelling the SWF frenzy. Despite the potential, African SWFs face great challenges with corruption and the lack of transparency. It is against this backdrop that this paper elaborates on the motivations for setting up these funds and provides a brief profile of some of Africa’s SWFs. Furthermore, it analyses how SWFs may contribute to development in Africa, and considers the challenges that some of these funds face.

Why SWFs, and why now?

Countries set up SWFs for various reasons that may be motivated by their individual national economic interests; however, the general impetus for their creation is to foster economic growth. A well-managed fund has the potential to promote domestic growth in various ways, including: 1) cushioning the economy from the impact of commodity price volatility, 2) diversifying the wealth of the country, 3) positively affecting international credit ratings, and 4) encouraging the creation and development of ancillary industries, such as investment banking and fund management services. The first benefit, namely, protecting the economy from the impact of commodity price volatility and the promotion of price and revenue stabilisation, is the main motivation for setting up SWFs in Africa. As a result of recent commodity price fluctuations, resource-rich African countries which have recently begun to accumulate substantial surplus reserves from exports of natural resources have put in place mechanisms to better control their revenues or expenditure planning. Among such mechanisms are SWFs, which act as a buffer by controlling government expenditure derived from volatile natural resources.

In addition to commodity price stabilisation, a well-managed SW, set up at the right stage of a country’s economic development, is a responsible approach to managing a country’s assets and promotes economic growth through encouraging diversification of wealth generated from natural resources. Countries may choose to invest these excess funds in diverse sectors through financial instruments, such as foreign government bonds, or hard investments, such as infrastructure development. An ancillary benefit of SWFs is that they may result in both a shift away from the use of traditional central bank reserves and a reduction in the opportunity cost of these reserves.(7) Furthermore, SWFs have the potential to enhance the international borrowing profile of a country by improving its credit ratings, which can in turn ease revenue generation on international markets through cheaper borrowing costs. Such additional and cheaper funds are not dependent on hydrocarbon exports.(8) Nigeria is one of the countries that has benefited from improved credit ratings due to the establishment of a SWF. In 2012, Nigeria received, for the first time, a credit rating of Ba3 by rating agency Moody’s, which was attributed partly to the establishment of a SWF.(9)

The potential benefits of SWFs cannot be overstated; however, at this stage of Africa’s development of such mechanisms, it is not yet clear whether the phenomenon is timely for some African countries. On one hand, the move towards creating SWFs has arisen when the continent is benefiting from the twin trends of 1) inflated government revenues resulting from higher commodity prices and increased production, and 2) fiscal discipline, which has facilitated increased savings.(10) On the other hand, African countries have been criticised for not accumulating sufficient excess revenues or savings to set these funds up. Oil is the main source of excess revenues for the creation of both African and global sovereign wealth funds. An estimated 58% of SWF assets worldwide are derived from oil and gas revenues.(11) Opponents of African SWFs pose the argument that African oil producers, including Angola, Ghana and Nigeria, have reportedly not saved much of their oil revenue.(12) For a country like Zimbabwe, which is also contemplating setting up a SWF, the timing to do so does not seem right because of the Zimbabwean Government’s recent history of economic mismanagement. The government should rather be geared towards creating conditions which will allow the country a surplus that can then be held in a SWF for future generations.(13) There is no ‘one size fits all’ answer to the question of whether SWFs in Africa are timely, and it cannot be answered on behalf of the continent as a whole. The issue should be considered from the perspective of individual countries.

Country trends: Botswana, Angola, Ghana and Nigeria

As of December 2013, there were 15 African countries with SWFs, namely Algeria, Angola, Botswana, Chad, Equatorial Guinea, Gabon, Ghana, Kenya, Libya, Mauritania, Nigeria, Rwanda, Sao Tome and Principe, South Sudan and Tanzania.(14) The largest among them are the Libyan Investment Authority and Algeria’s Revenue Regulation Fund, which hold total assets amounting to US$ 65 billion and US$ 56.7 billion, respectively.(15) Botswana was the first African country to set up a fund in 1994 through the enactment of the Bank of Botswana Act. Section 35(1) of the Act authorises the Bank, after consultation with the relevant government minister, to establish a separate long-term investment fund or funds in which to invest assets in excess of those needed for the Primary International Reserve which is set up in terms of section 31 of the Act to hold securities and other assets. As such, the Botswana Pula Fund, which is managed by the Bank of Botswana, was created for the investment of surplus revenues from diamond exports primarily for the benefit of future generations. The Botswana Pula Fund, which forms part of Botswana’s foreign exchange reserves, is invested exclusively in foreign currency-denominated assets and its asset allocation includes public equity and fixed income instruments in industrialised economies.(16)

