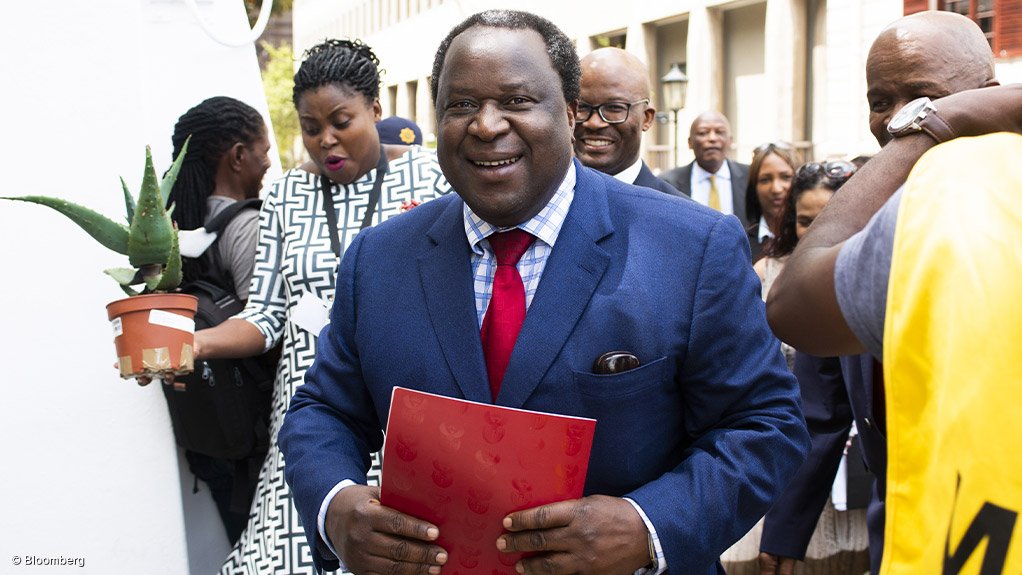

Finance Minister Tito Mboweni used his inaugural Budget address on Wednesday to outline the “tough steps” required to fix South Africa’s deteriorating fiscal position and the country’s failing State-owned enterprises (SoEs).

He told lawmakers there were “no quick fixes”, while confirming a R23-billion-a-year bailout for Eskom over three years, which had been made conditional on the unbundling of the power unity into three separate SoEs. The unbundling plan is currently being opposed by several trade unions, which see it as a precursor to privatisation.

The Eskom intervention was the main highlight of the 2019 Budget and also a key reason for a deterioration in the fiscal framework, which included: a rise in the expenditure ceiling, a widening of the deficit, a further deterioration in government’s debt-to-gross domestic product (GDP) outlook and a surge in debt-servicing costs.

The weak fiscal position was also undermined by a R15.4-billion downward revision to the tax revenue estimate for 2018/19 to R1.45-billion.

Support for Eskom, together with allocations for an infrastructure fund and the 2021 Census, were listed as key reasons for the R14-billion upward revision in the 2019/20 expenditure ceiling. The ceiling would also be R1.3-billion and R732-million higher in 2020/21 and 2021/22 respectively.

The additional expenditure would be partly met through tax increases, amounting to R15-billion in 2019/20 and R10-billion in 2020/21. No changes were made to personal income tax brackets, however.

The main revisions to the fiscal framework unveiled in the 2019 Budget related to debt. The Budget estimates a higher debt-to-GDP ratio, which would stabilises at 60.2% of GDP in 2023/24. The Medium-Term Budget Policy Statement of October indicated a debt-to-GDP peak of 59.6% in that same year.

Likewise, the deficit – which at 4.2% in 2018/19 was already wider than the 3.6% estimated in the 2018 Budget, as well as the 4% revision of October – is forecast to rise further.

The 2019 Budget estimates that the deficit will increase to 4.5% in 2019/20, before declining modestly to 4.3% in 2020/21 and 4% in 2021/22.

Compared with Budget 2018 estimates, the borrowing requirement and debt-servicing cost had also been revised upwards, owing to a larger main Budget deficit.

“In this coming year, we expect revenues of R1.58-billion and spending of R1.83-trillion. That means we will spend R243-billion more than we earn,” Mboweni stated.

“Put another way, we are borrowing about R1.2-billion a day, assuming we don’t borrow money on a weekend.”

Interest expenditure will be R209.4-billion. “This is R1-billion per day,” he added.

Asked whether the deterioration in the Budget framework would trigger a downgrade by Moody’s, Mboweni said that there had already been some “very, very difficult conversations” with the ratings agencies and that government would continue to communicate the reasons for some of the actions taken.

He indicated that it was a case of “damned if we do, damned if we don’t”, while stressing various interventions that could be interpreted as positive by the agencies, such as creating the conditions for higher growth.

The National Treasury is forecasting growth to rise from its estimate of 0.7% in 2018 to 1.5% in 2019, before rising modesty to 1.7% and 2.1% in 2020 and 2021.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here