The other 14 African countries established their SWFs between 2000 and 2014. The more recent participants are Angola and Ghana, which set up their SWFs in 2012. Angola launched Fundo Soberano de Angola (FSDEA) with initial surplus revenue of US$ 5 billion from oil exports. A 2013 law allows the government to use 70% of oil revenues to fund its budget and save 30% in a heritage and stabilisation fund.(17) The FSDEA is among the few African SWFs which has made its investment strategy and other information readily accessible to the public. The fund has been created in line with the Santiago Principles, which are voluntary principles that set out international best practice for SWFs proposed by the International Working Group of Sovereign Wealth Funds. Among these international best practice principles are requirements for a sound legal framework, public disclosure, timely reporting of data, clear mandates for governing bodies and annual auditing of financial statements. Despite the reported application of these international best practice principles, the Angolan SWF, like other African funds, has been subject to criticism for transparency issues. In particular, the fund was criticised for appointing José Filomeno dos Santos, the son of Angolan president José Eduardo dos Santos, who has been in power for more than three decades, as chairman of the FSDEA.(18) His appointment has been opposed on the basis that it undermines confidence in the transparent and independent management of the fund. Furthermore, the fund faces a backlash for alleged mismanagement of revenue due to the splurging of US$ 350,000 on a luxury office block in an exclusive district in London in 2013.(19)

Following in the footsteps of other oil-rich countries, Ghana has also established SWFs. In 2011, the country enacted the Petroleum Revenue Management Act, which is aimed at regulating the collection, allocation and management of petroleum revenue derived from upstream and mainstream petroleum operations. The Act achieves this objective through the Petroleum Holding Fund for the receipt of petroleum-related revenues for transfer to other funds, and the Ghana Petroleum Fund, which comprises a Stabilisation Fund and a Heritage Fund. Revenue is transferred from the Petroleum Holding Fund to the Ghana Stabilisation Fund to cushion the economy from the impact of revenue shortfall due to possible decreases in oil prices, and to the Ghana Heritage Fund to set aside surplus revenues for future generations.(20) Likewise, Tanzania enacted the Natural Gas Policy of 2013, which provides for the establishment of a National Gas Revenue Fund to ensure transparency and accountability over collection, allocation and management of natural gas revenues. The main aims of the fund are to provide for stabilisation of revenue transfer to the government for public expenditure in strategic areas and for domestic savings for future investment.(21)

In East Africa, recent major oil and gas discoveries are likely to provide new opportunities for more African SWFs to manage revenues from these new resource discoveries.(22) Kenya is among the East African countries that plans to establish a SWF and will do so even before oil starts to flow at a projected date of 2016. The country is establishing a fund with various mandates, including stabilisation, savings and infrastructure allocation.(23) Further south, Zimbabwe and Zambia are also contemplating setting up SWFs.

A discussion on African SWFs cannot avoid mentioning Nigeria, not only because of the challenges the Nigerian funds face, but also because they are based on revenues derived from the continent’s largest oil industry. Nigeria’s sovereign reserve was created in 2011 with its main focus on infrastructure, collective savings and commodity price stabilisation.(24) Nigeria’s surplus reserves are divided into a Future Generations Fund, a Stabilisation Fund and an Infrastructure Fund.(25) Unfortunately, due to continuous political wrangling between federal governments and states in the early stages of the establishment of the Nigerian SWF, it had initial assets of US$ 1 billion, despite the country’s US$ 7 billion Excess Crude Account.(26)

Angola and Nigeria show that African SWFs have potential, yet simultaneously face setbacks that slow growth and hamper development. The first such setback relates to issues of poor governance and corruption. Poor governance in the form of lack of transparency and accountability, as well as weak institutional frameworks, have not only negatively affected the credibility of some funds, but may also lead to higher risk of expropriation and corruption. The failure of SWFs in Chad and Equatorial Guinea has been attributed to corruption and lack of transparency.

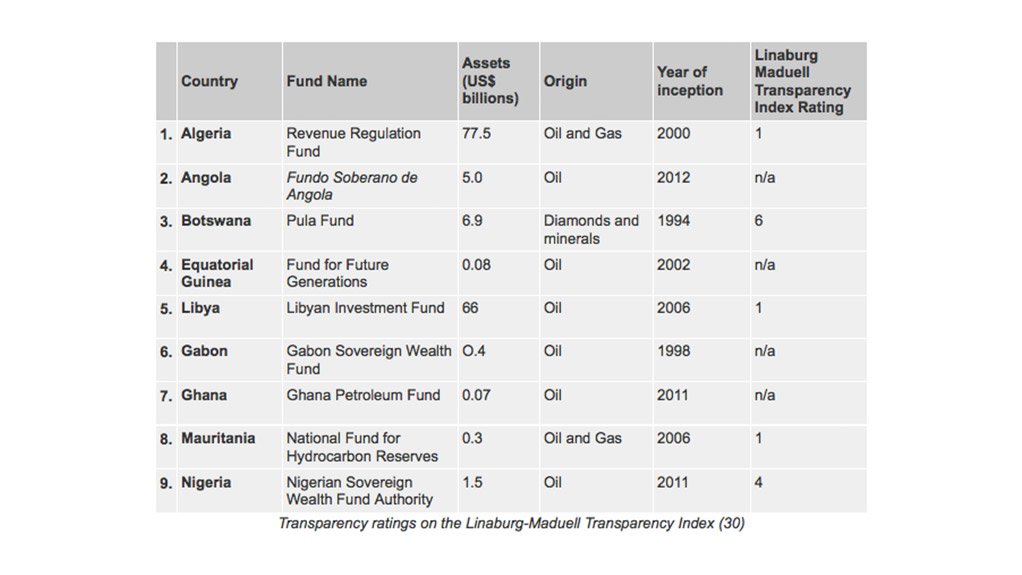

African SWFs, which are facing issues of lack of transparency, rank very low on the Linaburg-Maduell Transparency Index, developed by the Sovereign Wealth Research Institute.(27) The Botswana Pula Fund is currently the continent’s most transparent fund on this index with a rating of 6 out of 10.(28) The Linaburg-Maduell Transparency Index is calculated by adding 1 point for every principle that a country’s SWF meets. As such, 10 is the highest possible score because there are 10 principles, including information provision on creation, origins, wealth and government ownership structure; up-to-date independent audited annual reports; and clear strategies and objectives.(29) According to the Sovereign Wealth Fund Institute, Africa’s SWFs have the following transparency ratings on the Linaburg-Maduell Transparency Index (see table above)

Figure 1: Transparency ratings on the Linaburg-Maduell Transparency Index (30)

In addition to governance, transparency and corruption, African SWFs face internal risk management issues, including operational and financial risks.(31) These risks are aggravated by mismanagement and poor investment decisions by investment fund managers. For example, the Libyan Investment Authority has brought a legal claim of US$ 1 billion against Goldman Sachs, a US-based global investment firm, alleging that the investment bank exploited the fund’s limited financial experience, forcing it into risky and ultimately loss-making investments.(32) The lack of expertise in fund management is a challenge many other African countries face.

A role for development in Africa?

The recent discovery of natural resources in Africa has raised questions about how such resources will be managed in a manner that benefits the continent and leads to development. SWFs have been viewed as potential tools to achieve development for Africa’s benefit. They may indeed lead to development in both the fund’s home country and host countries where fund investments may be directed. The African Development Bank (AfDB) states that SWFs contribute to development by enhancing productivity and spurring intra-African investment through allocating part of their assets to growing sectors in Africa.(33) Furthermore, they have the potential to contribute towards fostering the private sector. Generally, investments by SWFs tend towards investments in global financial markets rather than in emerging or developing countries, but African countries can use SWF revenue to invest in domestic companies that boost growth and create jobs through the private sector.(34) From Africa’s perspective, SWFs may also provide extra liquidity for local and regional debt and equity markets. (35)

Despite the potential benefits and recent popularity of sovereign wealth funds, a few important factors should be noted about their contribution to African development. First, Africa’s challenges are deep-rooted and complex, in particular those related to resource management. The mere establishment of a SWF is not, in itself, a panacea for the continent’s problems, although they can assist. As is evident from their low transparency ranking and challenges associated with corruption and governance, SWFs are not in and of themselves a solution for resource mismanagement. Second, SWFs are complex financial tools which require expertise to manage effectively. Some African countries have resorted to outsourcing investment banking and management services of their SWFs to foreign banks, such as UBS Global, a global financial services company headquartered in Zurich and Basel, Switzerland, Goldman Sachs and Credit Suisse Group, a global financial services company also headquartered in Zurich.(36) Nevertheless, this does not guarantee that fund revenues will not be mismanaged, as shown by the allegations levelled against Goldman Sachs by Libya. Furthermore, the outsourcing of such services does not assist with developing the financial and investment service sectors on the continent.

Concluding remarks

The boom of sovereign wealth funds in Africa over the past decade has been viewed by some as a positive development. However, the continent is only in the early stages of developing sound legislative policies to manage resource revenues and maximise their impact. SWFs have the potential to create fiscal stability and development on the continent; however, to fully realise the benefits, funds should be managed in line with transparency and international best practice. Furthermore, the establishment of SWFs in Africa should not be viewed as a one-size-fits-all solution to the continent’s economic and development challenges. Rather, their establishment should be coupled with broad-based institutional development, poverty reduction programmes and the promotion of good governance.

Written by Magalie Masamba (1)

NOTES:

(1) Magalie Masamba is a Research Associate with CAI. Her key areas of interest are trade and investment promotion, strategy and risk mitigation in emerging markets. Contact Magalie through Consultancy Africa Intelligence's Industry & Business unit ( industry.business@consultancyafrica.com). Edited by Nicky Berg. Research Manager: Ingi Salgado.

(2) Sovereign Wealth Fund Institute website, http://www.swfinstitute.org.

(3) Ibid.

(4) Whitehead, E., ‘Rise of the African sovereign wealth fund’, This Is Africa, 22 December 2012, http://www.thisisafricaonline.com.

(5) Mungai, C., ‘New oil, gas finds: Is East Africa ready for sovereign wealth funds?’, The East African, 3 January 2014, http://www.theeastafrican.co.ke.

(6) ‘The boom in African sovereign wealth funds’, African Development Bank (AfDB), 1 January 2013, http://www.afdb.org.

(7) Ibid.

(8) Whitehead, E., ‘Rise of the African sovereign wealth fund’, This Is Africa, 22 December 2012, http://www.thisisafricaonline.com.

(9) Ibid.

(10) Blas, J., ‘Funds expand in Africa’, Financial Times, 15 December 2013, http://www.ft.com.

(11) ‘The boom in African sovereign wealth funds’, African Development Bank (AfDB), 1 January 2013, http://www.afdb.org.

(12) Rundell, S., ‘African countries come to the sovereign wealth fund party’, The Top 1000 Firms, 5 December 2012, http://www.top1000funds.com.

(13) Moyo, N., ‘ZANU-PF ploughs ahead with the sovereign wealth fund’, SW Radio Africa, 24 March 2014, http://www.swradioafrica.com.

(14) ‘List of African Sovereign Wealth Funds 2013’, Investment Frontiers, 20 December 2013, http://www.investmentfrontier.com.

(15) ‘The boom in African sovereign wealth funds’, African Development Bank (AfDB), 1 January 2013, http://www.afdb.org.

(16) International Forum of Sovereign Wealth Funds website, http://www.ifswf.org.

(17) Rundell, S., ‘African countries come to the sovereign wealth fund party’, The Top 1000 Firms, 5 December 2012, http://www.top1000funds.com.

(18) Blas, J., ‘Funds expand in Africa’, Financial Times, 15 December 2013, http://www.ft.com.

(19) Mungai, C., ‘New oil, gas finds: Is East Africa ready for sovereign wealth funds?’, The East African, 3 January 2014, http://www.theeastafrican.co.ke.

(20) Sovereign Wealth Fund Institute website, http://www.swfinstitute.org.

(21) ‘Natural Gas Policy of Tanzania’, United Republic of Tanzania, October 2013, http://www.tanzania.go.tz.

(22) Ibid.

(23) Sovereign Wealth Fund Institute website, http://www.swfinstitute.org.

(24) Nyambura-Mwaura, H., ‘African nations race to build sovereign funds’, Business Day Live, 14 February 2014, http://www.bdlive.co.za.

(25) Rundell, S., ‘African countries come to the sovereign wealth fund party’, The Top 1000 Firms, 5 December 2012, http://www.top1000funds.com.

(26) Whitehead, E., ‘Rise of the African Sovereign Wealth Fund‘, This IS Africa,, 22 December 2012, http://www.thisisafricaonline.com.

(27) ‘The boom in African sovereign wealth funds’, African Development Bank (AfDB), 1 January 2013, http://www.afdb.org.

(28) Nyambura-Mwaura, H., ‘African nations race to build sovereign funds’, Business Day Live, 14 February 2014, http://www.bdlive.co.za.

(29) Sovereign Wealth Fund Institute website, http://www.swfinstitute.org.

(30) Compiled by the author with data from the Sovereign Wealth Fund Institute website, http://www.swfinstitute.org.

(31) ‘The boom in African sovereign wealth funds’, African Development Bank (AfDB), 1 January 2013, http://www.afdb.org.

(32) Goff, S., ‘Libya’s sovereign wealth fund to sue Goldman over $1bn trades’, Financial Times, 30 January 2014, http://www.ft.com.

(33) ‘The boom in African sovereign wealth funds’, African Development Bank (AfDB), 1 January 2013, http://www.afdb.org.

(34) Ibid.

(35) Blas, J., ‘Funds expand in Africa’, Financial Times, 15 December 2013, http://www.ft.com.

(36) Ibid.

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here